Answered step by step

Verified Expert Solution

Question

1 Approved Answer

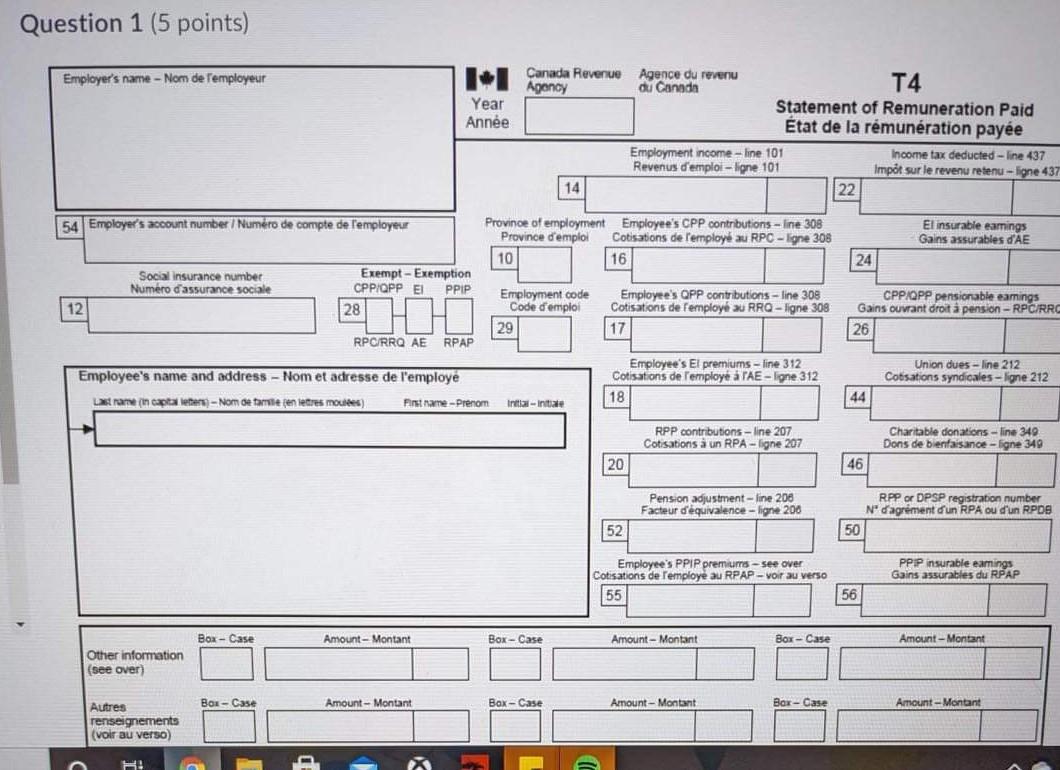

Question 1 (5 points) Employer's name - Nom de l'employeur Il Canada Revenue Agency Year Anne Agence du revenu du Canada T4 Statement of Remuneration

