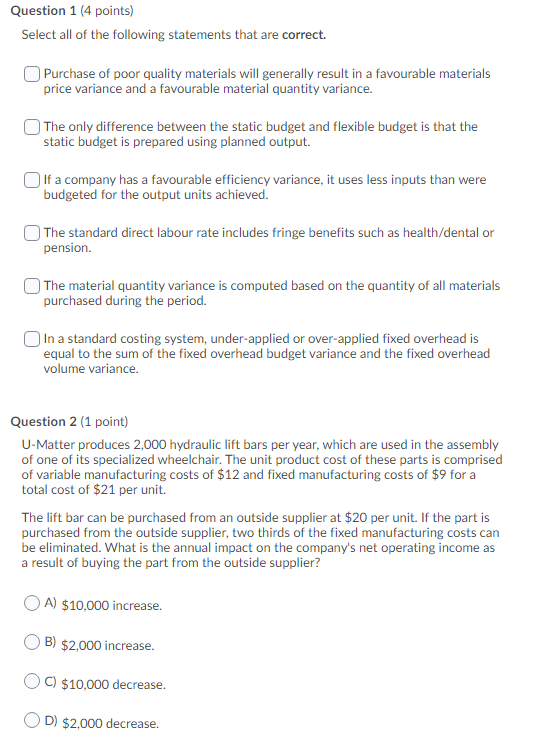

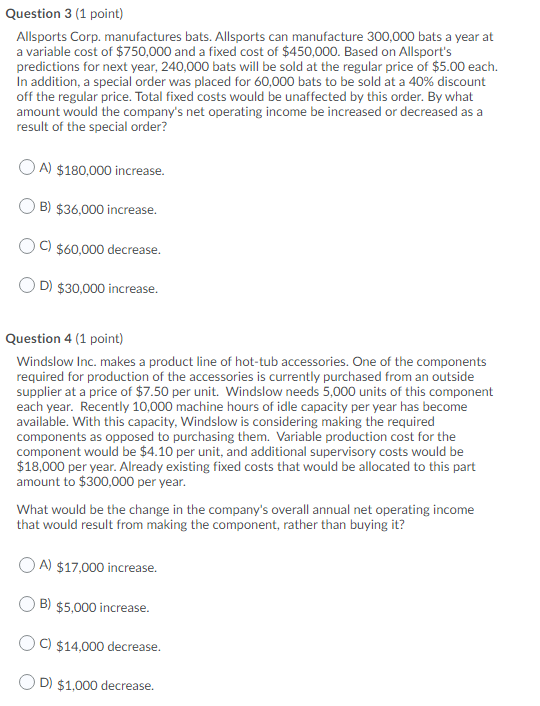

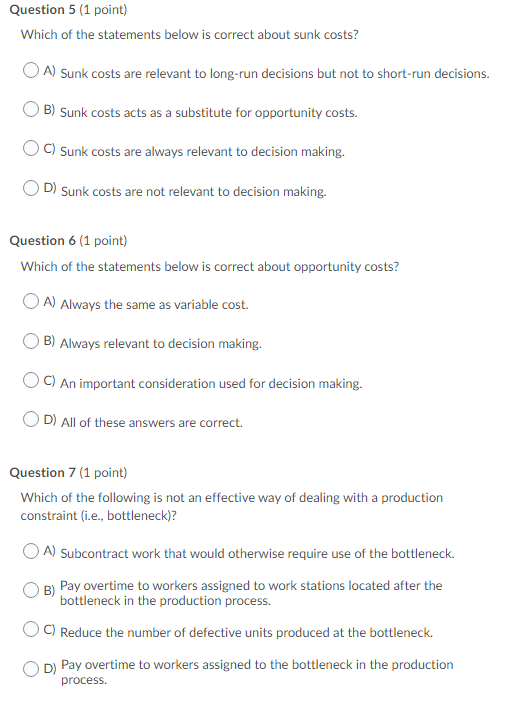

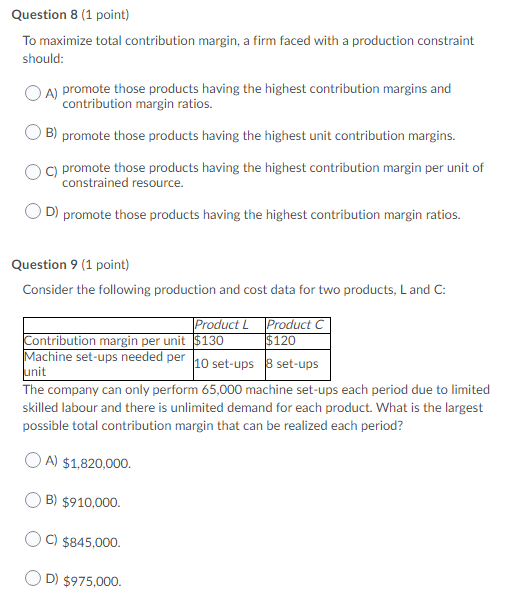

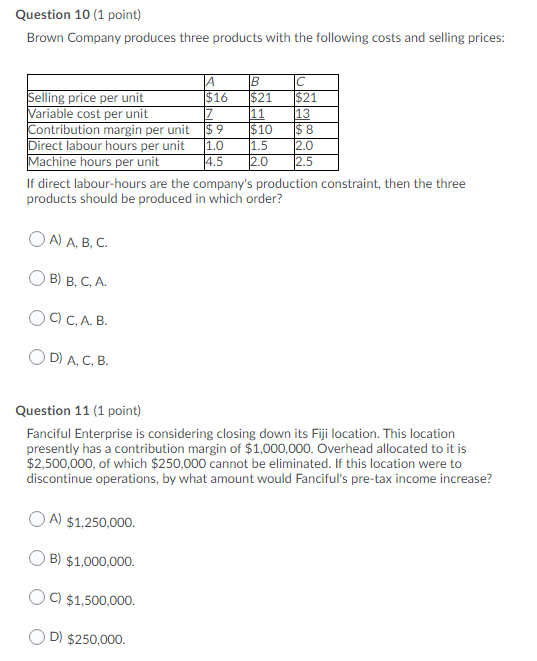

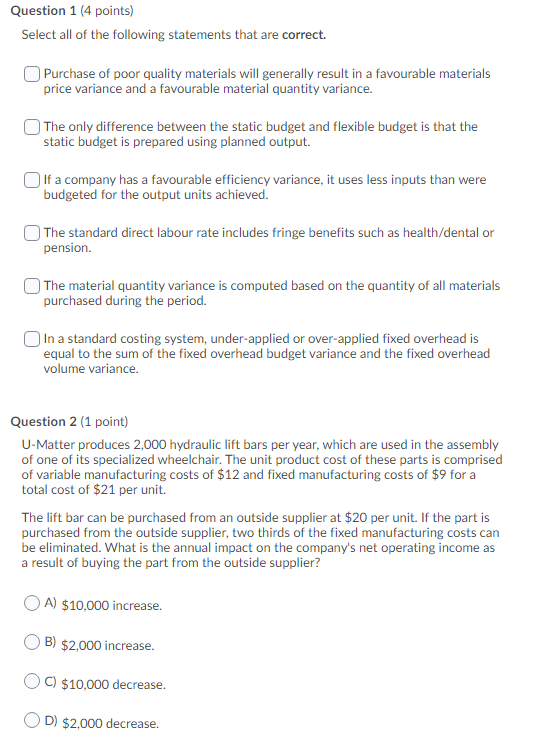

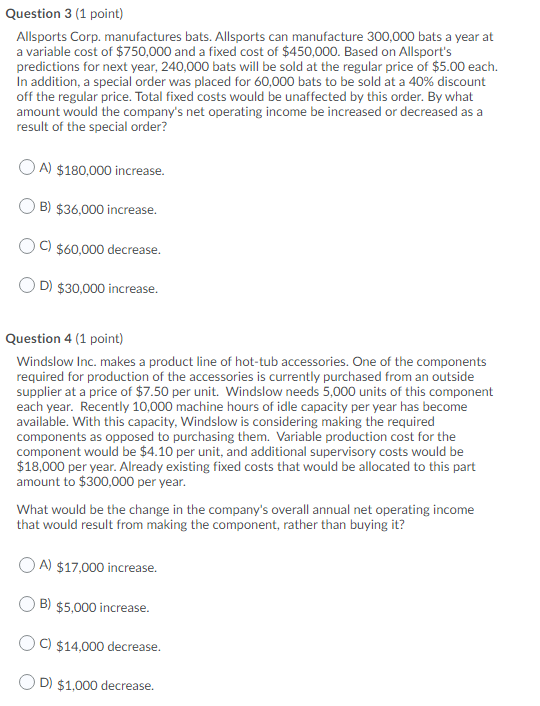

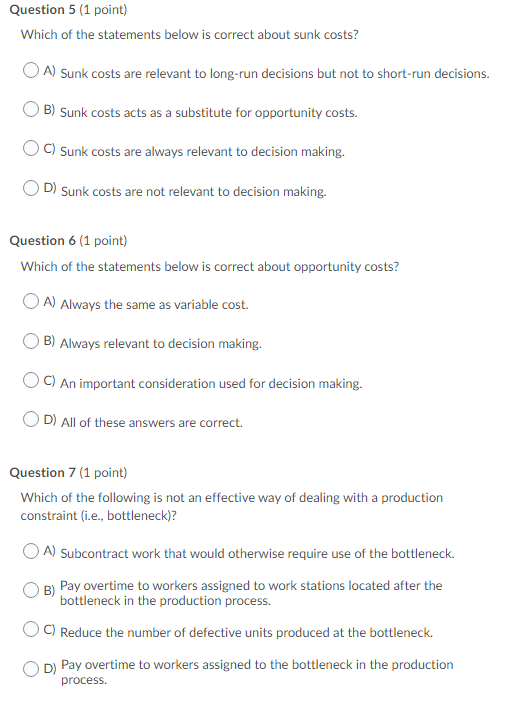

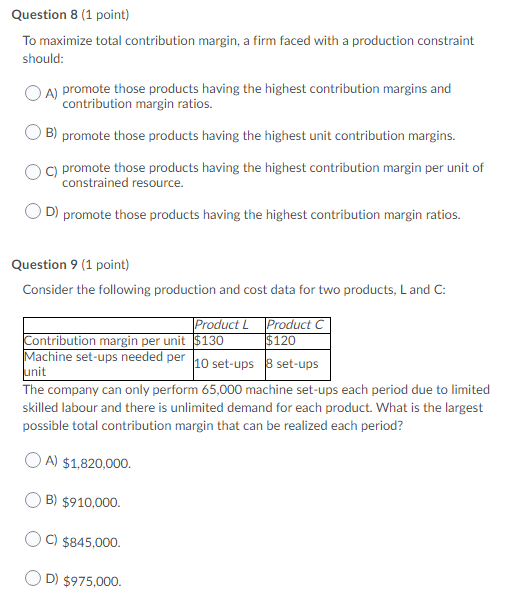

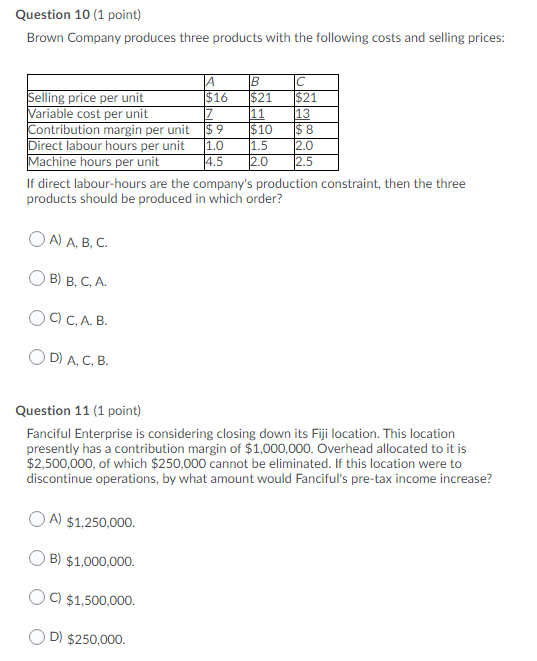

Question 1 (4 points) Select all of the following statements that are correct. Purchase of poor quality materials will generally result in a favourable materials price variance and a favourable material quantity variance. The only difference between the static budget and flexible budget is that the static budget is prepared using planned output. If a company has a favourable efficiency variance, it uses less inputs than were budgeted for the output units achieved. The standard direct labour rate includes fringe benefits such as health/dental or pension. The material quantity variance is computed based on the quantity of all materials purchased during the period. In a standard costing system, under-applied or over-applied fixed overhead is equal to the sum of the fixed overhead budget variance and the fixed overhead volume variance. Question 2 (1 point) U-Matter produces 2,000 hydraulic lift bars per year, which are used in the assembly of one of its specialized wheelchair. The unit product cost of these parts is comprised of variable manufacturing costs of $12 and fixed manufacturing costs of $9 for a total cost of $21 per unit. The lift bar can be