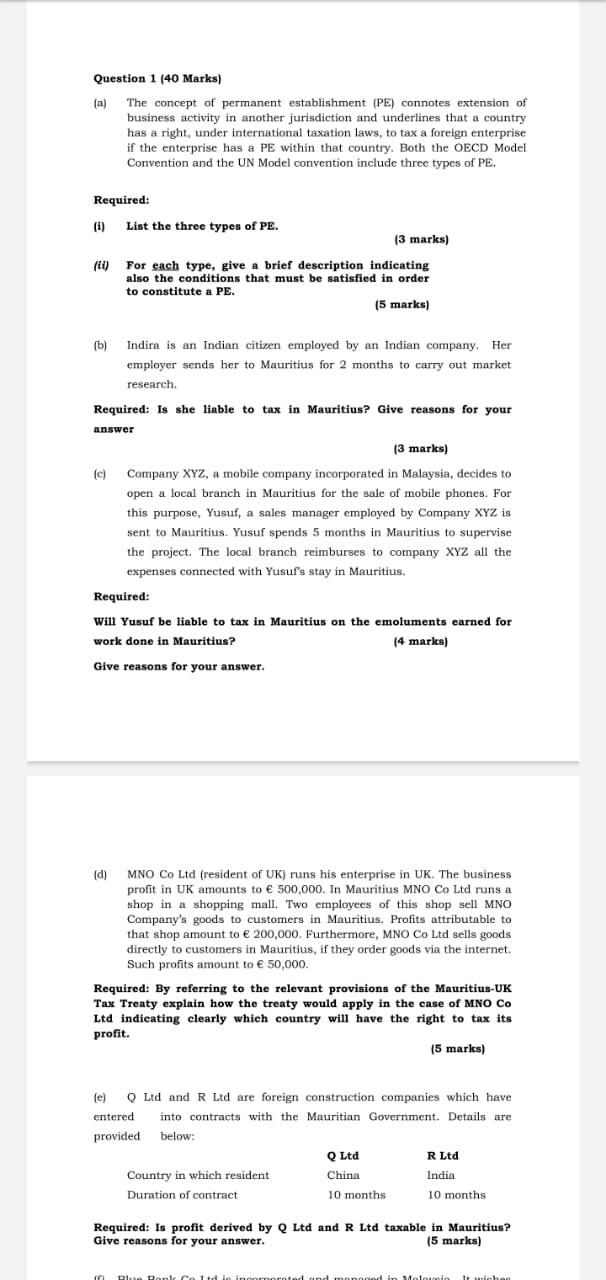

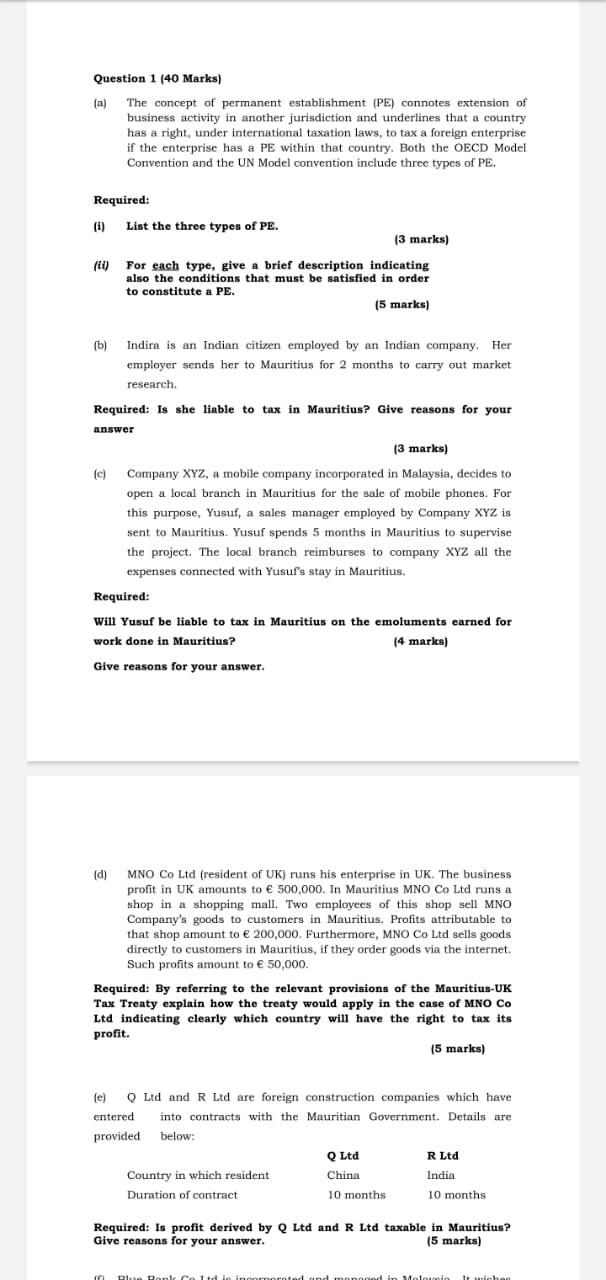

Question 1 (40 Marks) (a) The concept of permanent establishment (PE) connotes extension of business activity in another jurisdiction and underlines that a country has a right, under international taxation laws, to tax a foreign enterprise if the enterprise has a PE within that country. Both the OECD Model Convention and the UN Model convention include three types of PE. Required: List the three types of PE. (3 marks) fill) For each type, give a brief description indicating also the conditions that must be satisfied in order to constitute a PE. (5 marks) (b) Indira is an Indian citizen employed by an Indian company. Her employer sends her to Mauritius for 2 months to carry out market research Required: Is she liable to tax in Mauritius? Give reasons for your answer 13 marks) (c) Company XYZ, a mobile company incorporated in Malaysia, decides to open a local branch in Mauritius for the sale of mobile phones. For this purpose, Yusuf, a sales manager employed by Company XYZ is sent to Mauritius. Yusuf spends 5 months in Mauritius to supervise the project. The local branch reimburses to company XYZ all the expenses connected with Yusuf's stay in Mauritius, Required: Will Yusuf be liable to tax in Mauritius on the emoluments earned for work done in Mauritius? (4 marks) Give reasons for your answer. (d) MNO Co Ltd (resident UK) runs his enterprise business profit in UK amounts to 500.000. In Mauritius MNO Co Ltd runs a shop in a shopping mall. Two employees of this shop sell MNO Company's goods to customers in Mauritius. Profits attributable to that shop amount to 200,000. Furthermore, MNO Co Ltd sells goods directly to customers in Mauritius, if they order goods via the internet. Such profits amount to 50,000. Required: By referring to the relevant provisions of the Mauritius-UK Tax Treaty explain how the treaty would apply in the case of MNO CO Ltd indicating clearly which country will have the right to tax its profit. (5 marks) (e) O Ltd and R Ltd are foreign construction companies which have entered into contracts with the Mauritian Government. Details are provided below: Q Ltd R Ltd Country in which resident China India Duration of contract 10 months 10 months Required: Is profit derived by Q Ltd and R Ltd taxable in Mauritius? Give reasons for your answer. (5 marks) plant It wricho