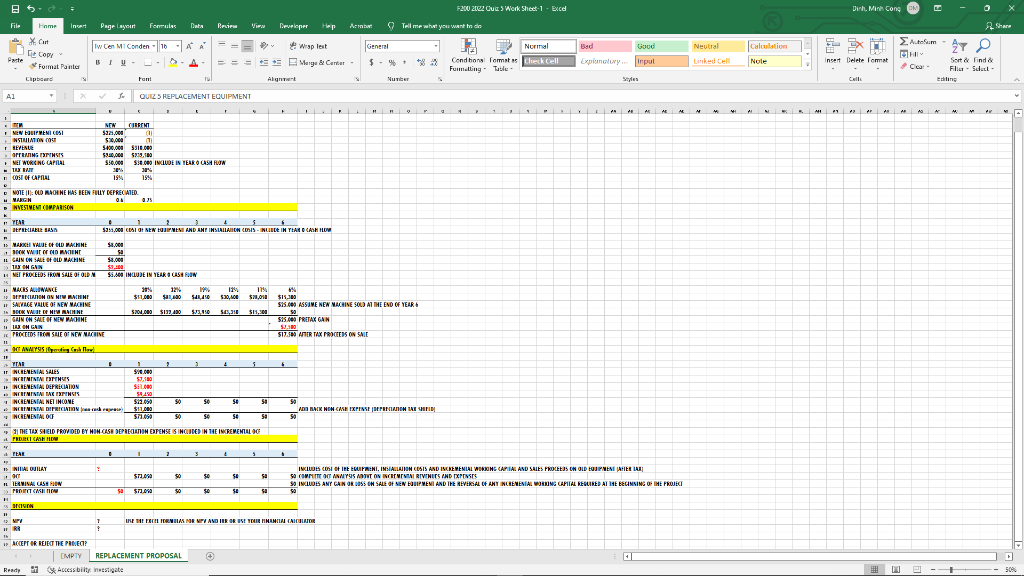

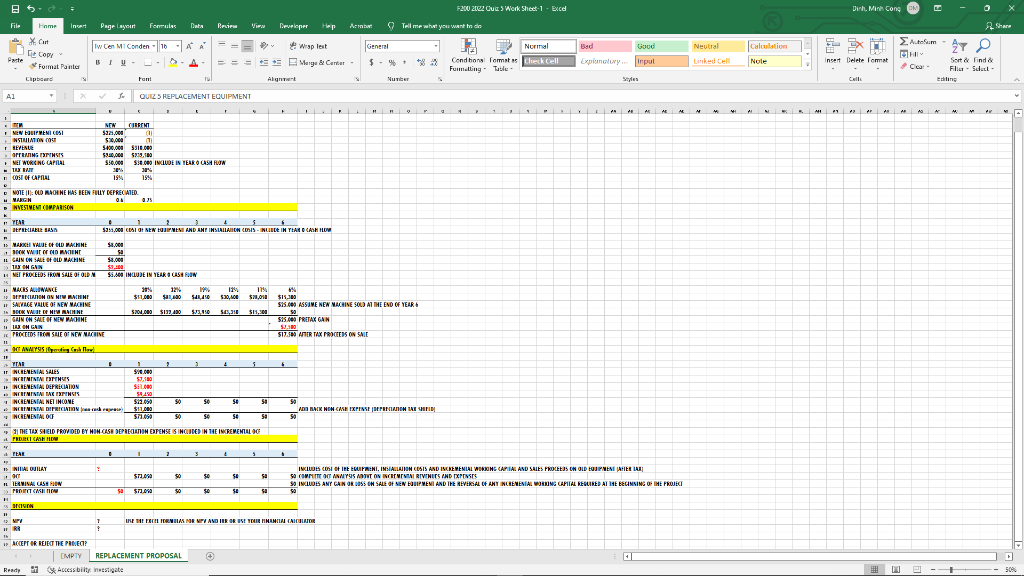

Question 1 4 pts The Excel spread sheet included in the instructions to this quiz details a capital budgeting proposal for a new piece of equipment for your company that will replace an existing piece of equipment (replacement project). You are the financial manager that will explain the proposal to the senior management. What is the (tax) depreciable basis of the new equipment proposed? O $150,000 O $175,000 O $255,000 Non of the above Question 2 4 pts The new equipment will increase cash flow by reducing annual expenses by $7,500. True False F200 2122 Out 5 Work Sheet-1 - Excel Dih, Minh Cng - 0 X File Home Insert Page Layout Formule Dieta A Share X. Cart Twen MI Conden - 16 AA Normal Neutral Auteum Beiru Viru Developer Hep Arbor Tell me what you want to de Wrap leat General 17 = = = Merge & Carter $ - 4 +387 Cond tons Tomat Fummelting Toute Alynn Number De Co ite *Formal Painter 47 O Bad Goud Explontury. Input Calculation Nole - EX II Insert Delete Format A Check Cell Sort find File - Sedali - ang Clipboard Fami Styles Call 41 QUIZ 5 REPLACEMENT EQUIPMENT ME M M ! MEN FOU MENISI SIMON OU REVENUE Oru INSIS NETWORKING CAPITAL NEN CHINI COM 5220.000 U 520.000 5400.000 5310.00 $180,000 $999.180 550.000 $99.000 INCLUDE IN TEARO CASH RON - COST OF CAPITAL 15% 15% NOTE 11:00 RACINE HAS BEEN FULLY DEPRECATED WWW 00 NVESTMENT COMPARISON PYAR OPELLAELE BASS $39.000 CATONEN EQUIPMENT AND AN INSTALLATION IS INCLUDE IN TEAR DAM HU 1) MARXH VALUE OF OLD MACHINE $8.000 BOOK WINDMINE -12 IL CAIN ON SALE OF OLD MACHINE $8.000 TUSHGAN $9.00 MET PROCEEDS IRON SAITOTOINSA INGLUDE IN YEAR TUSHROON SALE 30% $11.000 12% 1.0 SD 530,1 11% 571,010 $ % $15.00 $25.000 ASSUME NEW MACHINE SOLD AT THE END OF YEAR 500.000 $123.400 $3,NO SES, $15.30 SIS. PRETAX GAN Sa 517.500 AFTER TAX PROCEEDS ON SALE $ MALES ALINANCE 1 DIPERCANON ON NI RAHNE SALVACE VALUE OF NEN MACHINE 14 BOK VAUDE DE NIV RACHINE I