purchased from an outside supplier at $20 per unit. If the part is purchased from the outside supplier, two thirds of the fixed manufacturing costs can be eliminated. What is the annual impact on the company's net operating income as a result of buying the part from the outside supplier? A) $10,000 increase. B) $2,000 increase. C) $10,000 decrease. D) $2.000 decrease. Question 3 (1 point) Allsports Corp. manufactures bats. Allsports can manufacture 300,000 bats a year at a variable cost of $750,000 and a fixed cost of $450,000. Based on Allsport's predictions for next year, 240,000 bats will be sold at the regular price of $5.00 each. In addition, a special order was placed for 60,000 bats to be sold at a 40% discount off the regular price. Total fixed costs would be unaffected by this order. By what amount would the company's net operating income be increased or decreased as a result of the special order? A) $180,000 increase. B) $36,000 increase. C) $60,000 decrease. D) $30,000 increase. Question 4 (1 point) Windslow Inc. makes a product line of hot-tub accessories. One of the components required for production of the accessories is currently purchased from an outside supplier at a price of $7.50 per unit. Windslow needs 5,000 units of this component each year. Recently 10,000 machine hours of idle capacity per year has become available. With this capacity, Windslow is considering making the required components as opposed to purchasing them. Variable production cost for the component would be $4.10 per unit, and additional supervisory costs would be $18,000 per