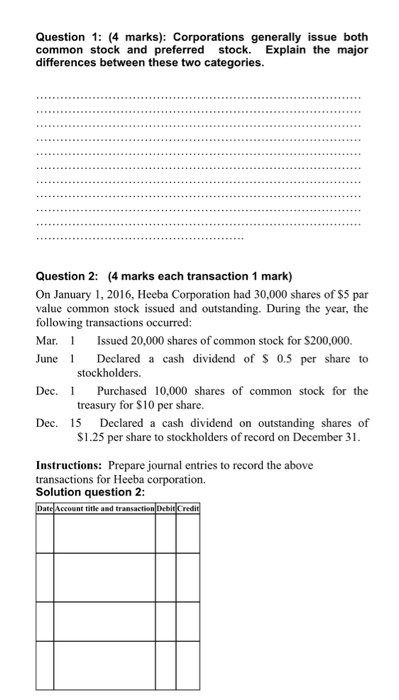

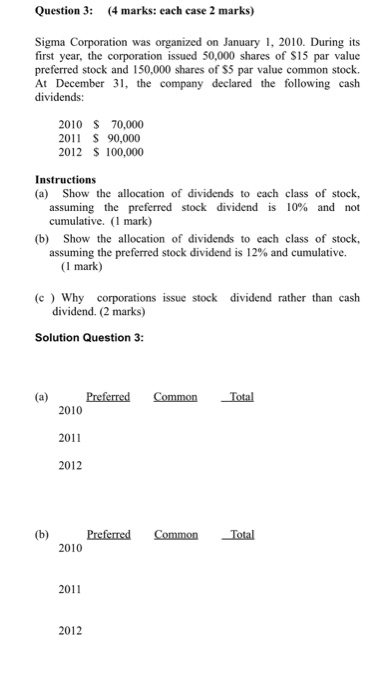

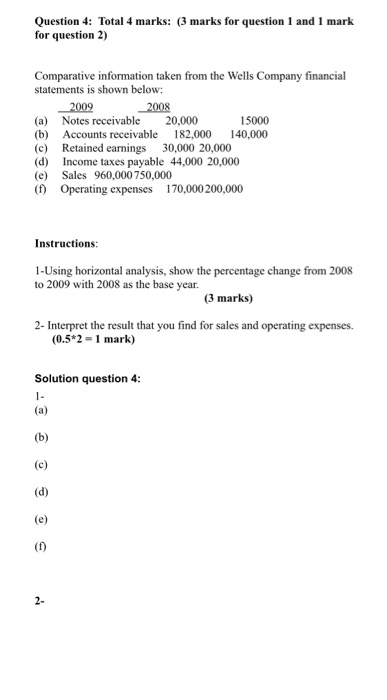

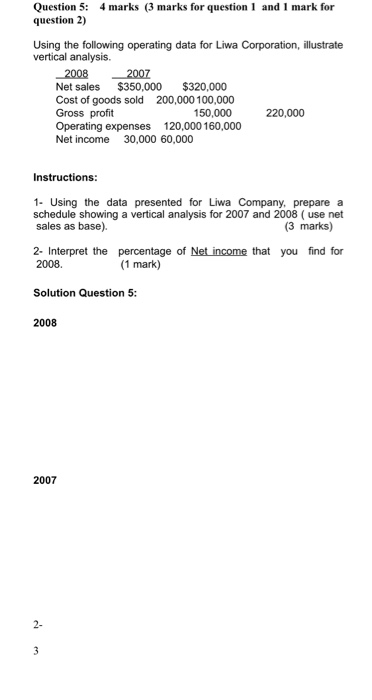

Question 1: (4 marks): Corporations generally issue both common stock and preferred stock. Explain the major differences between these two categories. Question 2: (4 marks each transaction 1 mark) On January 1, 2016, Heeba Corporation had 30,000 shares of $5 par value common stock issued and outstanding. During the year, the following transactions occurred: Mar. 1 Issued 20,000 shares of common stock for $200,000. June Declared a cash dividend of $ 0.5 per share to stockholders. Dec.1 Purchased 10,000 shares of common stock for the treasury for $10 per share. Dec. 15 Declared a cash dividend on outstanding shares of $1.25 per share to stockholders of record on December 31. Instructions: Prepare journal entries to record the above transactions for Heeba corporation. Solution question 2: Date Account title and transaction Debit Credit Question 3: (4 marks: each case 2 marks) Sigma Corporation was organized on January 1, 2010. During its first year, the corporation issued 50,000 shares of S15 par value preferred stock and 150,000 shares of $5 par value common stock. At December 31, the company declared the following cash dividends: 2010 $ 70,000 2011 S 90,000 2012 $ 100,000 Instructions (a) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 10% and not cumulative. (1 mark) (b) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 12% and cumulative. (1 mark) dividend rather than cash (c) Why corporations issue stock dividend. (2 marks) Solution Question 3: Common Total Preferred 2010 2011 2012 Preferred Common Total 2010 2011 2012 Question 4: Total 4 marks: (3 marks for question 1 and 1 mark for question 2) Comparative information taken from the Wells Company financial statements is shown below: 2009 2008 (a) Notes receivable 20,000 15000 (b) Accounts receivable 182,000 140,000 (c) Retained earnings 30,000 20,000 (d) Income taxes payable 44,000 20,000 (e) Sales 960,000 750,000 (f) Operating expenses 170,000 200,000 Instructions: 1-Using horizontal analysis, show the percentage change from 2008 to 2009 with 2008 as the base year. (3 marks) 2- Interpret the result that you find for sales and operating expenses. (0.5*2 = 1 mark) Solution question 4: Question 5: 4 marks (3 marks for question 1 and 1 mark for question 2) Using the following operating data for Liwa Corporation, illustrate vertical analysis. 2008 2007 Net sales $350,000 $320,000 Cost of goods sold 200,000 100,000 Gross profit 150,000 220,000 Operating expenses 120,000 160,000 Net income 30,000 60,000 Instructions: 1. Using the data presented for Liwa Company, prepare a schedule showing a vertical analysis for 2007 and 2008 (use net sales as base). (3 marks) 2- Interpret the percentage of Net income that you 2008. (1 mark) find for Solution Question 5: 2008 2007