Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 [41 Marks] Queen, one of the directors of Queen Ltd. (Queen), worked in the clothing industry in the USA for a period of

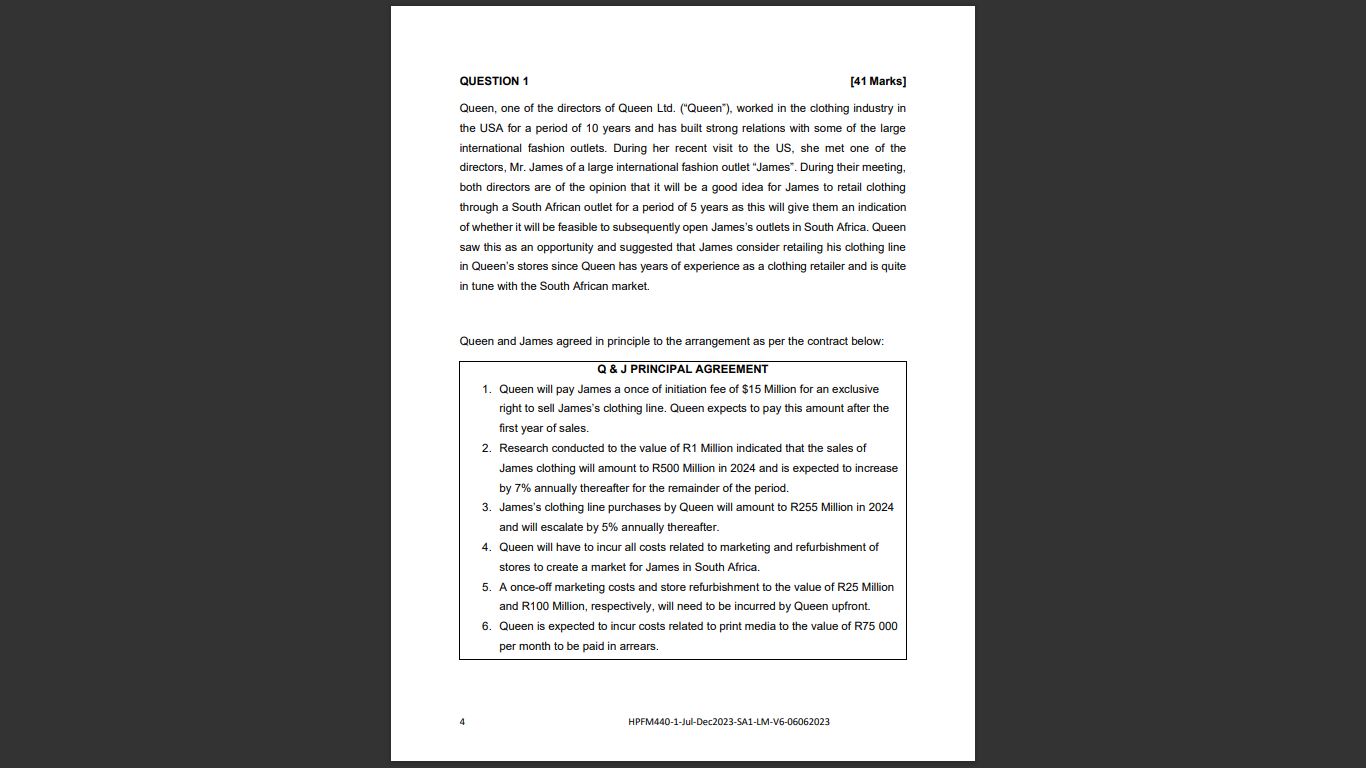

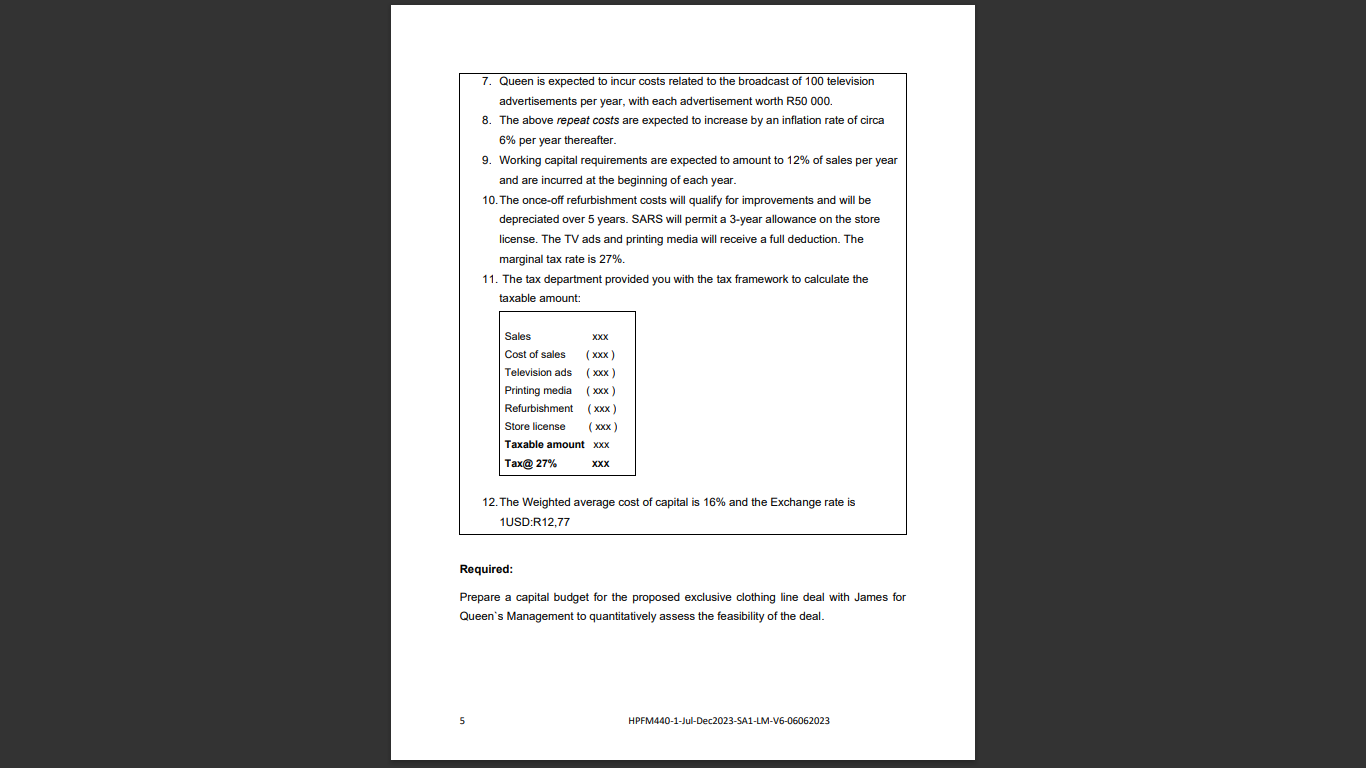

QUESTION 1 [41 Marks] Queen, one of the directors of Queen Ltd. ("Queen"), worked in the clothing industry in the USA for a period of 10 years and has built strong relations with some of the large international fashion outlets. During her recent visit to the US, she met one of the directors, Mr. James of a large international fashion outlet "James". During their meeting, both directors are of the opinion that it will be a good idea for James to retail clothing through a South African outlet for a period of 5 years as this will give them an indication of whether it will be feasible to subsequently open James's outlets in South Africa. Queen saw this as an opportunity and suggested that James consider retailing his clothing line in Queen's stores since Queen has years of experience as a clothing retailer and is quite in tune with the South African market. Queen and James agreed in principle to the arrangement as per the contract below: Q \& J PRINCIPAL AGREEMENT 1. Queen will pay James a once of initiation fee of $15 Million for an exclusive right to sell James's clothing line. Queen expects to pay this amount after the first year of sales. 2. Research conducted to the value of R1 Million indicated that the sales of James clothing will amount to R500 Million in 2024 and is expected to increase by 7% annually thereafter for the remainder of the period. 3. James's clothing line purchases by Queen will amount to R255 Million in 2024 and will escalate by 5% annually thereafter. 4. Queen will have to incur all costs related to marketing and refurbishment of stores to create a market for James in South Africa. 5. A once-off marketing costs and store refurbishment to the value of R25 Million and R100 Million, respectively, will need to be incurred by Queen upfront. 6. Queen is expected to incur costs related to print media to the value of R75 000 per month to be paid in arrears. 4 HPFM440-1-Jul-Dec2023-SA1-LM-V6-06062023 Queen's Management Instructions: - Capital budget should be from column A to G. Merge and center row 1, column AG and type in "Capital Budget" and bold the words. Prepare the tax calculation on a separate worksheet and only include the final tax amounts in the Capital Budget. - Add a notes area to the sheets on column "i" where you enter sales and costs of sale percentage increases, exchange rates, tax percentage, inflation, TV advertisements, to use as reference when calculating amounts in your capital budget. - Make use of formulas, cell reference and absolute cell referencing when preparing the capital budget and tax calculation. The notes area in column " i " should be used as cell reference in your capital budgeting. - Include the Normal view and Formula view in separate sheets before converting your assignment to PDF as per the assessment instructions. Mark allocation: Net Present Value - Normal view - Formula view Tax calculation - Normal view - Formula view (14 Marks) (10 Marks) (8 Marks) (8 Marks) Excel instructions - Merge and center row 1 and bolding the words "Capital budget" (1 Mark) 7. Queen is expected to incur costs related to the broadcast of 100 television advertisements per year, with each advertisement worth R50 000 . 