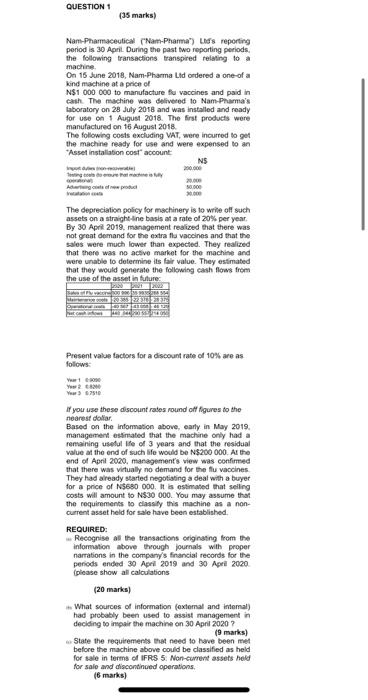

QUESTION 1 (35 marks) machine Nam Pharmaceutical ("Nam-Pharma") Lid's reporting period is 30 April During the past two reporting periods. the following transactions transpired relating to a On 15 June 2018, Nam-Pharma Ltd ordered a one of a kind machine at a price of N$1 000 000 to manufacture flu vaccines and paid in cash The machine was delivered to Nam. Phamma's Laboratory on 28 July 2018 and was installed and ready for use on 1 August 2018. The first products were manufactured on 16 August 2018 The following costs excluding VAT, were incurred to get the machine ready for use and were expensed to an *Asset installation cost account NS go Arte w product . The depreciation policy for machinery is to write of such assets on a straight line basis at a rate of 20% per year By 30 April 2019. management realized that there was not great demand for the extra flu vaccines and that the sales were much lower than expected. They realized that there was no active market for the machine and were unable to determine its fair value. They estimated that they would generate the following cash flows from the use of the asset in future TE Present value factors for a discount rate of 10% are as follows: 67510 If you use these discount rates round of figures to the nearest dollar Based on the information above, early in May 2019. management estimated that the machine only had a remaining useful le of 3 years and that the residual value at the end of such life would be N$200 000. At the end of April 2020, management's view was confirmed that there was virtually no demand for the flu vaccines They had already started negotiating a deal with a buyer for a price of N$680 000 is estimated that seiling costs will amount to N830 000. You may assume that the requirements to classify this machine as a non- Current asset held for sale have been established REQUIRED Recognise all the transactions originating from the information above through journals with proper narrations in the company's financial records for the periods ended 30 April 2019 and 30 April 2020 (please show all calculations (20 marks) What sources of information (extemal and Intemal) had probably been used to assist management in deciding to impair the machine on 30 April 2020? (9 marks) State the requirements that need to have been met before the machine above could be classified as held for sale in terms of IFRS 5. Non-current assets held for sale and discontinued operations. (6 marks) QUESTION 1 (35 marks) machine Nam Pharmaceutical ("Nam-Pharma") Lid's reporting period is 30 April During the past two reporting periods. the following transactions transpired relating to a On 15 June 2018, Nam-Pharma Ltd ordered a one of a kind machine at a price of N$1 000 000 to manufacture flu vaccines and paid in cash The machine was delivered to Nam. Phamma's Laboratory on 28 July 2018 and was installed and ready for use on 1 August 2018. The first products were manufactured on 16 August 2018 The following costs excluding VAT, were incurred to get the machine ready for use and were expensed to an *Asset installation cost account NS go Arte w product . The depreciation policy for machinery is to write of such assets on a straight line basis at a rate of 20% per year By 30 April 2019. management realized that there was not great demand for the extra flu vaccines and that the sales were much lower than expected. They realized that there was no active market for the machine and were unable to determine its fair value. They estimated that they would generate the following cash flows from the use of the asset in future TE Present value factors for a discount rate of 10% are as follows: 67510 If you use these discount rates round of figures to the nearest dollar Based on the information above, early in May 2019. management estimated that the machine only had a remaining useful le of 3 years and that the residual value at the end of such life would be N$200 000. At the end of April 2020, management's view was confirmed that there was virtually no demand for the flu vaccines They had already started negotiating a deal with a buyer for a price of N$680 000 is estimated that seiling costs will amount to N830 000. You may assume that the requirements to classify this machine as a non- Current asset held for sale have been established REQUIRED Recognise all the transactions originating from the information above through journals with proper narrations in the company's financial records for the periods ended 30 April 2019 and 30 April 2020 (please show all calculations (20 marks) What sources of information (extemal and Intemal) had probably been used to assist management in deciding to impair the machine on 30 April 2020? (9 marks) State the requirements that need to have been met before the machine above could be classified as held for sale in terms of IFRS 5. Non-current assets held for sale and discontinued operations. (6 marks)