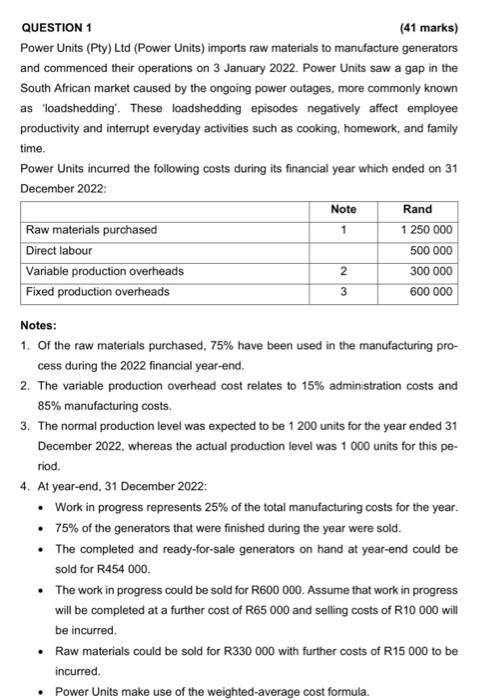

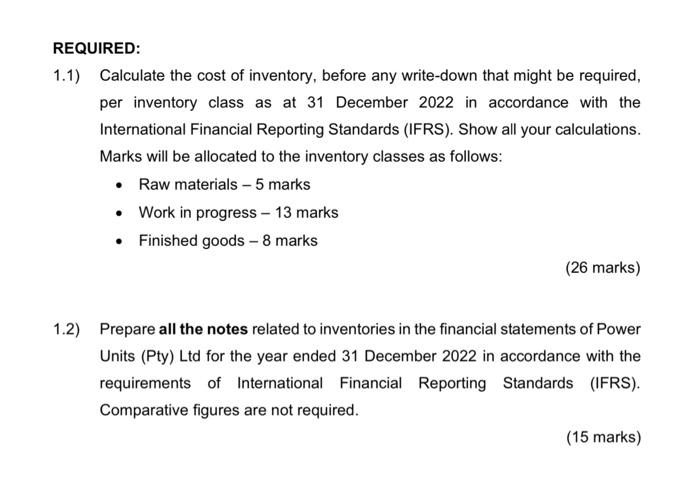

QUESTION 1 (41 marks) Power Units (Pty) Ltd (Power Units) imports raw materials to manufacture generators and commenced their operations on 3 January 2022. Power Units saw a gap in the South African market caused by the ongoing power outages, more commonly known as 'loadshedding'. These loadshedding episodes negatively affect employee productivity and interrupt everyday activities such as cooking, homework, and family time. Power Units incurred the following costs during its financial year which ended on 31 December 2022: Notes: 1. Of the raw materials purchased, 75% have been used in the manufacturing process during the 2022 financial year-end. 2. The variable production overhead cost relates to 15% administration costs and 85% manufacturing costs. 3. The normal production level was expected to be 1200 units for the year ended 31 December 2022, whereas the actual production level was 1000 units for this period. 4. At year-end, 31 December 2022: - Work in progress represents 25% of the total manufacturing costs for the year. - 75% of the generators that were finished during the year were sold. - The completed and ready-for-sale generators on hand at year-end could be sold for R454 000. - The work in progress could be sold for R600 000 . Assume that work in progress will be completed at a further cost of R65 000 and selling costs of R10 000 will be incurred. - Raw materials could be sold for R330000 with further costs of R15000 to be incurred. - Power Units make use of the weighted-average cost formula. REQUIRED: 1.1) Calculate the cost of inventory, before any write-down that might be required, per inventory class as at 31 December 2022 in accordance with the International Financial Reporting Standards (IFRS). Show all your calculations. Marks will be allocated to the inventory classes as follows: - Raw materials - 5 marks - Work in progress - 13 marks - Finished goods -8 marks (26 marks) 1.2) Prepare all the notes related to inventories in the financial statements of Power Units (Pty) Ltd for the year ended 31 December 2022 in accordance with the requirements of International Financial Reporting Standards (IFRS). Comparative figures are not required