8. The above repeat costs are expected to increase by an inflation rate of circa 6% per year thereafter. 9. Working capital requirements are expected to amount to 12% of sales per year and are incurred at the beginning of each year. 10. The once-off refurbishment costs will qualify for improvements and will be depreciated over 5 years. SARS will permit a 3-year allowance on the store license. The TV ads and printing media will receive a full deduction. The marginal tax rate is 27%. 11. The tax department provided you with the tax framework to calculate the taxable amount: 12. The Weighted average cost of capital is 16% and the Exchange rate is 1USD:R12,77 Required: Prepare a capital budget for the proposed exclusive clothing line deal with James for Queen's Management to quantitatively assess the feasibility of the deal. QUESTION 1 [41 Marks] Queen, one of the directors of Queen Ltd. ("Queen"), worked in the clothing industry in the USA for a period of 10 years and has built strong relations with some of the large international fashion outlets. During her recent visit to the US, she met one of the directors, Mr. James of a large international fashion outlet "James". During their meeting, both directors are of the opinion that it will be a good idea for James to retail clothing through a South African outlet for a period of 5 years as this will give them an indication of whether it will be feasible to subsequently open James's outlets in South Africa. Queen saw this as an opportunity and suggested that James consider retailing his clothing line in Queen's stores since Queen has years of experience as a clothing retailer and is quite in tune with the South African market. Queen and James agreed in principle to the arrangement as per the contract below: Q \& J PRINCIPAL AGREEMENT 1. Queen will pay James a once of initiation fee of $15 Million for an exclusive right to sell James's clothing line. Queen expects to pay this amount after the first year of sales. 2. Research conducted to the value of R1 Million indicated that the sales of James clothing will amount to R500 Million in 2024 and is expected to increase by 7% annually thereafter for the remainder of the period. 3. James's clothing line purchases by Queen will amount to R255 Million in 2024 and will escalate by 5% annually thereafter. 4. Queen will have to incur all costs related to marketing and refurbishment of stores to create a market for James in South Africa. 5. A once-off marketing costs and store refurbishment to the value of R25 Million and R100 Million, respectively, will need to be incurred by Queen upfront. 6. Queen is expected to incur costs related to print media to the value of R75 000 per month to be paid in arrears. 