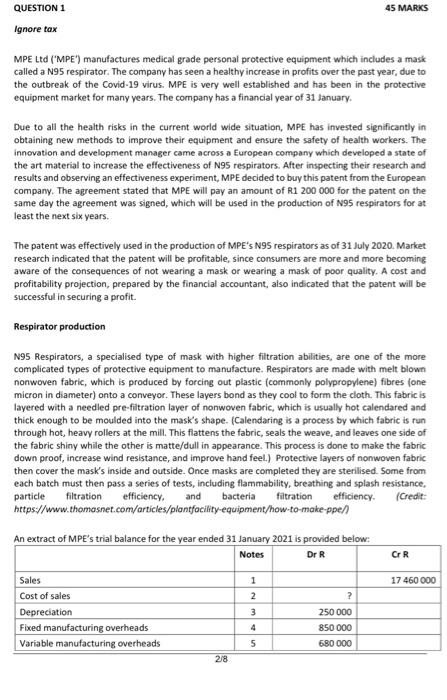

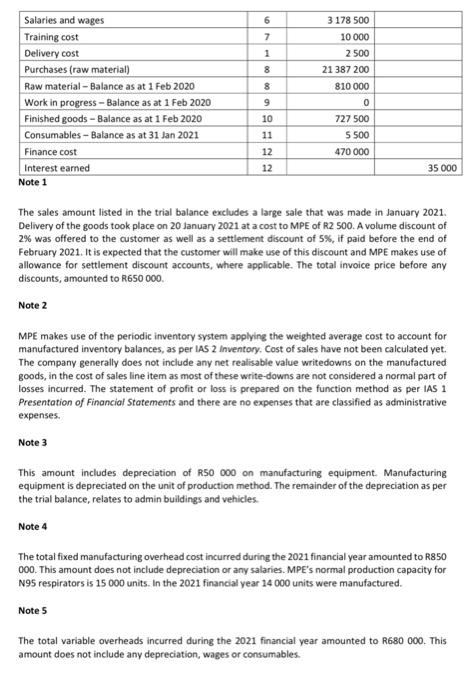

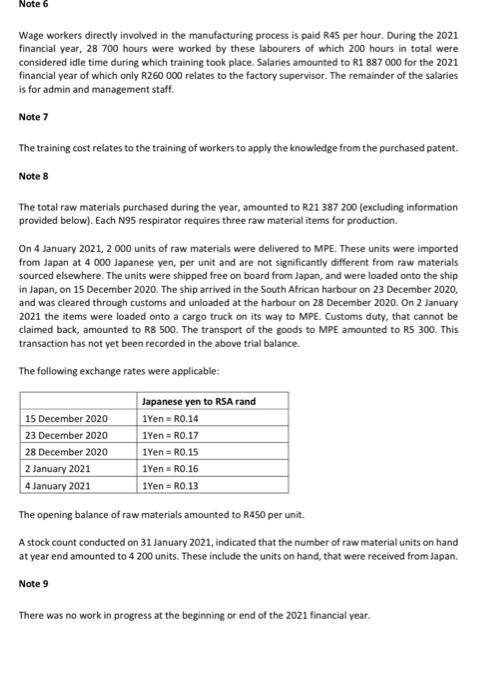

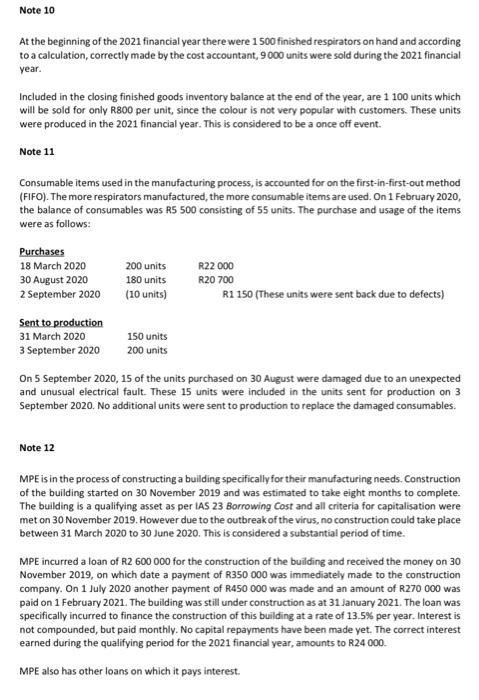

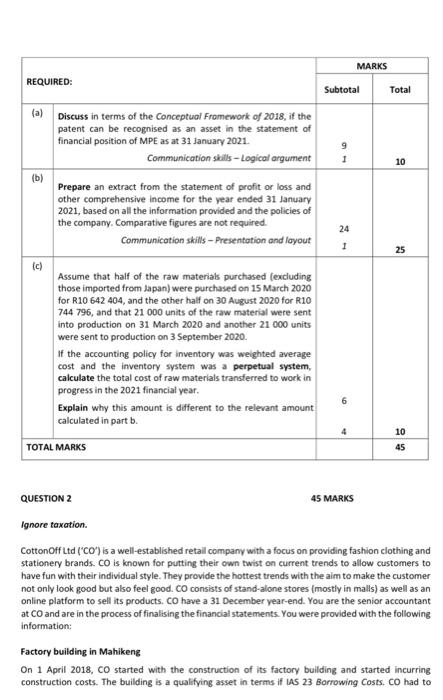

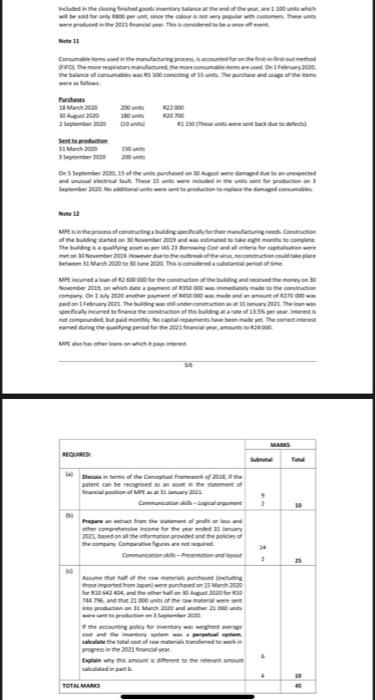

QUESTION 1 45 MARKS Ignore tax MPE Ltd ("MPE') manufactures medical grade personal protective equipment which includes a mask called a N95 respirator. The company has seen a healthy increase in profits over the past year, due to the outbreak of the Covid-19 virus. MPE is very well established and has been in the protective equipment market for many years. The company has a financial year of 31 January Due to all the health risks in the current world wide situation, MPE has invested significantly in obtaining new methods to improve their equipment and ensure the safety of health workers. The innovation and development manager came across a European company which developed a state of the art material to increase the effectiveness of N95 respirators. After inspecting their research and results and observing an effectiveness experiment, MPE decided to buy this patent from the European company. The agreement stated that MPE will pay an amount of R1 200 000 for the patent on the same day the agreement was signed, which will be used in the production of N95 respirators for at least the next six years. The patent was effectively used in the production of MPE's N95 respirators as of 31 July 2020. Market research indicated that the patent will be profitable, since consumers are more and more becoming aware of the consequences of not wearing a mask or wearing a mask of poor quality. A cost and profitability projection, prepared by the financial accountant, also indicated that the patent will be successful in securing a profit. Respirator production N95 Respirators, a specialised type of mask with higher filtration abilities, are one of the more complicated types of protective equipment to manufacture. Respirators are made with melt blown nonwoven fabric, which is produced by forcing out plastic (commonly polypropylene) fibres (one micron in diameter) onto a conveyor. These layers bond as they cool to form the cloth. This fabric is layered with a needled pre-filtration layer of nonwoven fabric, which is usually hot calendared and thick enough to be moulded into the mask's shape. (Calendaring is a process by which fabric is run through hot, heavy rollers at the mill. This flattens the fabric, seals the weave, and leaves one side of the fabric shiny while the other is matte/dull in appearance. This process is done to make the fabric down proof, increase wind resistance, and improve hand feel.) Protective layers of nonwoven fabric then cover the mask's inside and outside. Once masks are completed they are sterilised. Some from each batch must then pass a series of tests, including flammability, breathing and splash resistance. particle filtration efficiency and bacteria filtration efficiency (Credit: https://www.thomasnet.com/articles/plantfacility-equipment/how-to-make-ppe/ An extract of MPE's trial balance for the year ended 31 January 2021 is provided below: Dr R Notes CrR 17 460 000 1 2 ? Sales Cost of sales Depreciation Fixed manufacturing overheads Variable manufacturing overheads 3 4 250 000 850 000 680 000 218 6 7 1 8 Salaries and wages Training cost Delivery cost Purchases (raw material) Raw material - Balance as at 1 Feb 2020 Work in progress-Balance as at 1 Feb 2020 Finished goods - Balance as at 1 Feb 2020 Consumables - Balance as at 31 Jan 2021 Finance cost Interest earned Note 