Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 4 As of March 9 , 2 0 2 1 , the price of GameStop Corp. ( ticker: GME ) is $ 2

Question

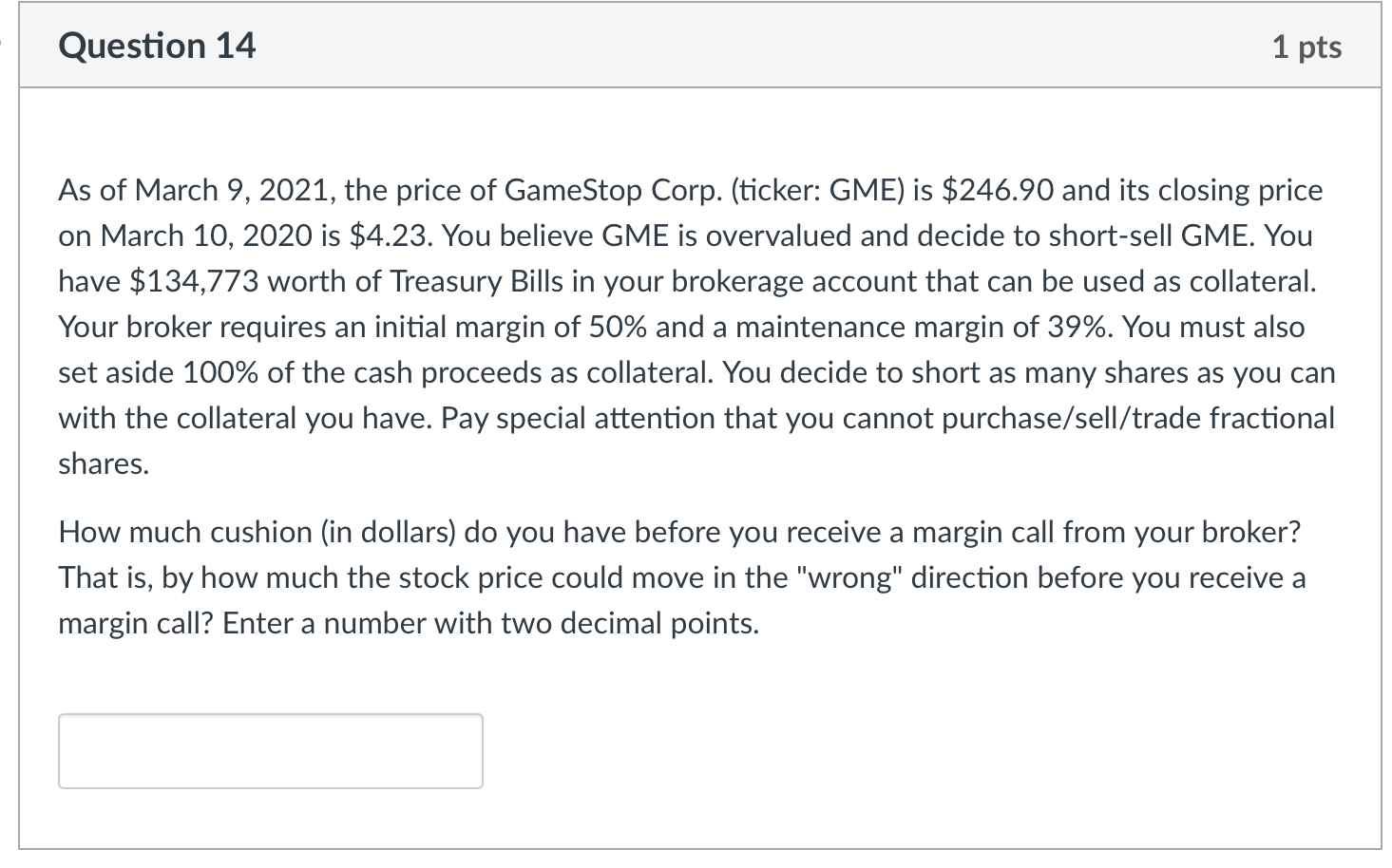

As of March the price of GameStop Corp. ticker: GME is $ and its closing price

on March is $ You believe GME is overvalued and decide to shortsell GME. You

have $ worth of Treasury Bills in your brokerage account that can be used as collateral.

Your broker requires an initial margin of and a maintenance margin of You must also

set aside of the cash proceeds as collateral. You decide to short as many shares as you can

with the collateral you have. Pay special attention that you cannot purchaseselltrade fractional

shares.

How much cushion in dollars do you have before you receive a margin call from your broker?

That is by how much the stock price could move in the "wrong" direction before you receive a

margin call? Enter a number with two decimal points.

Your stock portfolio earned and for the last three years. What is your

annualized return for the last three years on average? Enter a number with two decimal points.

Answer the question in percentage terms, ie if your return is or enter

A stock has a return that follows the normal distribution with a mean of and a standard

deviation of What is the probability that the stock will have a return between and

The one two and threesigma probability of the normal distribution is

and Enter a number with one decimal points. Answer the question in percentage terms, ie

if the answer is enter

Your stock portfolio earned and for the last three years. What is your

annualized return for the last three years on average? Enter a number with two decimal points.

Answer the question in percentage terms, ie if your return is or enter

The market maker offers the following bids and asks with respective depth to the market:

You are not happy with the price impact from your trade so let's do it again but trade in a smaller

amount this time. Say you submit a market sell order with shares, what's your weighted

average execution price? Enter a number with two decimal points.

The market maker offers the following bids and asks with respective depths:

If you submit a market sell order with shares, what's your weighted average execution

price? Enter a number with two decimal points.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started