4 HPFM440-1-Jul-Dec2023-SA1-LM-V6-06062023 Queen's Management Instructions: - Capital budget should be from column A to G. Merge and center row 1, column AG and type in "Capital Budget" and bold the words. Prepare the tax calculation on a separate worksheet and only include the final tax amounts in the Capital Budget. - Add a notes area to the sheets on column "i" where you enter sales and costs of sale percentage increases, exchange rates, tax percentage, inflation, TV advertisements, to use as reference when calculating amounts in your capital budget. - Make use of formulas, cell reference and absolute cell referencing when preparing the capital budget and tax calculation. The notes area in column " i " should be used as cell reference in your capital budgeting. - Include the Normal view and Formula view in separate sheets before converting your assignment to PDF as per the assessment instructions. Mark allocation: Net Present Value - Normal view - Formula view Tax calculation - Normal view - Formula view (14 Marks) (10 Marks) (8 Marks) (8 Marks) Excel instructions - Merge and center row 1 and bolding the words "Capital budget" (1 Mark) 7. Queen is expected to incur costs related to the broadcast of 100 television advertisements per year, with each advertisement worth R50 000 . 8. The above repeat costs are expected to increase by an inflation rate of circa 6% per year thereafter. 9. Working capital requirements are expected to amount to 12% of sales per year and are incurred at the beginning of each year. 10. The once-off refurbishment costs will qualify for improvements and will be depreciated over 5 years. SARS will permit a 3-year allowance on the store license. The TV ads and printing media will receive a full deduction. The marginal tax rate is 27%. 11. The tax department provided you with the tax framework to calculate the taxable amount: 12. The Weighted average cost of capital is 16% and the Exchange rate is 1USD:R12,77 Required: Prepare a capital budget for the proposed exclusive clothing line deal with James for Queen's Management to quantitatively assess the feasibility of the deal

QUESTION 1 [41 Marks] Queen, one of the directors of Queen Ltd. ("Queen"), worked in the clothing industry in the USA for a period of 10 years and has built strong relations with some of the large international fashion outlets. During her recent visit to the US, she met one of the directors, Mr. James of a large international fashion outlet "James". During their meeting, both directors are of the opinion that it will be a good idea for James to retail clothing through a South African outlet for a period of 5 years as this will give them an indication of whether it will be feasible to subsequently open James's outlets in South Africa. Queen saw this as an opportunity and suggested that James consider retailing his clothing line in Queen's stores since Queen has years of experience as a clothing retailer and is quite in tune with the South African market. Queen and James agreed in principle to the arrangement as per the contract below: Q \& J PRINCIPAL AGREEMENT 1. Queen will pay James a once of initiation fee of $15 Million for an exclusive right to sell James's clothing line. Queen expects to pay this amount after the first year of sales. 2. Research conducted to the value of R1 Million indicated that the sales of James clothing will amount to R500 Million in 2024 and is expected to increase by 7% annually thereafter for the remainder of the period. 3. James's clothing line purchases by Queen will amount to R255 Million in 2024 and will escalate by 5% annually thereafter. 