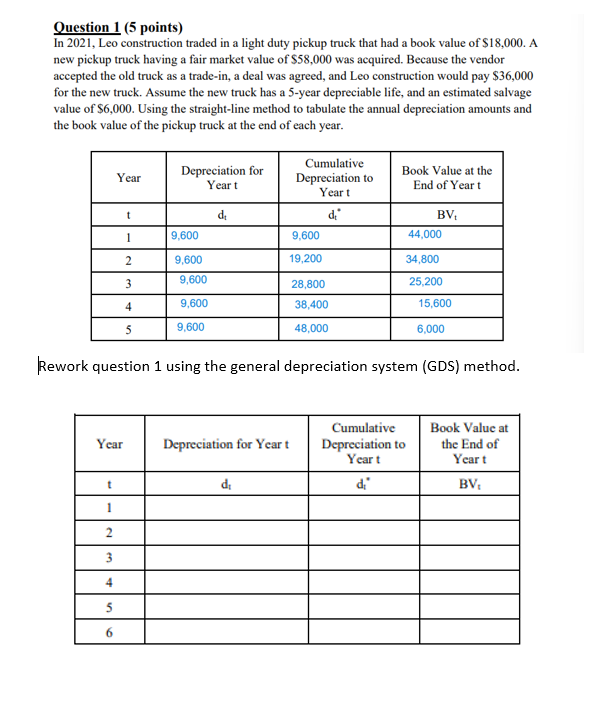

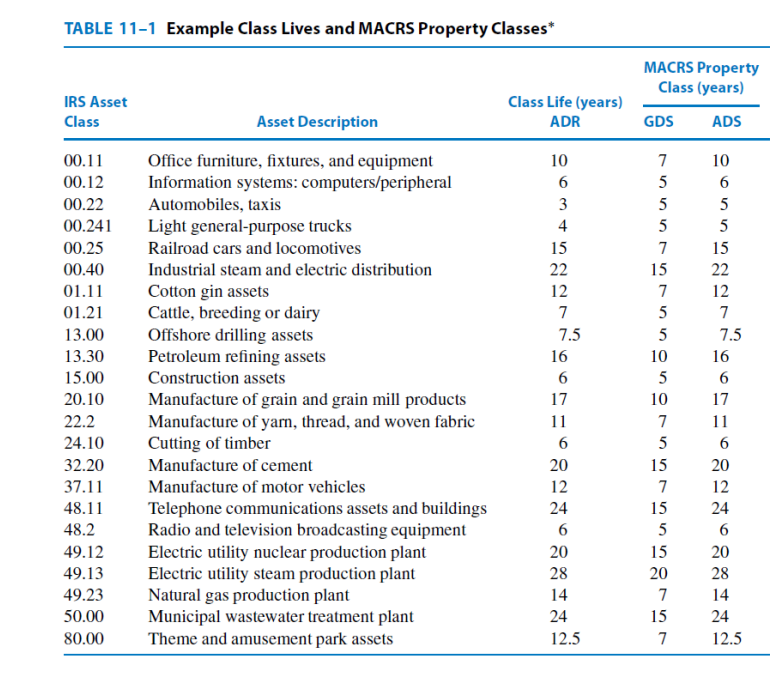

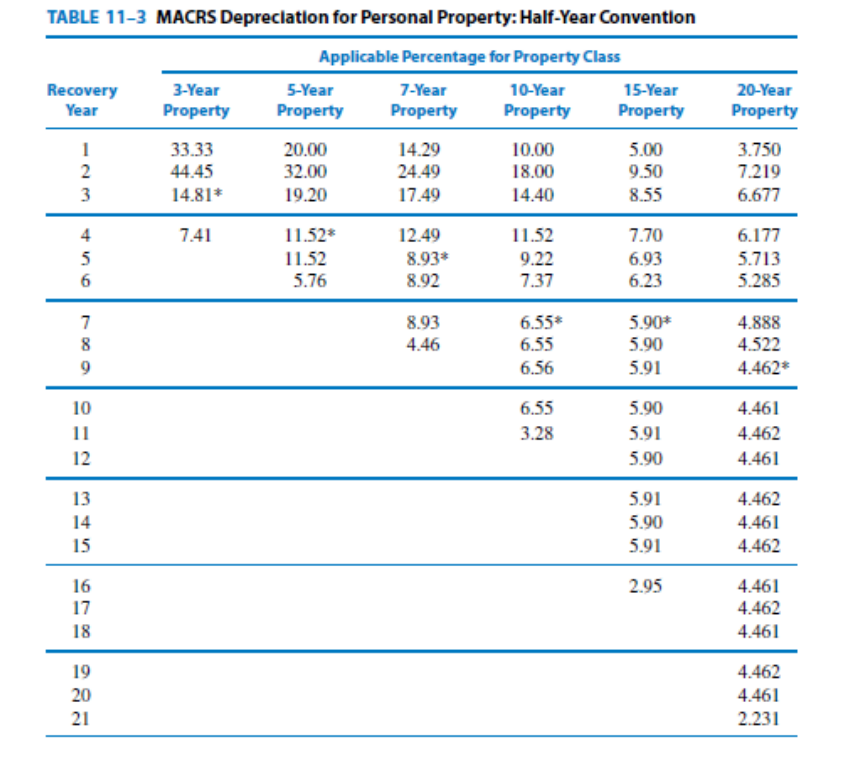

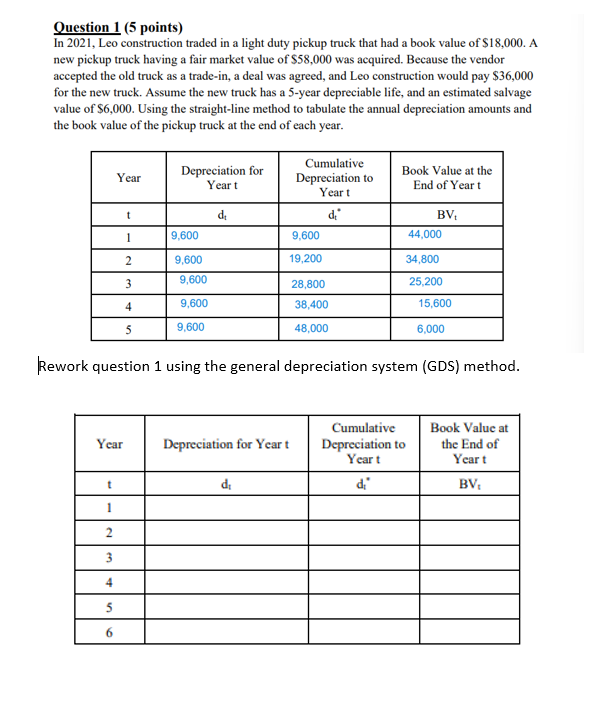

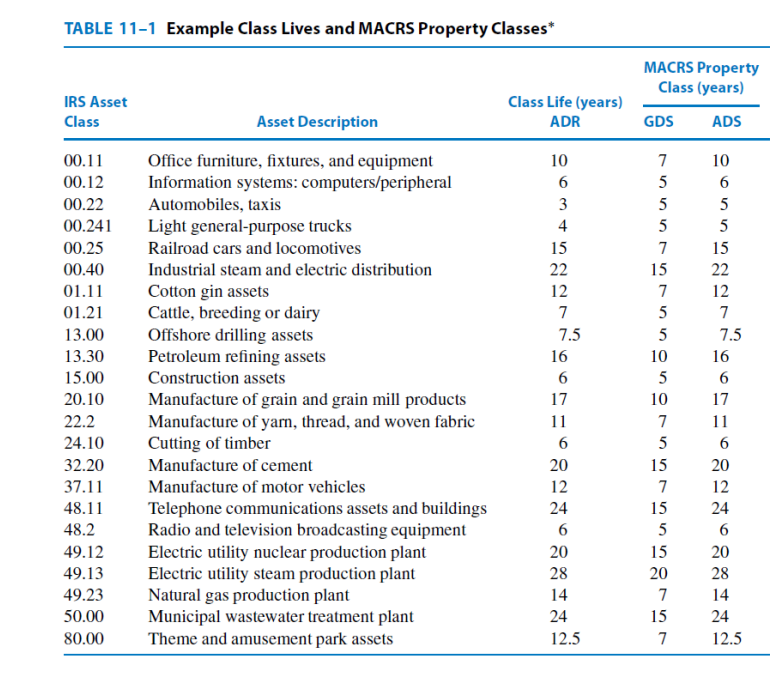

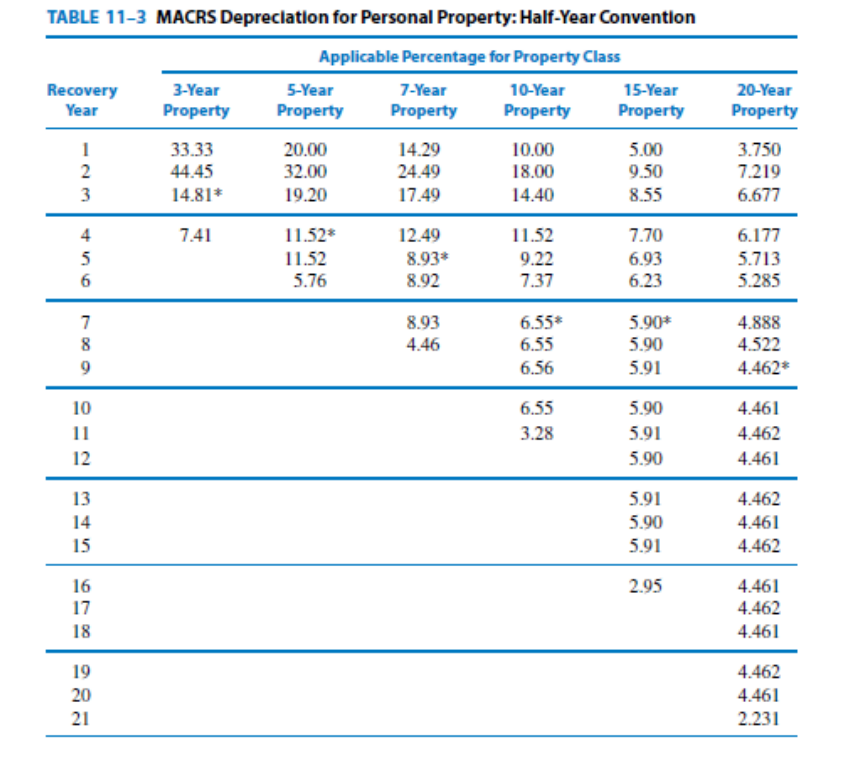

Question 1 (5 points) In 2021, Leo construction traded in a light duty pickup truck that had a book value of $18,000. A new pickup truck having a fair market value of $58,000 was acquired. Because the vendor accepted the old truck as a trade-in, a deal was agreed, and Leo construction would pay $36,000 for the new truck. Assume the new truck has a 5-year depreciable life, and an estimated salvage value of $6,000. Using the straight-line method to tabulate the annual depreciation amounts and the book value of the pickup truck at the end of each year. Year Depreciation for Yeart Cumulative Depreciation to Yeart di* Book Value at the End of Yeart d BV 44,000 1 9,600 9,600 2 19,200 34,800 9,600 9,600 3 28,800 25,200 4 9,600 38,400 15,600 5 9,600 48,000 6,000 Rework