Question

Question 1 (35 marks) Part I IU Caf Group is downsizing. The company has just paid a $4.5 annual dividend and announces that the dividend

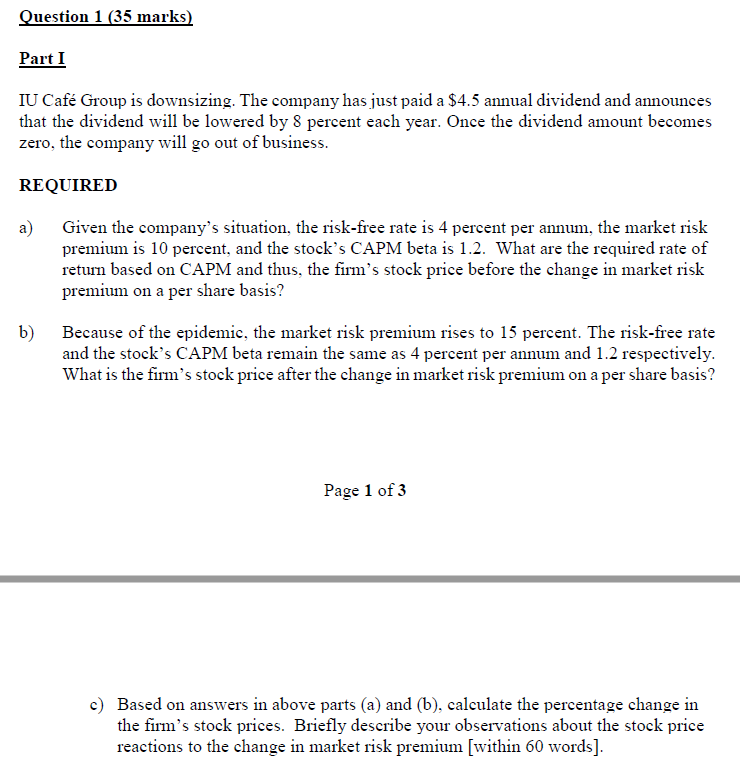

Question 1 (35 marks) Part I IU Caf Group is downsizing. The company has just paid a $4.5 annual dividend and announces that the dividend will be lowered by 8 percent each year. Once the dividend amount becomes zero, the company will go out of business. REQUIRED a) Given the companys situation, the risk-free rate is 4 percent per annum, the market risk premium is 10 percent, and the stocks CAPM beta is 1.2. What are the required rate of return based on CAPM and thus, the firms stock price before the change in market risk premium on a per share basis? b) Because of the epidemic, the market risk premium rises to 15 percent. The risk-free rate and the stocks CAPM beta remain the same as 4 percent per annum and 1.2 respectively. What is the firms stock price after the change in market risk premium on a per share basis? Page 2 of 3 c) Based on answers in above parts (a) and (b), calculate the percentage change in the firms stock prices. Briefly describe your observations about the stock price reactions to the change in market risk premium [within 60 words].

Question 1 (35 marks) Part I IU Caf Group is downsizing. The company has just paid a $4.5 annual dividend and announces that the dividend will be lowered by 8 percent each year. Once the dividend amount becomes zero, the company will go out of business. REQUIRED a) Given the company's situation, the risk-free rate is 4 percent per annum, the market risk premium is 10 percent, and the stock's CAPM beta is 1.2. What are the required rate of return based on CAPM and thus, the firm's stock price before the change in market risk premium on a per share basis? Because of the epidemic, the market risk premium rises to 15 percent. The risk-free rate and the stock's CAPM beta remain the same as 4 percent per annum and 1.2 respectively. What is the firm's stock price after the change in market risk premium on a per share basis? b) Page 1 of 3 c) Based on answers in above parts (a) and (b), calculate the percentage change in the firm's stock prices. Briefly describe your observations about the stock price reactions to the change in market risk premium (within 60 words]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started