1 8 9 10 3 178 500 10 000 2500 21 387 200 810 000 0 727 500 5 500 470 000 11 12 12 35 000 The sales amount listed in the trial balance excludes a large sale that was made in January 2021. Delivery of the goods took place on 20 January 2021 at a cost to MPE of R2 500. A volume discount of 2% was offered to the customer as well as a settlement discount of 5%, if paid before the end of February 2021. It is expected that the customer will make use of this discount and MPE makes use of allowance for settlement discount accounts, where applicable. The total invoice price before any discounts, amounted to R650 000 Note 2 MPE makes use of the periodic inventory system applying the weighted average cost to account for manufactured inventory balances, as per IAS 2 Inventory. Cost of sales have not been calculated yet. The company generally does not include any net realisable value writedowns on the manufactured goods, in the cost of sales line item as most of these write-downs are not considered a normal part of losses incurred. The statement of profit or loss is prepared on the function method as per IAS 1 Presentation of Financial Statements and there are no expenses that are classified as administrative expenses. Note 3 This amount includes depreciation of R50 000 on manufacturing equipment Manufacturing equipment is depreciated on the unit of production method. The remainder of the depreciation as per the trial balance, relates to admin buildings and vehicles Note 4 The total fixed manufacturing overhead cost incurred during the 2021 financial year amounted to R850 000. This amount does not include depreciation or any salaries. MPE's normal production capacity for N95 respirators is 15 000 units. In the 2021 financial year 14 000 units were manufactured. Notes The total variable overheads incurred during the 2021 financial year amounted to R680 000. This amount does not include any depreciation, wages or consumables. Note 6 Wage workers directly involved in the manufacturing process is paid R45 per hour. During the 2021 financial year, 28 700 hours were worked by these labourers of which 200 hours in total were considered idle time during which training took place. Salaries amounted to R1 887 000 for the 2021 financial year of which only R260 000 relates to the factory supervisor. The remainder of the salaries is for admin and management staff. Note 7 The training cost relates to the training of workers to apply the knowledge from the purchased patent. Note 8 The total raw materials purchased during the year, amounted to R21 387 200 (excluding information provided below). Each N95 respirator requires three raw material items for production On 4 January 2021, 2 000 units of raw materials were delivered to MPE. These units were imported from Japan at 4 000 Japanese yen, per unit and are not significantly different from raw materials sourced elsewhere. The units were shipped free on board from Japan, and were loaded onto the ship in Japan, on 15 December 2020. The ship arrived in the South African harbour on 23 December 2020, and was cleared through customs and unloaded at the harbour on 28 December 2020. On 2 January 2021 the items were loaded onto a cargo truck on its way to MPE Customs duty, that cannot be claimed back, amounted to R8 500. The transport of the goods to MPE amounted to RS 300. This transaction has not yet been recorded in the above trial balance. The following exchange rates were applicable: 15 December 2020 23 December 2020 28 December 2020 2 January 2021 4 January 2021 Japanese yen to RSA rand 1Yen R0.14 1Yen = R0.17 1Yen = R0.15 1Yen = R0.16 1Yen = R0.13 The opening balance of raw materials amounted to R450 per unit. A stock count conducted on 31 January 2021, indicated that the number of raw material units on hand at year end amounted to 4 200 units. These include the units on hand that were received from Japan. Note 9 There was no work in progress at the beginning or end of the 2021 financial year. Note 10 At the beginning of the 2021 financial year there were 1500 finished respirators on hand and according to a calculation, correctly made by the cost accountant, 9000 units were sold during the 2021 financial year. Included in the closing finished goods inventory balance at the end of the year, are 1 100 units which will be sold for only R800 per unit, since the colour is not very popular with customers. These units were produced in the 2021 financial year. This is considered to be a once off event. Note 11 Consumable items used in the manufacturing process, is accounted for on the first-in-first-out method (FIFO). The more respirators manufactured, the more consumable items are used. On 1 February 2020, the balance of consumables was R5 500 consisting of 55 units. The purchase and usage of the items were as follows: Purchases 18 March 2020 200 units R22 000 30 August 2020 180 units R20 700 2 September 2020 (10 units) R1 150 (These units were sent back due to defects) Sent to production 31 March 2020 150 units 3 September 2020 200 units On 5 September 2020, 15 of the units purchased on 30 August were damaged due to an unexpected and unusual electrical fault. These 15 units were included in the units sent for production on 3 September 2020. No additional units were sent to production to replace the damaged consumables. Note 12 MPE is in the process of constructing a building specifically for their manufacturing needs. Construction of the building started on 30 November 2019 and was estimated to take eight months to complete. The building is a qualifying asset as per IAS 23 Borrowing Cost and all criteria for capitalisation were met on 30 November 2019. However due to the outbreak of the virus, no construction could take place between 31 March 2020 to 30 June 2020. This is considered a substantial period of time. MPE incurred a loan of R2 600 000 for the construction of the building and received the money on 30 November 2019, on which date a payment of R350 000 was immediately made to the construction company. On 1 July 2020 another payment of R450 000 was made and an amount of R270 000 was paid on 1 February 2021. The building was still under construction as at 31 January 2021. The loan was specifically incurred to finance the construction of this building at a rate of 13.5% per year. Interest is not compounded, but paid monthly. No capital repayments have been made yet. The correct interest earned during the qualifying period for the 2021 financial year, amounts to R24 000 MPE also has other loans on which it pays interest. MARKS REQUIRED: Subtotal Total 9 1 10 24 1 25 (a) Discuss in terms of the Conceptual Framework of 2018, if the patent can be recognised as an asset in the statement of financial position of MPE as at 31 January 2021. Communication skills - Logical argument (b) Prepare an extract from the statement of profit or loss and other comprehensive income for the year ended 31 January 2021, based on all the information provided and the policies of the company. Comparative figures are not required Communication skills - Presentation and layout (c) Assume that half of the raw materials purchased (excluding those imported