question 1 using the general depreciation system (GDS) method. Year Depreciation for Yeart Cumulative Depreciation to Yeart Book Value at the End of Yeart BV t d di 2 3 4 5 6 TABLE 11-1 Example Class Lives and MACRS Property Classes* MACRS Property Class (years) IRS Asset Class Class Life (years) ADR Asset Description GDS ADS 10 6 3 4 15 22 12 00.11 00.12 00.22 00.241 00.25 00.40 01.11 01.21 13.00 13.30 15.00 20.10 22.2 24.10 32.20 37.11 48.11 48.2 49.12 49.13 49.23 50.00 80.00 Office furniture, fixtures, and equipment Information systems: computers/peripheral Automobiles, taxis Light general-purpose trucks Railroad cars and locomotives Industrial steam and electric distribution Cotton gin assets Cattle, breeding or dairy Offshore drilling assets Petroleum refining assets Construction assets Manufacture of grain and grain mill products Manufacture of yarn, thread, and woven fabric Cutting of timber Manufacture of cement Manufacture of motor vehicles Telephone communications assets and buildings Radio and television broadcasting equipment Electric utility nuclear production plant Electric utility steam production plant Natural gas production plant Municipal wastewater treatment plant Theme and amusement park assets 7 7.5 16 6 17 11 6 7 5 5 5 7 15 7 5 5 10 5 10 7 5 15 7 10 6 5 5 15 22 12 7 7.5 16 6 17 11 6 20 12 24 6 20 28 14 24 12.5 20 15 5 15 12 24 6 20 28 14 24 12.5 20 7 15 7 20-Year Property TABLE 11-3 MACRS Depreciation for Personal Property: Half-Year Convention Applicable Percentage for Property Class Recovery 3-Year 5-Year 7-Year 10-Year 15-Year Year Property Property Property Property Property 1 33.33 20.00 14.29 10.00 5.00 2 44.45 32.00 24.49 18.00 9.50 3 14.81* 19.20 17.49 14.40 4 7.41 11.52* 12.49 11.52 7.70 5 11.52 8.93* 9.22 6.93 6 5.76 8.92 7.37 8.55 3.750 7.219 6.677 6.177 5.713 5.285 6.23 7 8 9 8.93 4.46 6.55* 6.55 6.56 5.90* 5.90 5.91 4.888 4.522 4.462 10 11 12 6.55 3.28 5.90 5.91 5.90 4.461 4.462 4.461 13 14 15 5.91 5.90 5.91 4.462 4.461 4.462 2.95 16 17 4.461 4.462 4.461 18 19 20 21 4.462 4.461 2.231