4. Queen will have to incur all costs related to marketing and refurbishment of stores to create a market for James in South Africa. 5. A once-off marketing costs and store refurbishment to the value of R25 Million and R100 Million, respectively, will need to be incurred by Queen upfront. 6. Queen is expected to incur costs related to print media to the value of R75 000 per month to be paid in arrears. 4 HPFM440-1-Jul-Dec2023-SA1-LM-V6-06062023 Queen's Management Instructions: - Capital budget should be from column A to G. Merge and center row 1, column AG and type in "Capital Budget" and bold the words. Prepare the tax calculation on a separate worksheet and only include the final tax amounts in the Capital Budget. - Add a notes area to the sheets on column "i" where you enter sales and costs of sale percentage increases, exchange rates, tax percentage, inflation, TV advertisements, to use as reference when calculating amounts in your capital budget. - Make use of formulas, cell reference and absolute cell referencing when preparing the capital budget and tax calculation. The notes area in column " i " should be used as cell reference in your capital budgeting. - Include the Normal view and Formula view in separate sheets before converting your assignment to PDF as per the assessment instructions. Mark allocation: Net Present Value - Normal view - Formula view Tax calculation - Normal view - Formula view (14 Marks) (10 Marks) (8 Marks) (8 Marks) Excel instructions - Merge and center row 1 and bolding the words "Capital budget" (1 Mark) 7. Queen is expected to incur costs related to the broadcast of 100 television advertisements per year, with each advertisement worth R50 000 . 8. The above repeat costs are expected to increase by an inflation rate of circa 6% per year thereafter. 9. Working capital requirements are expected to amount to 12% of sales per year and are incurred at the beginning of each year. 10. The once-off refurbishment costs will qualify for improvements and will be depreciated over 5 years. SARS will permit a 3-year allowance on the store license. The TV ads and printing media will receive a full deduction. The marginal tax rate is 27%. 11. The tax department provided you with the tax framework to calculate the taxable amount: 12. The Weighted average cost of capital is 16% and the Exchange rate is 1USD:R12,77 Required: Prepare a capital budget for the proposed exclusive clothing line deal with James for Queen's Management to quantitatively assess the feasibility of the deal. QUESTION 1 [41 Marks] Queen, one of the directors of Queen Ltd. ("Queen"), worked in the clothing industry in the USA for a period of 10 years and has built strong relations with some of the large international fashion outlets. During her recent visit to the US, she met one of the directors, Mr. James of a large international fashion outlet "James". During their meeting, both directors are of the opinion that it will be a good idea for James to retail clothing through a South African outlet for a period of 5 years as this will give them an indication of whether it will be feasible to subsequently open James's outlets in South Africa. Queen saw this as an opportunity and suggested that James consider retailing his clothing line in Queen's stores since Queen has years of experience as a clothing retailer and is quite in tune with the South African market. Queen and James agreed in principle to the arrangement as per the contract below: Q \& J PRINCIPAL AGREEMENT 1. Queen will pay James a once of initiation fee of $15 Million for an exclusive right to sell James's clothing line. Queen expects to pay this amount after the first year of sales. 