SAIN OH SALE ONE WHNE HIIUM GAN PROCEEDS TRASHEGI NEW ICHINE 11 - 00 ANMEYSSIC IF TIAD ir NLBENENIA, SALES NUNTATISTS IF INCRENENTAL DEPRECIATION MENINTA MARTINS NINIATAL NET INCONE 1 INCREMENIN BEPRECIATION NCRININTA OF 3 2 4 90.000 53.100 S.RO $940 $12.050 $11. $71.050 50 SC SE Sa 50 ADD BAK NINCASHIXHINSEPARAREHEID 50 50 se 50 58 1 THE TAX SHELD PROVIDED BY HIM-CASE DEPREDANIN EXPENSES INCLUDED IN THE INTEMENTAL DO PRE CARE IN TEAE . 1 2 3 & 5 ? E NINJILAY LAMINAL CASE ON PROIECT CASH NON $71.000 50 $4 90 $0 INCLUDES COST OF THE EQUIPMENT, INSI ALLATIONCOIS AND INCREMENTAL WORKING CAPITAL AND SALES PROCESS ON OID EQUIPMENT AFTER LAR Sa CON TOT MAITSISAATIT ON SENI RIVENUTS AND XPENSES 59 INCLUDES ANT GAIN OKUS ON SALE OF MEN BOUIPMEN AND THE REVERSAL OF ANY INCREMENIAWORKING CAPITAL REBUIRED AT THE BEGINNING OF IME PROJECT OR so sa $12.00 SE 90 H ORION MPV H RR IREMEERIR TORNILAS HORNEY AND TRE OR USE YOUR MINAMIN CALOR THE I ACCEPT OR BEJET THE PICO EMPTY REPLACEMENT PROPOSAL Ready 1 Accessbility investigate E -- - 500 Question 1 4 pts The Excel spread sheet included in the instructions to this quiz details a capital budgeting proposal for a new piece of equipment for your company that will replace an existing piece of equipment (replacement project). You are the financial manager that will explain the proposal to the senior management. What is the (tax) depreciable basis of the new equipment proposed? O $150,000 O $175,000 O $255,000 Non of the above Question 2 4 pts The new equipment will increase cash flow by reducing annual expenses by $7,500. True False F200 2122 Out 5 Work Sheet-1 - Excel Dih, Minh Cng - 0 X File Home Insert Page Layout Formule Dieta A Share X. Cart Twen MI Conden - 16 AA Normal Neutral Auteum Beiru Viru Developer Hep Arbor Tell me what you want to de Wrap leat General 17 = = = Merge & Carter $ - 4 +387 Cond tons Tomat Fummelting Toute Alynn Number De Co ite *Formal Painter 47 O Bad Goud Explontury. Input Calculation Nole - EX II