from Japan) were purchased on 15 March 2020 for R10 642 404, and the other half on 30 August 2020 for R10 744 796, and that 21 000 units of the raw material were sent into production on 31 March 2020 and another 21 000 units were sent to production on 3 September 2020 If the accounting policy for inventory was weighted average cost and the inventory system was a perpetual system, calculate the total cost of raw materials transferred to work in progress in the 2021 financial year. Explain why this amount is different to the relevant amount calculated in part b. TOTAL MARKS 6 10 45 QUESTION 2 45 MARKS Ignore taxation. CottonOff Ltd ("CO") is a well-established retail company with a focus on providing fashion clothing and stationery brands. Co is known for putting their own twist on current trends to allow customers to have fun with their individual style. They provide the hottest trends with the aim to make the customer not only look good but also feel good. Co consists of stand-alone stores (mostly in malls) as well as an online platform to sell its products. Co have a 31 December year-end. You are the senior accountant at Co and are in the process of finalising the financial statements. You were provided with the following information: Factory building in Mahikeng On 1 April 2018, CO started with the construction of its factory building and started incurring construction costs. The building is a qualifying asset in terms if IAS 23 Borrowing Costs. CO had to Weddings will be only in the them 3000, me.com.mm 11 March 2022.000 3000 Sagreb 13000 1 onde these Mercating of the building and The 23 3 March 2013 MP 260000 trecated:30 como one231. the building.com.hr Special Financing 13.5 o comunidade de Theo MARS rest on teie che consent 2011. Basel Timen arwami and Dem 1 >> for and the hehe 21000 of the production and when we tai ha ha ha tin di tam - wria mi Eowy samonterest to meet TOTALMARKS QUESTION 1 45 MARKS Ignore tax MPE Ltd ("MPE') manufactures medical grade personal protective equipment which includes a mask called a N95 respirator. The company has seen a healthy increase in profits over the past year, due to the outbreak of the Covid-19 virus. MPE is very well established and has been in the protective equipment market for many years. The company has a financial year of 31 January Due to all the health risks in the current world wide situation, MPE has invested significantly in obtaining new methods to improve their equipment and ensure the safety of health workers. The innovation and development manager came across a European company which developed a state of the art material to increase the effectiveness of N95 respirators. After inspecting their research and results and observing an effectiveness experiment, MPE decided to buy this patent from the European company. The agreement stated that MPE will pay an amount of R1 200 000 for the patent on the same day the agreement was signed, which will be used in the production of N95 respirators for at least the next six years. The patent was effectively used in the production of MPE's N95 respirators as of 31 July 2020. Market research indicated that the patent will be profitable, since consumers are more and more becoming aware of the consequences of not wearing a mask or wearing a mask of poor quality. A cost and profitability projection, prepared by the financial accountant, also indicated that the patent will be successful in securing a profit. Respirator production N95 Respirators, a specialised type of mask with higher filtration abilities, are one of the more complicated