Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 4 Not yet answered Marked out of 1 . 0 0 Flag question The type of business structure an individual ( or group

Question

Not yet answered

Marked out of

Flag question

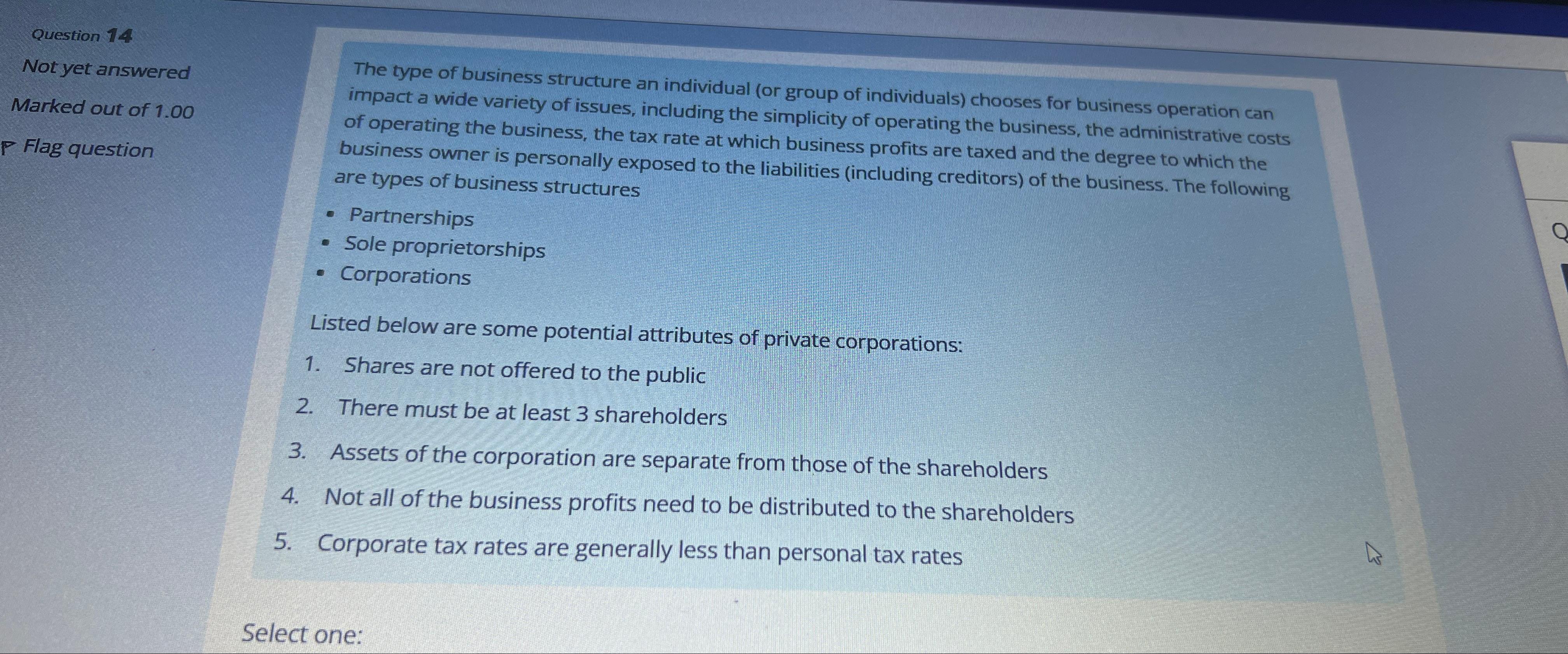

The type of business structure an individual or group of individuals chooses for business operation can impact a wide variety of issues, including the simplicity of operating the business, the administrative costs of operating the business, the tax rate at which business profits are taxed and the degree to which the business owner is personally exposed to the liabilities including creditors of the business. The following are types of business structures

Partnerships

Sole proprietorships

Corporations

Listed below are some potential attributes of private corporations:

Shares are not offered to the public

There must be at least shareholders

Assets of the corporation are separate from those of the shareholders

Not all of the business profits need to be distributed to the shareholders

Corporate tax rates are generally less than personal tax rates

Select one:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started