Answered step by step

Verified Expert Solution

Question

1 Approved Answer

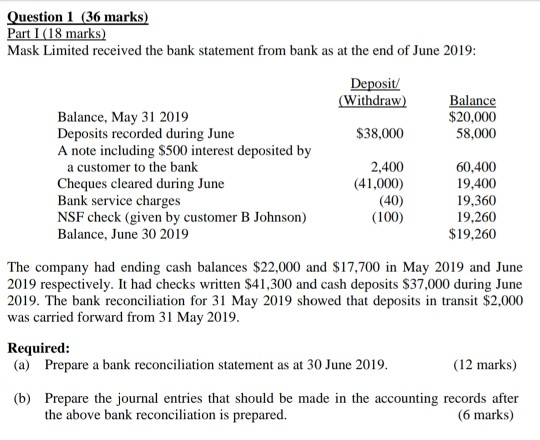

Question 1 (36 marks) Part I (18 marks) Mask Limited received the bank statement from bank as at the end of June 2019: Deposit/ (Withdraw)

Question 1 (36 marks) Part I (18 marks) Mask Limited received the bank statement from bank as at the end of June 2019: Deposit/ (Withdraw) Balance $20,000 58,000 $38,000 Balance, May 31 2019 Deposits recorded during June A note including $500 interest deposited by a customer to the bank Cheques cleared during June Bank service charges NSF check (given by customer B Johnson) Balance, June 30 2019 2,400 (41,000) (40) (100) 60,400 19,400 19,360 19,260 $19,260 The company had ending cash balances $22,000 and $17,700 in May 2019 and June 2019 respectively. It had checks written $41,300 and cash deposits $37,000 during June 2019. The bank reconciliation for 31 May 2019 showed that deposits in transit $2,000 was carried forward from 31 May 2019. Required: (a) Prepare a bank reconciliation statement as at 30 June 2019. (12 marks) (b) Prepare the journal entries that should be made in the accounting records after the above bank reconciliation is prepared. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started