types of protective equipment to manufacture. Respirators are made with melt blown nonwoven fabric, which is produced by forcing out plastic (commonly polypropylene) fibres (one micron in diameter) onto a conveyor. These layers bond as they cool to form the cloth. This fabric is layered with a needled pre-filtration layer of nonwoven fabric, which is usually hot calendared and thick enough to be moulded into the mask's shape. (Calendaring is a process by which fabric is run through hot, heavy rollers at the mill. This flattens the fabric, seals the weave, and leaves one side of the fabric shiny while the other is matte/dull in appearance. This process is done to make the fabric down proof, increase wind resistance, and improve hand feel.) Protective layers of nonwoven fabric then cover the mask's inside and outside. Once masks are completed they are sterilised. Some from each batch must then pass a series of tests, including flammability, breathing and splash resistance. particle filtration efficiency and bacteria filtration efficiency (Credit: https://www.thomasnet.com/articles/plantfacility-equipment/how-to-make-ppe/ An extract of MPE's trial balance for the year ended 31 January 2021 is provided below: Dr R Notes CrR 17 460 000 1 2 ? Sales Cost of sales Depreciation Fixed manufacturing overheads Variable manufacturing overheads 3 4 250 000 850 000 680 000 218 6 7 1 8 Salaries and wages Training cost Delivery cost Purchases (raw material) Raw material - Balance as at 1 Feb 2020 Work in progress-Balance as at 1 Feb 2020 Finished goods - Balance as at 1 Feb 2020 Consumables - Balance as at 31 Jan 2021 Finance cost Interest earned Note 1 8 9 10 3 178 500 10 000 2500 21 387 200 810 000 0 727 500 5 500 470 000 11 12 12 35 000 The sales amount listed in the trial balance excludes a large sale that was made in January 2021. Delivery of the goods took place on 20 January 2021 at a cost to MPE of R2 500. A volume discount of 2% was offered to the customer as well as a settlement discount of 5%, if paid before the end of February 2021. It is expected that the customer will make use of this discount and MPE makes use of allowance for settlement discount accounts, where applicable. The total invoice price before any discounts, amounted to R650 000 Note 2 MPE makes use of the periodic inventory system applying the weighted average cost to account for manufactured inventory balances, as per IAS 2 Inventory. Cost of sales have not been calculated yet. The company generally does not include any net realisable value writedowns on the manufactured goods, in the cost of sales line item as most of these write-downs are not considered a normal part of losses incurred. The statement of profit or loss is prepared on the function method as per IAS 1 Presentation of Financial Statements and there are no expenses that are classified as administrative expenses. Note 3 This amount includes depreciation of R50 000 on manufacturing equipment Manufacturing equipment is depreciated on the unit of production method. The remainder of the depreciation as per the trial balance, relates to admin buildings and vehicles Note 4 The total fixed manufacturing overhead cost incurred during the 2021 financial year amounted to R850 000. This amount does not include depreciation or any salaries. MPE's normal production capacity for N95 respirators is 15 000 units. In the 2021 financial year 14 000 units were manufactured. Notes The total variable overheads incurred during the 2021 financial year amounted to R680 000. This amount does not include any depreciation, wages