Insert Delete Format A Check Cell Sort find File - Sedali - ang Clipboard Fami Styles Call 41 QUIZ 5 REPLACEMENT EQUIPMENT ME M M ! MEN FOU MENISI SIMON OU REVENUE Oru INSIS NETWORKING CAPITAL NEN CHINI COM 5220.000 U 520.000 5400.000 5310.00 $180,000 $999.180 550.000 $99.000 INCLUDE IN TEARO CASH RON - COST OF CAPITAL 15% 15% NOTE 11:00 RACINE HAS BEEN FULLY DEPRECATED WWW 00 NVESTMENT COMPARISON PYAR OPELLAELE BASS $39.000 CATONEN EQUIPMENT AND AN INSTALLATION IS INCLUDE IN TEAR DAM HU 1) MARXH VALUE OF OLD MACHINE $8.000 BOOK WINDMINE -12 IL CAIN ON SALE OF OLD MACHINE $8.000 TUSHGAN $9.00 MET PROCEEDS IRON SAITOTOINSA INGLUDE IN YEAR TUSHROON SALE 30% $11.000 12% 1.0 SD 530,1 11% 571,010 $ % $15.00 $25.000 ASSUME NEW MACHINE SOLD AT THE END OF YEAR 500.000 $123.400 $3,NO SES, $15.30 SIS. PRETAX GAN Sa 517.500 AFTER TAX PROCEEDS ON SALE $ MALES ALINANCE 1 DIPERCANON ON NI RAHNE SALVACE VALUE OF NEN MACHINE 14 BOK VAUDE DE NIV RACHINE I SAIN OH SALE ONE WHNE HIIUM GAN PROCEEDS TRASHEGI NEW ICHINE 11 - 00 ANMEYSSIC IF TIAD ir NLBENENIA, SALES NUNTATISTS IF INCRENENTAL DEPRECIATION MENINTA MARTINS NINIATAL NET INCONE 1 INCREMENIN BEPRECIATION NCRININTA OF 3 2 4 90.000 53.100 S.RO $940 $12.050 $11. $71.050 50 SC SE Sa 50 ADD BAK NINCASHIXHINSEPARAREHEID 50 50 se 50 58 1 THE TAX SHELD PROVIDED BY HIM-CASE DEPREDANIN EXPENSES INCLUDED IN THE INTEMENTAL DO PRE CARE IN TEAE . 1 2 3 & 5 ? E NINJILAY LAMINAL CASE ON PROIECT CASH NON $71.000 50 $4 90 $0 INCLUDES COST OF THE EQUIPMENT, INSI ALLATIONCOIS AND INCREMENTAL WORKING CAPITAL AND SALES PROCESS ON OID EQUIPMENT AFTER LAR Sa CON TOT MAITSISAATIT ON SENI RIVENUTS AND XPENSES 59 INCLUDES ANT GAIN OKUS ON SALE OF MEN BOUIPMEN AND THE REVERSAL OF ANY INCREMENIAWORKING CAPITAL REBUIRED AT THE BEGINNING OF IME PROJECT OR so sa $12.00 SE 90 H ORION MPV H RR IREMEERIR TORNILAS HORNEY AND TRE OR USE YOUR MINAMIN CALOR THE I ACCEPT OR BEJET THE PICO EMPTY REPLACEMENT PROPOSAL Ready 1 Accessbility investigate E -- - 500