Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1- 49 marks, suggested time 35 minutes THIS PART IS WORTH 50% OF TEST 1 GRADE You are to record journal entries for Post

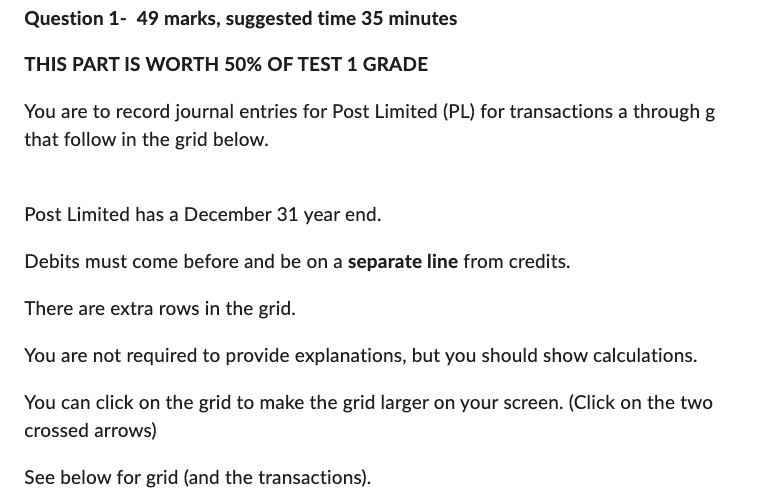

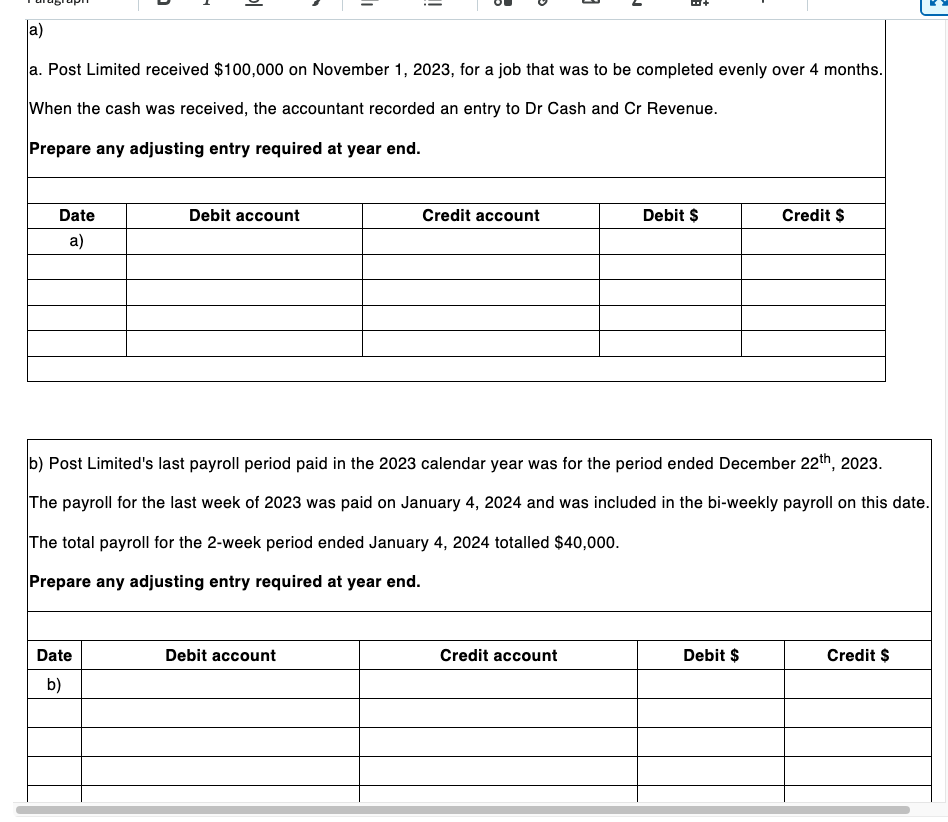

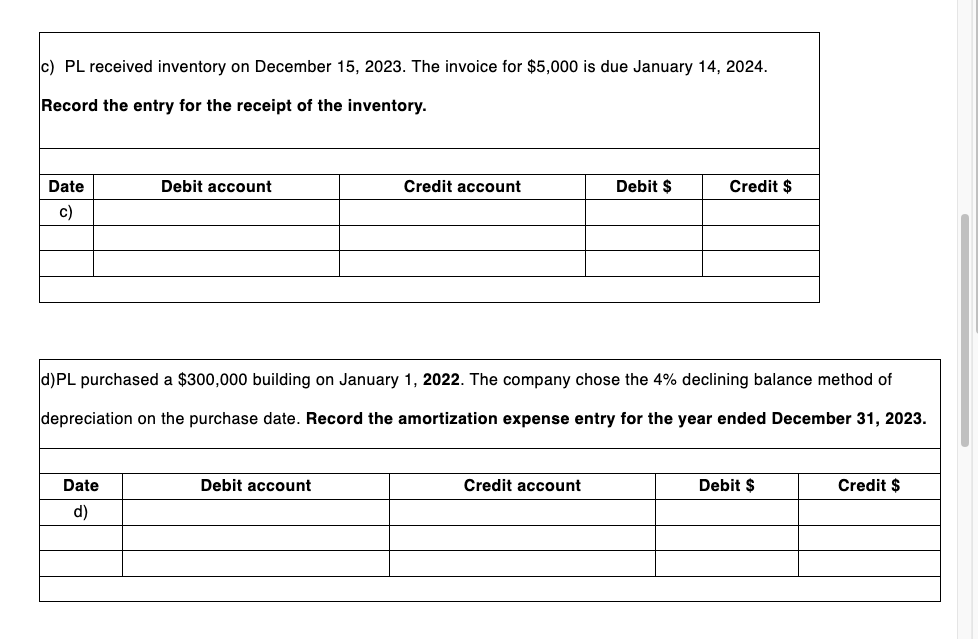

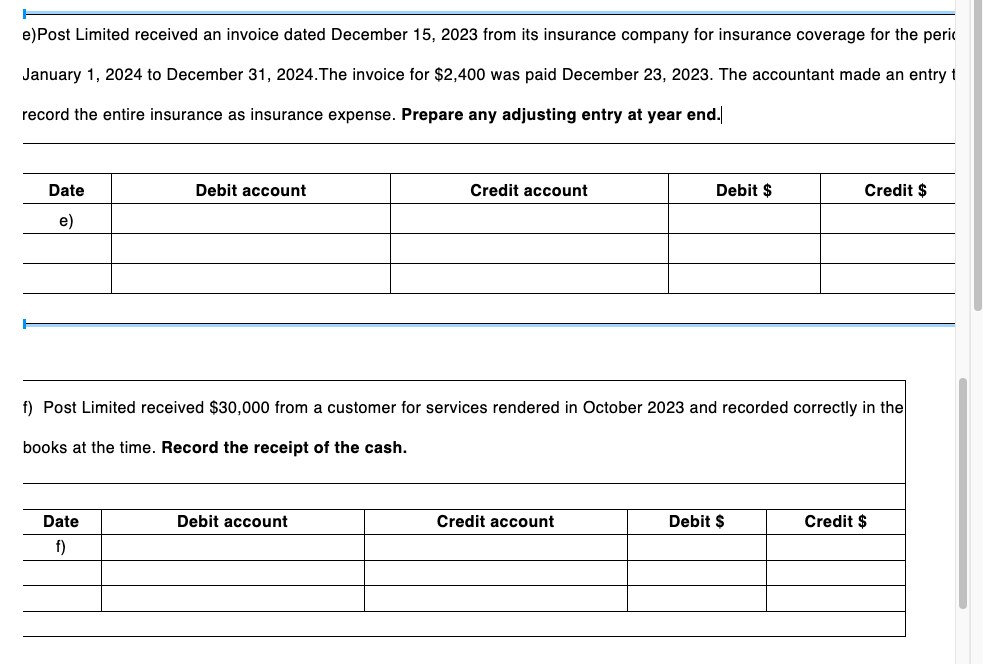

Question 1- 49 marks, suggested time 35 minutes THIS PART IS WORTH 50\% OF TEST 1 GRADE You are to record journal entries for Post Limited (PL) for transactions a through g that follow in the grid below. Post Limited has a December 31 year end. Debits must come before and be on a separate line from credits. There are extra rows in the grid. You are not required to provide explanations, but you should show calculations. You can click on the grid to make the grid larger on your screen. (Click on the two crossed arrows) See below for grid (and the transactions). e)Post Limited received an invoice dated December 15, 2023 from its insurance company for insurance coverage for the peri January 1, 2024 to December 31, 2024. The invoice for $2,400 was paid December 23,2023 . The accountant made an entry record the entire insurance as insurance expense. Prepare any adjusting entry at year end.| f) Post Limited received $30,000 from a customer for services rendered in October 2023 and recorded correctly in the books at the time. Record the receipt of the cash. c) PL received inventory on December 15,2023 . The invoice for $5,000 is due January 14,2024 . Record the entry for the receipt of the inventory. d)PL purchased a $300,000 building on January 1,2022 . The company chose the 4% declining balance method of depreciation on the purchase date. Record the amortization expense entry for the year ended December 31,2023. a. Post Limited received $100,000 on November 1,2023 , for a job that was to be completed evenly over 4 months. When the cash was received, the accountant recorded an entry to Dr Cash and Cr Revenue. Prepare any adjusting entry required at year end. b) Post Limited's last payroll period paid in the 2023 calendar year was for the period ended December 22th,2023. The payroll for the last week of 2023 was paid on January 4, 2024 and was