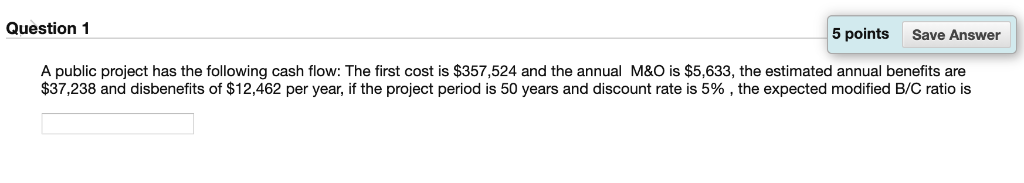

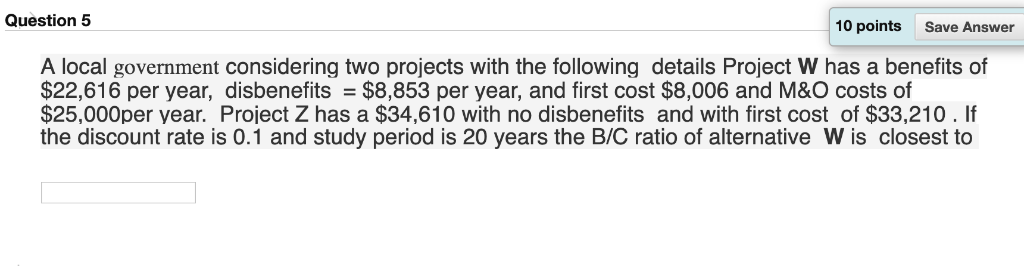

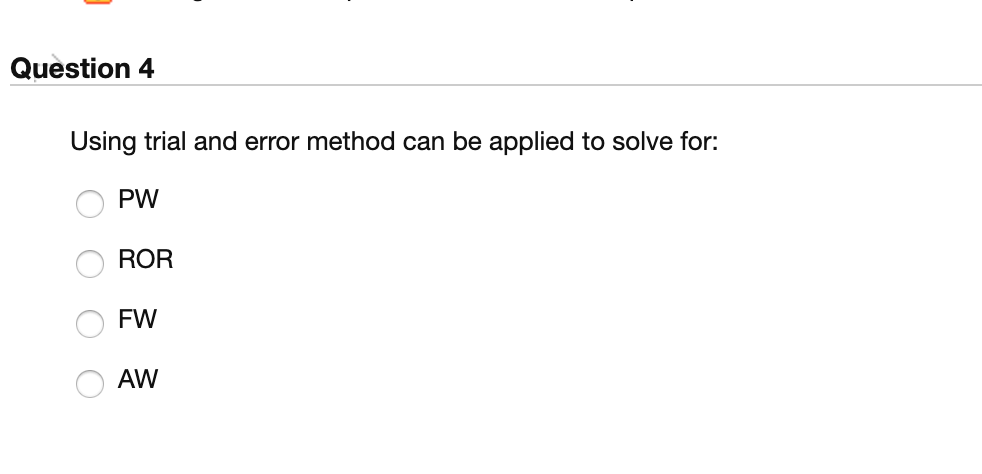

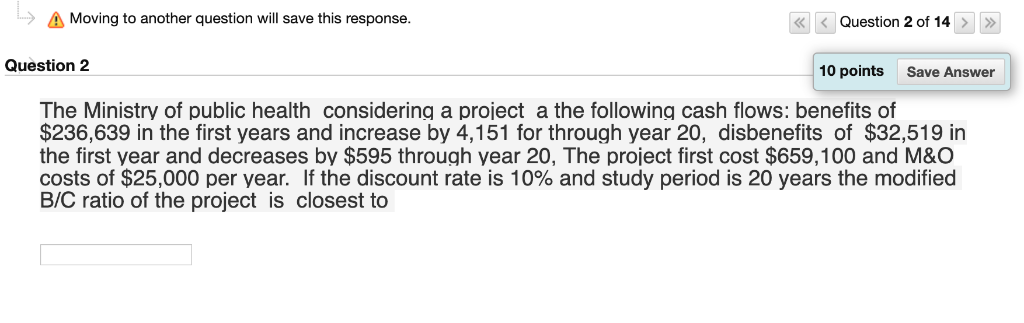

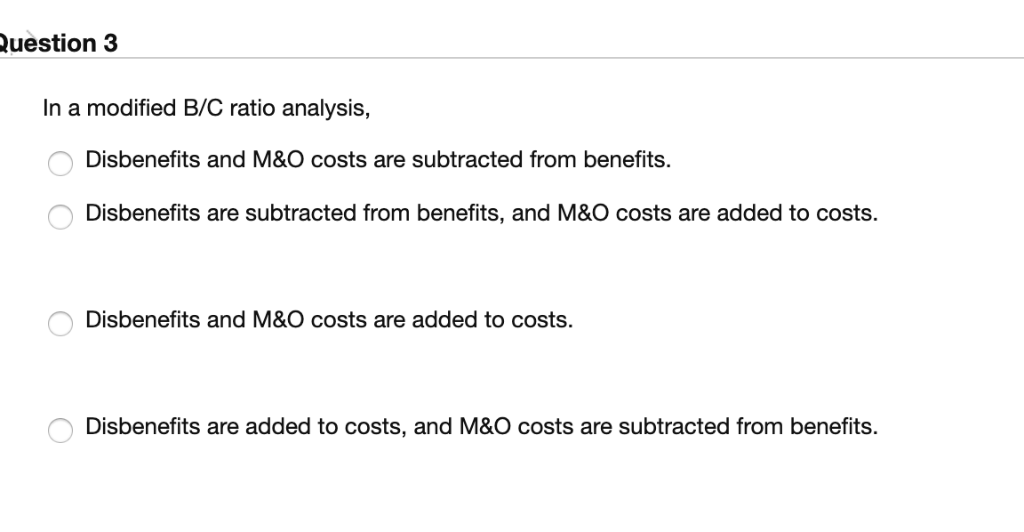

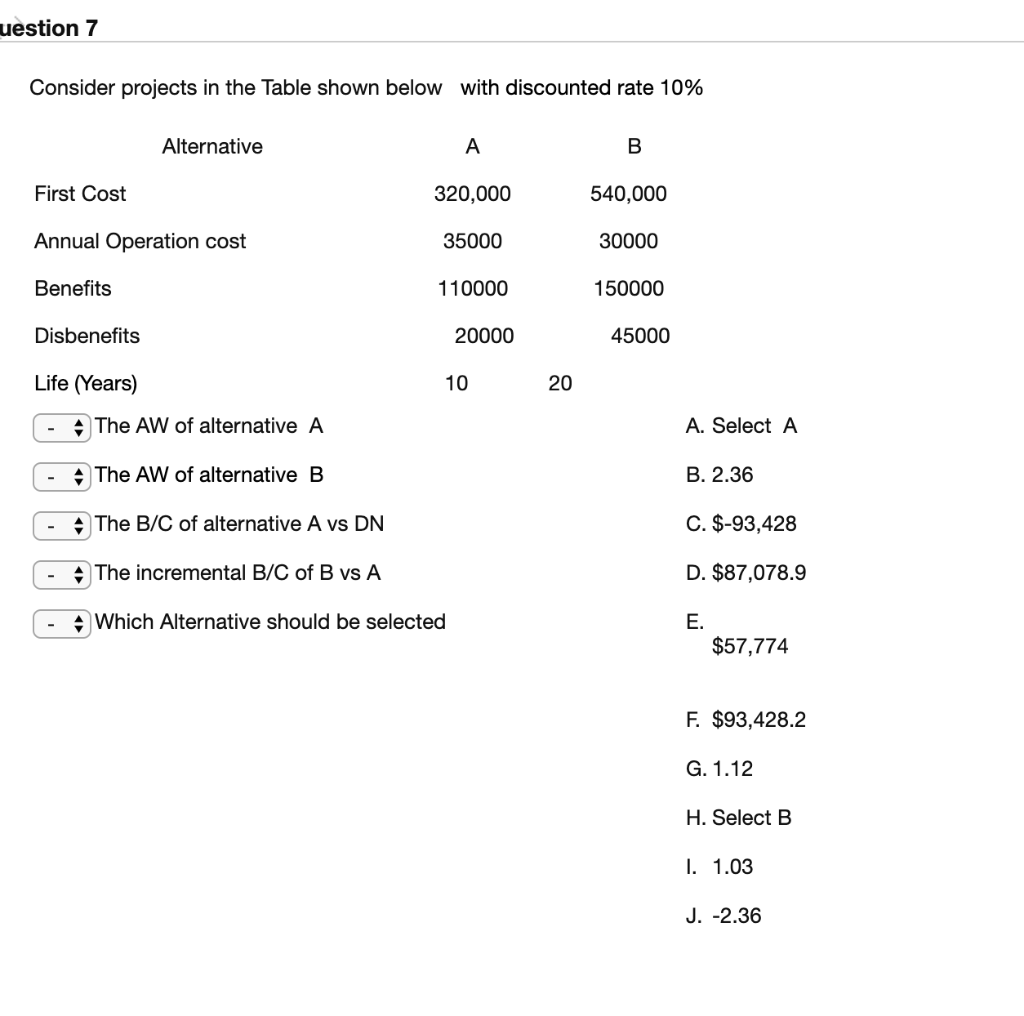

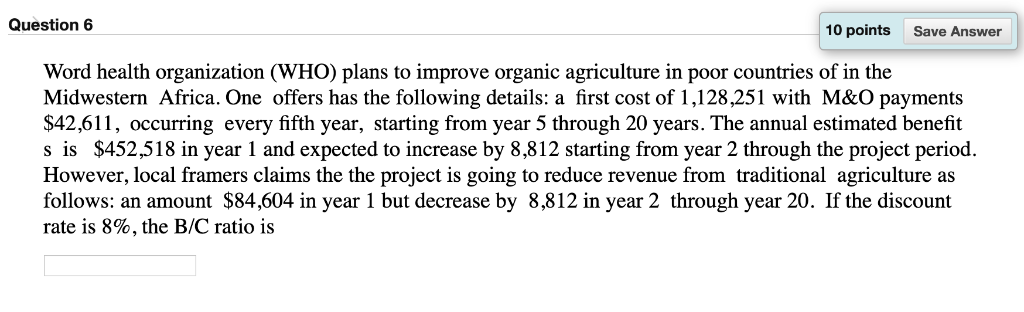

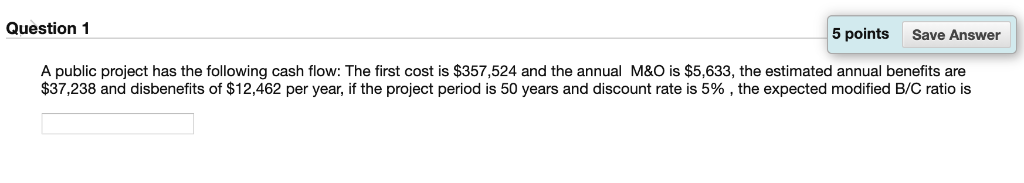

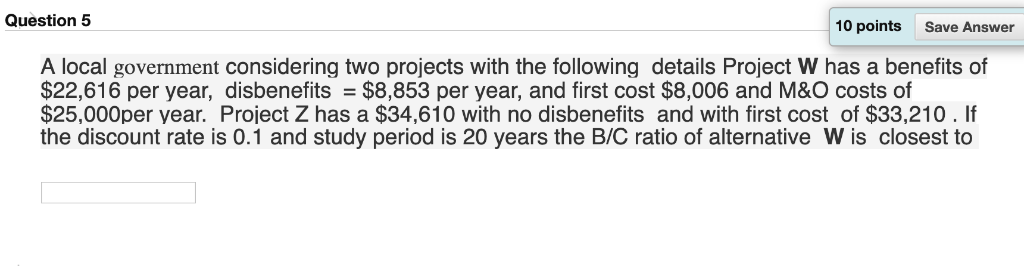

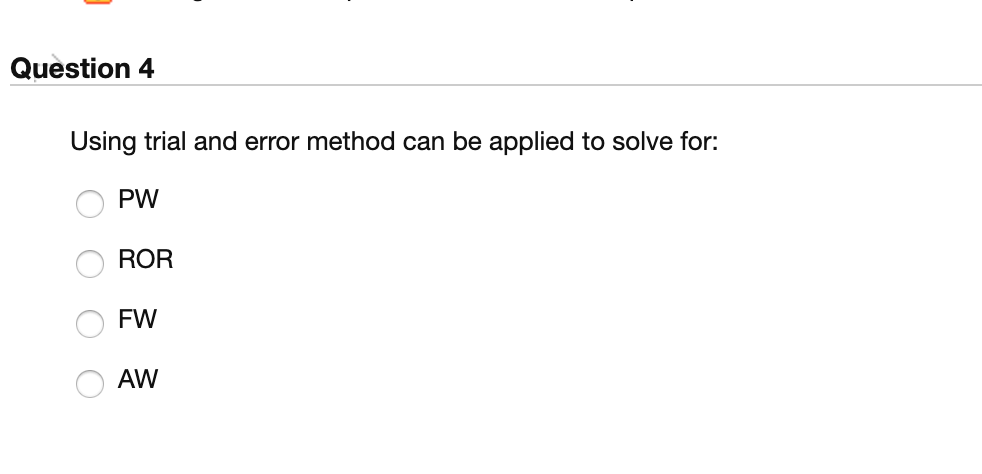

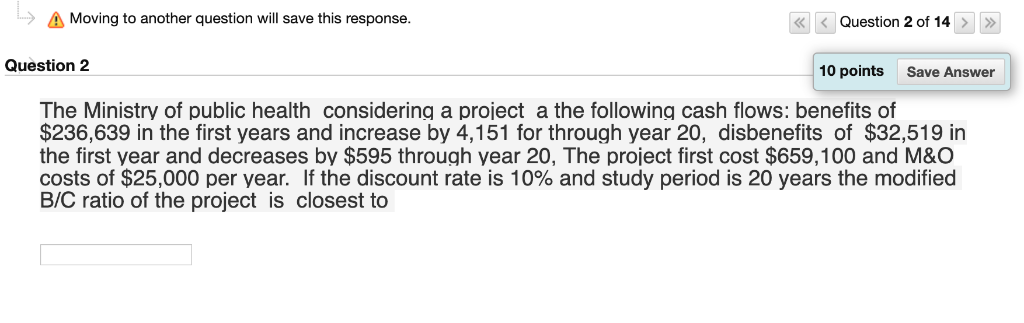

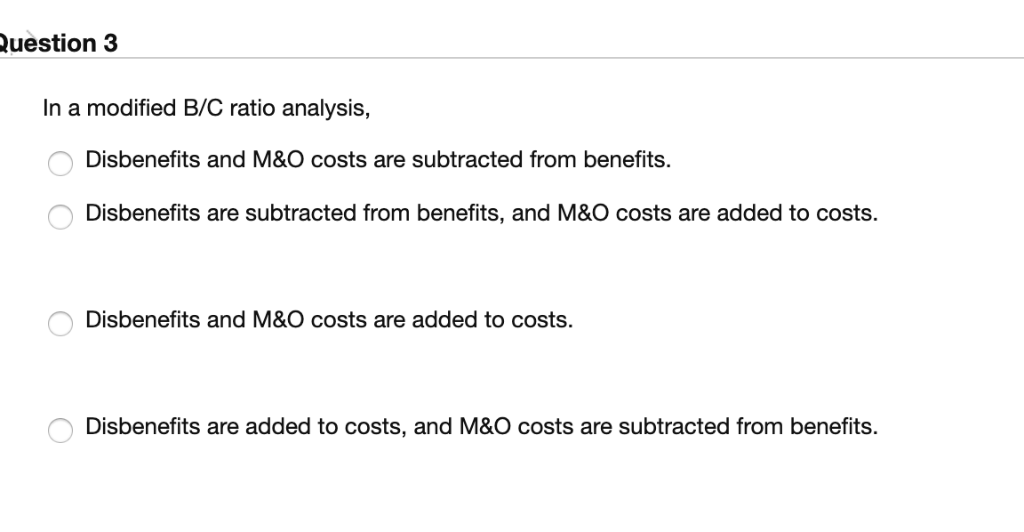

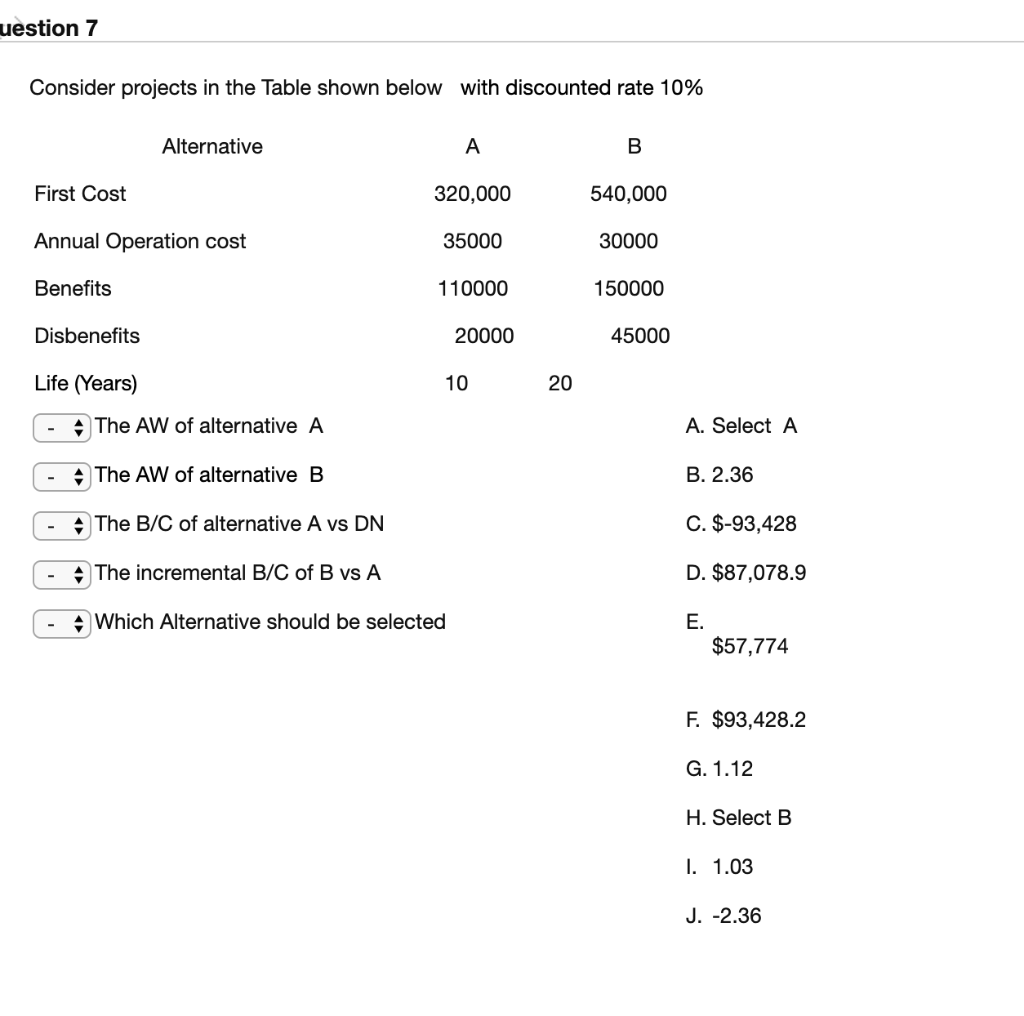