year. Already existing fixed costs that would be allocated to this part amount to $300,000 per year. What would be the change in the company's overall annual net operating income that would result from making the component, rather than buying it? A) $17,000 increase. B) $5,000 increase. C) $14.000 decrease. D) $1,000 decrease. Question 5 (1 point) Which of the statements below is correct about sunk costs? A) Sunk costs are relevant to long-run decisions but not to short-run decisions. B) Sunk costs acts as a substitute for opportunity costs. C) Sunk costs are always relevant to decision making. D) Sunk costs are not relevant to decision making. Question 6 (1 point) Which of the statements below is correct about opportunity costs? O A) Always the same as variable cost. B) Always relevant to decision making. C) An important consideration used for decision making. OD) All of these answers are correct. Question 7 (1 point) Which of the following is not an effective way of dealing with a production constraint (i.e., bottleneck)? O A) Subcontract work that would otherwise require use of the bottleneck. B) Pay overtime to workers assigned to work stations located after the bottleneck in the production process. OC) Reduce the number of defective units produced at the bottleneck. OD) Pay overtime to workers assigned to the bottleneck in the production process. Question 8 (1 point) To maximize total contribution margin, a firm faced with a production constraint should: A) promote those products having the highest contribution margins and contribution margin ratios. B) promote those products having the highest unit contribution margins. C) promote those products having the highest contribution margin per unit of constrained resource. D) promote those products having the highest contribution margin ratios. Question 9 (1 point) Consider the following production and cost data for two products, Land C: Product L Product C Contribution margin per unit $130 $120 Machine set-ups needed per 10 set-ups 3 set-ups unit The company can only perform 65,000 machine set-ups each period due to limited skilled labour and there is unlimited demand for each product. What is the largest possible total contribution margin that can be realized each period? A) $1,820,000 B) $910,000 C) $845,000 D) $975,000 Question 10 (1 point) Brown Company produces three products with the following costs and selling prices: A B C Selling price per unit $16 $21 $21 Variable cost per unit Z 11 13 Contribution margin per unit 1$ 9 $10 $ 8 Direct labour hours per unit 1.0 12.0 Machine hours per unit 4.5 12.0 12.5 If direct labour-hours are the company's production constraint, then the three products should be produced in which order? 1.5 OA) A, B, C. B) B, C, A. OC) C, A. B. OD A, C, B. Question 11 (1 point) Fanciful Enterprise is considering closing down its Fiji location. This location presently has a contribution margin of $1,000,000. Overhead allocated to it is $2,500,000, of which $250,000 cannot be eliminated. If this location were to discontinue operations, by what amount would Fanciful's pre-tax income increase? OA) $1,250,000 B) $1,000,000 C) $1,500,000 D) $250,000