included in the bi-weekly payroll on this dat The total payroll for the 2-week period ended January 4, 2024 totalled $40,000. Prepare any adjusting entry required at year end. Question 1- 49 marks, suggested time 35 minutes THIS PART IS WORTH 50\% OF TEST 1 GRADE You are to record journal entries for Post Limited (PL) for transactions a through g that follow in the grid below. Post Limited has a December 31 year end. Debits must come before and be on a separate line from credits. There are extra rows in the grid. You are not required to provide explanations, but you should show calculations. You can click on the grid to make the grid larger on your screen. (Click on the two crossed arrows) See below for grid (and the transactions). e)Post Limited received an invoice dated December 15, 2023 from its insurance company for insurance coverage for the peri January 1, 2024 to December 31, 2024. The invoice for $2,400 was paid December 23,2023 . The accountant made an entry record the entire insurance as insurance expense. Prepare any adjusting entry at year end.| f) Post Limited received $30,000 from a customer for services rendered in October 2023 and recorded correctly in the books at the time. Record the receipt of the cash. c) PL received inventory on December 15,2023 . The invoice for $5,000 is due January 14,2024 . Record the entry for the receipt of the inventory. d)PL purchased a $300,000 building on January 1,2022 . The company chose the 4% declining balance method of depreciation on the purchase date. Record the amortization expense entry for the year ended December 31,2023. a. Post Limited received $100,000 on November 1,2023 , for a job that was to be completed evenly over 4 months. When the cash was received, the accountant recorded an entry to Dr Cash and Cr Revenue. Prepare any adjusting entry required at year end. b) Post Limited's last payroll period paid in the 2023 calendar year was for the period ended December 22th,2023. The payroll for the last week of 2023 was paid on January 4, 2024 and was included in the bi-weekly payroll on this dat The total payroll for the 2-week period ended January 4, 2024 totalled $40,000. Prepare any adjusting entry required at year end