or consumables. Note 6 Wage workers directly involved in the manufacturing process is paid R45 per hour. During the 2021 financial year, 28 700 hours were worked by these labourers of which 200 hours in total were considered idle time during which training took place. Salaries amounted to R1 887 000 for the 2021 financial year of which only R260 000 relates to the factory supervisor. The remainder of the salaries is for admin and management staff. Note 7 The training cost relates to the training of workers to apply the knowledge from the purchased patent. Note 8 The total raw materials purchased during the year, amounted to R21 387 200 (excluding information provided below). Each N95 respirator requires three raw material items for production On 4 January 2021, 2 000 units of raw materials were delivered to MPE. These units were imported from Japan at 4 000 Japanese yen, per unit and are not significantly different from raw materials sourced elsewhere. The units were shipped free on board from Japan, and were loaded onto the ship in Japan, on 15 December 2020. The ship arrived in the South African harbour on 23 December 2020, and was cleared through customs and unloaded at the harbour on 28 December 2020. On 2 January 2021 the items were loaded onto a cargo truck on its way to MPE Customs duty, that cannot be claimed back, amounted to R8 500. The transport of the goods to MPE amounted to RS 300. This transaction has not yet been recorded in the above trial balance. The following exchange rates were applicable: 15 December 2020 23 December 2020 28 December 2020 2 January 2021 4 January 2021 Japanese yen to RSA rand 1Yen R0.14 1Yen = R0.17 1Yen = R0.15 1Yen = R0.16 1Yen = R0.13 The opening balance of raw materials amounted to R450 per unit. A stock count conducted on 31 January 2021, indicated that the number of raw material units on hand at year end amounted to 4 200 units. These include the units on hand that were received from Japan. Note 9 There was no work in progress at the beginning or end of the 2021 financial year. Note 10 At the beginning of the 2021 financial year there were 1500 finished respirators on hand and according to a calculation, correctly made by the cost accountant, 9000 units were sold during the 2021 financial year. Included in the closing finished goods inventory balance at the end of the year, are 1 100 units which will be sold for only R800 per unit, since the colour is not very popular with customers. These units were produced in the 2021 financial year. This is considered to be a once off event. Note 11 Consumable items used in the manufacturing process, is accounted for on the first-in-first-out method (FIFO). The more respirators manufactured, the more consumable items are used. On 1 February 2020, the balance of consumables was R5 500 consisting of 55 units. The purchase and usage of the items were as follows: Purchases 18 March 2020 200 units R22 000 30 August 2020 180 units R20 700 2 September 2020 (10 units) R1 150 (These units were sent back due to defects) Sent to production 31 March 2020 150 units 3 September 2020 200 units On 5 September 2020, 15 of the units purchased on 30 August were damaged due to an unexpected and unusual electrical fault. These 15 units were included in the units sent for production on 3 September 2020. No additional units were sent to production to replace the damaged consumables. Note 12 MPE is in the process of constructing a building specifically for their manufacturing needs. Construction of the building started on 30 November 2019 and was estimated