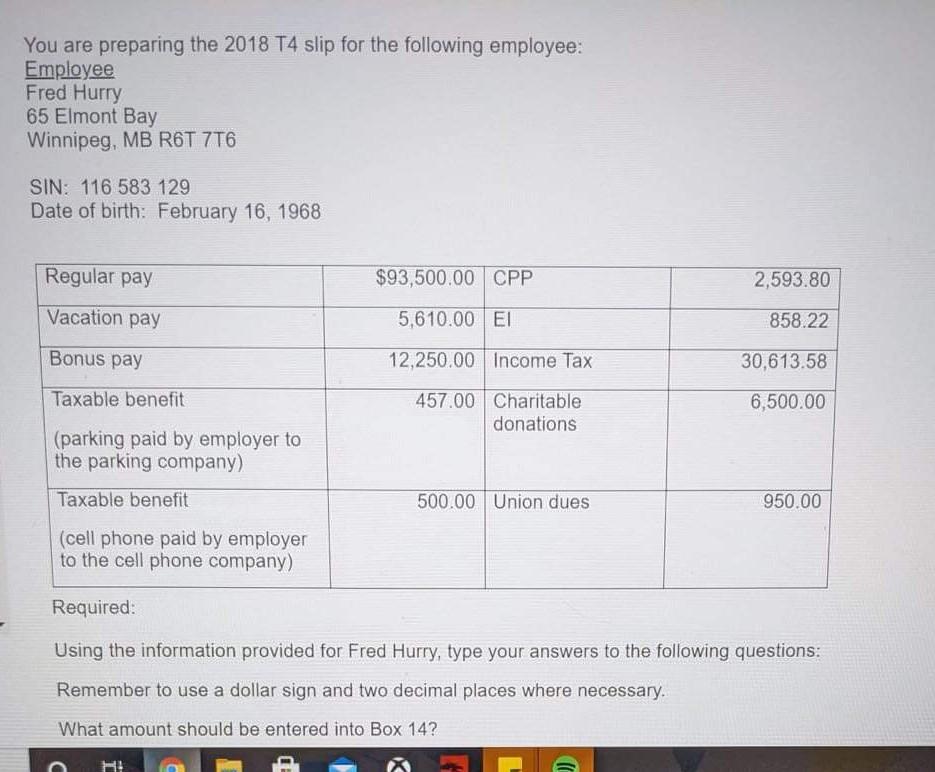

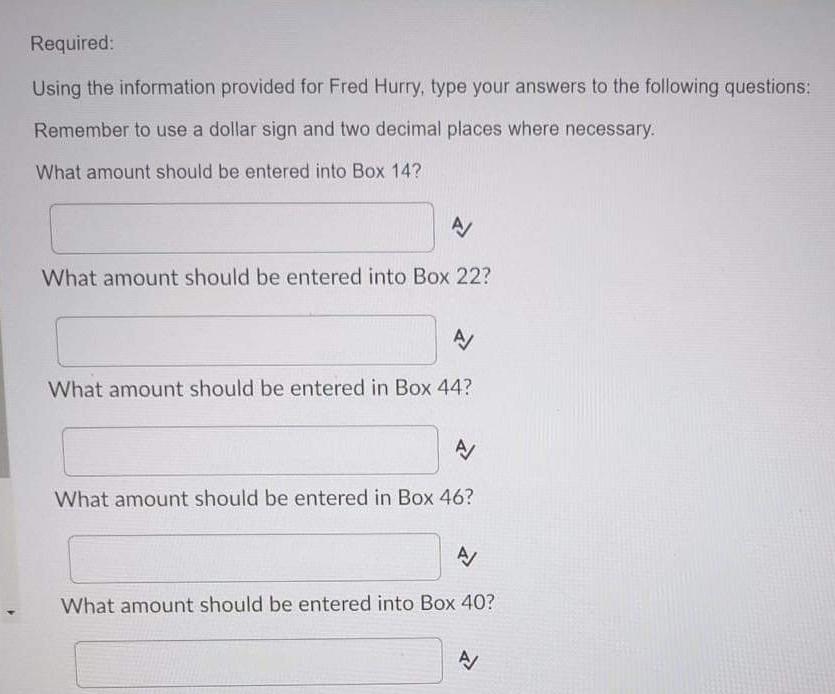

Question 1 (5 points) Employer's name - Nom de l'employeur Il Canada Revenue Agency Year Anne Agence du revenu du Canada T4 Statement of Remuneration Paid Etat de la rmunration paye Employment income - line 101 Income tax deducted - line 437 Revenus d'emploi ligne 101 Impt sur le revenu retenu - ligne 437 22 14 54 Employer's account number / Numro de compte de l'employeur Province of employment Employee's CPP contributions - Iine 308 Province d'emploi Cotisations de l'employ au RPC - Igre 308 10 16 El insurable earnings Gains assurables d'AE 24 Social Insurance number Numro d'assurance sociale Exempt - Exemption CPP OPP EI PPIP 28 12 Employment code Code d'emploi 29 Employee's QPP contributions - line 305 Cotisations de l'employ au RRQ - ligne 308 17 CPP OPP pensionable eamings Gains ouvrant droit pension - RPCIRRC 26 RPC/RRO AE RPAP Employee's name and address - Nom et adresse de l'employ Employee's El premiums - line 312 Cotisations de l'employ TAE-ligne 312 18 Union dues - line 212 Cotisations syndicales - ligne 212 Larane in captate - Nom de familie en letres moules) 44 First name-Prenom Inta-Initiae RPP contributions - line 207 Cotisations un RPA - ligne 207 Charitable donations - line 349 Dons de bienfaisance - ligne 349 20 46 Pension adjustment - fine 206 Facteur d'quivalence - ligne 200 RPP or DPSP registration number N' d'agrment d'un RPA ou d'un RPOS 50 52 Employee's PPIP premurs - see over Cotisations de l'employ au RPAP - voir au verso 55 PPP insurable earings Gains assurables du RPAP 56 Box - Case Amount - Montant Box-Case Amount - Montant Box - Case Amount - Montant Other information (see over) Bor-Case Amount - Montant Box- Case Amount - Montant Box-Case Amount - Montant Autres renseignements (voir au verso) H! X You are preparing the 2018 T4 slip for the following employee: Employee Fred Hurry 65 Elmont Bay Winnipeg, MB R6T 7T6 SIN: 116 583 129 Date of birth: February 16, 1968 Regular pay $93,500.00 CPP 2,593.80 Vacation pay 5,610.00 EI 858.22 Bonus pay 12,250.00 Income Tax 30,613.58 Taxable benefit 457.00 Charitable donations 6,500.00 (parking paid by employer to the parking company) Taxable benefit 500.00 Union dues 950.00 (cell phone paid by employer to the cell phone company) Required: Using the information provided for Fred Hurry, type your answers to the following questions: Remember to use a dollar sign and two decimal places where necessary. What amount should be entered into Box 14? n HI Required: Using the information provided for Fred Hurry, type your answers to the following questions: Remember to use a dollar sign and two decimal places where necessary. What amount should be entered into Box 14? A/ What amount should be entered into Box 22? AJ What amount should be entered in Box 44? A/ What amount should be entered in Box 46? A/ What amount should be entered into Box 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started