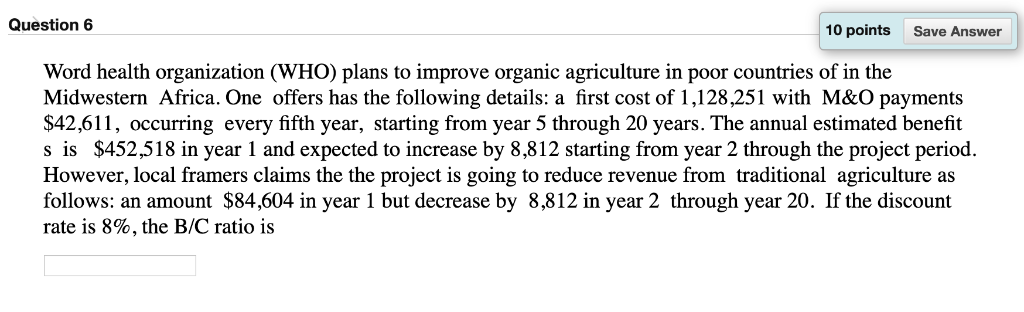

Question 1 5 points Save Answer A public project has the following cash flow: The first cost is $357,524 and the annual M&O is $5,633, the estimated annual benefits are $37,238 and disbenefits of $12,462 per year, if the project period is 50 years and discount rate is 5% , the expected modified B/C ratio is Question 5 10 points Save Answer A local government considering two projects with the following details Project W has a benefits of $22,616 per year, disbenefits $8,853 per year, and first cost $8,006 and M&O costs of $25,000per year. Project Z has a $34,610 with no disbenefits and with first cost of $33,210.If the discount rate is 0.1 and study period is 20 years the B/C ratio of alternative W is closest to Question 4 Using trial and error method can be applied to solve for: PW ROR FW AW A Moving to another question will save this response I Question 2 10 points Save Answer The Ministry of public health considering a project a the following cash flows: benefits of $236,639 in the first years and increase by 4,151 for through year 20, disbenefits of $32,519 in the first year and decreases by $595 through year 20, The project first cost $659,100 and M&O costs of $25,000 per year. If the discount rate is 10% and study period is 20 years the modified B/C ratio of the project is closest to uestion 3 In a modified B/C ratio analysis, Disbenefits and M&O costs are subtracted from benefits. Disbenefits are subtracted from benefits, and M&O costs are added to costs. Disbenefits and M&O costs are added to costs Disbenefits are added to costs, and M&O costs are subtracted from benefits. uestion 7 Consider projects in the Table shown below with discounted rate 10% Alternative First Cost Annual Operation cost Benefits Disbenefits Life (Years) 540,000 30000 150000 45000 320,000 35000 110000 20000 10 20 A. Select A B. 2.36 C. $-93,428 D. $87,078.9 E. 4 The AW of alternative A 4 The AW of alternative B 4 The B/C of alternative A vs DN The incremental B/C of B vs A Which Alternative should be selected $57,774 F. $93,428.2 G. 1.12 H. Select B I. 1.03 J. -2.36 Question 6 10 points Save Answer Word health organization (WHO) plans to improve organic agriculture in poor countries of in the Midwestern Africa. One offers has the following details: a first cost of 1,128,251 with M&O payments $42,611, occurring every fifth year, starting from year 5 through 20 years. The annual estimated benefit s is $452,518 in year 1 and expected to increase by 8,812 starting from year 2 through the project period. However, local framers claims the the project is going to reduce revenue from traditional agriculture as follows: an amount $84,604 in year 1 but decrease by 8,812 in year 2 through year 20. If the discount rate is 8%, the B/C ratio is