Question 1- 49 marks, suggested time 35 minutes THIS PART IS WORTH 50\% OF TEST 1 GRADE You are to record journal entries for Post Limited (PL) for transactions a through g that follow in the grid below. Post Limited has a December 31 year end. Debits must come before and be on a separate line from credits. There are extra rows in the grid. You are not required to provide explanations, but you should show calculations. You can click on the grid to make the grid larger on your screen. (Click on the two crossed arrows) See below for grid (and the transactions). e)Post Limited received an invoice dated December 15, 2023 from its insurance company for insurance coverage for the peri January 1, 2024 to December 31, 2024. The invoice for $2,400 was paid December 23,2023 . The accountant made an entry record the entire insurance as insurance expense. Prepare any adjusting entry at year end.| f) Post Limited received $30,000 from a customer for services rendered in October 2023 and recorded correctly in the books at the time. Record the receipt of the cash. c) PL received inventory on December 15,2023 . The invoice for $5,000 is due January 14,2024 . Record the entry for the receipt of the inventory. d)PL purchased a $300,000 building on January 1,2022 . The company chose the 4% declining balance method of depreciation on the purchase date. Record the amortization expense entry for the year ended December 31,2023. a. Post Limited received $100,000 on November 1,2023 , for a job that was to be completed evenly over 4 months. When the cash was received, the accountant recorded an entry to Dr Cash and Cr Revenue. Prepare any adjusting entry required at year end. b) Post Limited's last payroll period paid in the 2023 calendar year was for the period ended December 22th,2023. The payroll for the last week of 2023 was paid on January 4, 2024 and was included in the bi-weekly payroll on this dat The total payroll for the 2-week period ended January 4, 2024 totalled $40,000. Prepare any adjusting entry required at year end. Question 1- 49 marks, suggested time 35 minutes THIS PART IS WORTH 50\% OF TEST 1 GRADE You are to record journal entries for Post Limited (PL) for transactions a through g that follow in the grid below. Post Limited has a December 31 year end. Debits must come before and be on a separate line from credits. There are extra rows in the grid. You are not required to provide explanations, but you should show calculations. You can click on the grid to make the grid larger on your screen. (Click on the two crossed arrows) See below for grid (and the transactions). e)Post Limited received an invoice dated December 15, 2023 from its insurance company for insurance coverage for the peri January 1, 2024 to December 31, 2024. The invoice for $2,400 was paid December 23,2023 . The accountant made an entry record the entire insurance as insurance expense. Prepare any adjusting entry at year end.| f) Post Limited received $30,000 from a customer for services rendered in October 2023 and recorded correctly in the books at the time. Record the receipt of the cash. c) PL received inventory on December 15,2023 . The invoice for $5,000 is due January 14,2024 . Record the entry for the receipt of the inventory. d)PL purchased a $300,000 building on January 1,2022 . The company chose the 4% declining balance method of depreciation on the purchase date. Record the amortization expense entry for the year ended December 31,2023. a. Post Limited received $100,000 on November 1,2023 , for a job that was to be completed evenly over 4 months. When the cash was received, the accountant recorded an entry to Dr Cash and Cr Revenue. Prepare any adjusting entry required at year end. b) Post Limited's last payroll period paid in the 2023 calendar year was for the period ended December 22th,2023. The payroll for the last week of 2023 was paid on January 4, 2024 and was included in the bi-weekly payroll on this dat The total payroll for the 2-week period ended January 4, 2024 totalled $40,000. Prepare any adjusting entry required at year end Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started