to take eight months to complete. The building is a qualifying asset as per IAS 23 Borrowing Cost and all criteria for capitalisation were met on 30 November 2019. However due to the outbreak of the virus, no construction could take place between 31 March 2020 to 30 June 2020. This is considered a substantial period of time. MPE incurred a loan of R2 600 000 for the construction of the building and received the money on 30 November 2019, on which date a payment of R350 000 was immediately made to the construction company. On 1 July 2020 another payment of R450 000 was made and an amount of R270 000 was paid on 1 February 2021. The building was still under construction as at 31 January 2021. The loan was specifically incurred to finance the construction of this building at a rate of 13.5% per year. Interest is not compounded, but paid monthly. No capital repayments have been made yet. The correct interest earned during the qualifying period for the 2021 financial year, amounts to R24 000 MPE also has other loans on which it pays interest. MARKS REQUIRED: Subtotal Total 9 1 10 24 1 25 (a) Discuss in terms of the Conceptual Framework of 2018, if the patent can be recognised as an asset in the statement of financial position of MPE as at 31 January 2021. Communication skills - Logical argument (b) Prepare an extract from the statement of profit or loss and other comprehensive income for the year ended 31 January 2021, based on all the information provided and the policies of the company. Comparative figures are not required Communication skills - Presentation and layout (c) Assume that half of the raw materials purchased (excluding those imported from Japan) were purchased on 15 March 2020 for R10 642 404, and the other half on 30 August 2020 for R10 744 796, and that 21 000 units of the raw material were sent into production on 31 March 2020 and another 21 000 units were sent to production on 3 September 2020 If the accounting policy for inventory was weighted average cost and the inventory system was a perpetual system, calculate the total cost of raw materials transferred to work in progress in the 2021 financial year. Explain why this amount is different to the relevant amount calculated in part b. TOTAL MARKS 6 10 45 QUESTION 2 45 MARKS Ignore taxation. CottonOff Ltd ("CO") is a well-established retail company with a focus on providing fashion clothing and stationery brands. Co is known for putting their own twist on current trends to allow customers to have fun with their individual style. They provide the hottest trends with the aim to make the customer not only look good but also feel good. Co consists of stand-alone stores (mostly in malls) as well as an online platform to sell its products. Co have a 31 December year-end. You are the senior accountant at Co and are in the process of finalising the financial statements. You were provided with the following information: Factory building in Mahikeng On 1 April 2018, CO started with the construction of its factory building and started incurring construction costs. The building is a qualifying asset in terms if IAS 23 Borrowing Costs. CO had to Weddings will be only in the them 3000, me.com.mm 11 March 2022.000 3000 Sagreb 13000 1 onde these Mercating of the building and The 23 3 March 2013 MP 260000 trecated:30 como one231. the building.com.hr Special Financing 13.5 o comunidade de Theo MARS rest on teie che consent 2011. Basel Timen arwami and Dem 1 >> for and the hehe 21000 of the production and when we tai ha ha ha tin di tam - wria mi Eowy samonterest to meet TOTALMARKS