2. Research conducted to the value of R1 Million indicated that the sales of James clothing will amount to R500 Million in 2024 and is expected to increase by 7% annually thereafter for the remainder of the period. 3. James's clothing line purchases by Queen will amount to R255 Million in 2024 and will escalate by 5% annually thereafter. 4. Queen will have to incur all costs related to marketing and refurbishment of stores to create a market for James in South Africa. 5. A once-off marketing costs and store refurbishment to the value of R25 Million and R100 Million, respectively, will need to be incurred by Queen upfront. 6. Queen is expected to incur costs related to print media to the value of R75 000 per month to be paid in arrears. 4 HPFM440-1-Jul-Dec2023-SA1-LM-V6-06062023 Queen's Management Instructions: - Capital budget should be from column A to G. Merge and center row 1, column AG and type in "Capital Budget" and bold the words. Prepare the tax calculation on a separate worksheet and only include the final tax amounts in the Capital Budget. - Add a notes area to the sheets on column "i" where you enter sales and costs of sale percentage increases, exchange rates, tax percentage, inflation, TV advertisements, to use as reference when calculating amounts in your capital budget. - Make use of formulas, cell reference and absolute cell referencing when preparing the capital budget and tax calculation. The notes area in column " i " should be used as cell reference in your capital budgeting. - Include the Normal view and Formula view in separate sheets before converting your assignment to PDF as per the assessment instructions. Mark allocation: Net Present Value - Normal view - Formula view Tax calculation - Normal view - Formula view (14 Marks) (10 Marks) (8 Marks) (8 Marks) Excel instructions - Merge and center row 1 and bolding the words "Capital budget" (1 Mark) 7. Queen is expected to incur costs related to the broadcast of 100 television advertisements per year, with each advertisement worth R50 000 . 8. The above repeat costs are expected to increase by an inflation rate of circa 6% per year thereafter. 9. Working capital requirements are expected to amount to 12% of sales per year and are incurred at the beginning of each year. 10. The once-off refurbishment costs will qualify for improvements and will be depreciated over 5 years. SARS will permit a 3-year allowance on the store license. The TV ads and printing media will receive a full deduction. The marginal tax rate is 27%. 11. The tax department provided you with the tax framework to calculate the taxable amount: 12. The Weighted average cost of capital is 16% and the Exchange rate is 1USD:R12,77 Required: Prepare a capital budget for the proposed exclusive clothing line deal with James for Queen's Management to quantitatively assess the feasibility of the deal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started