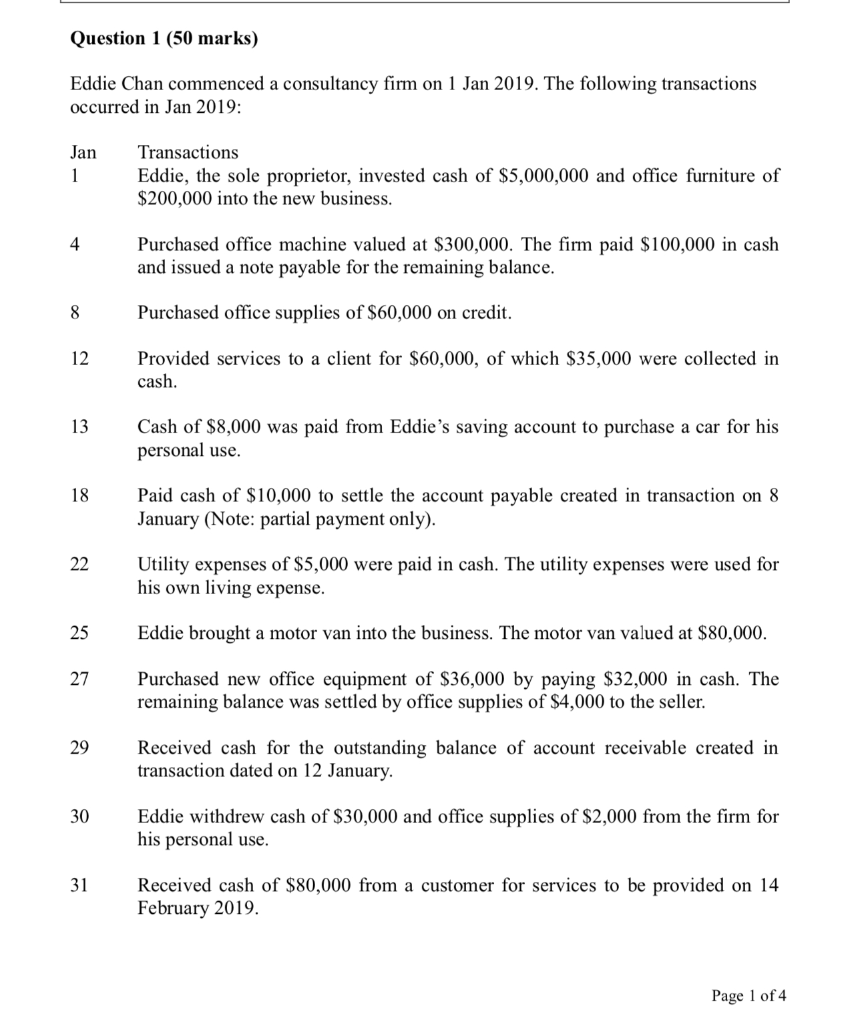

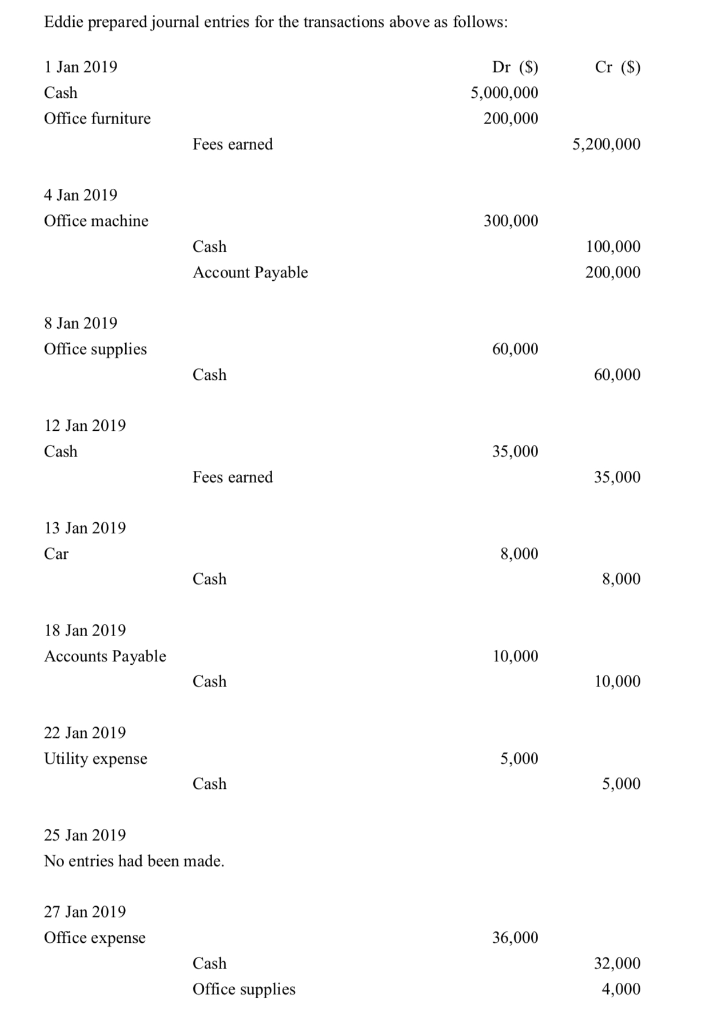

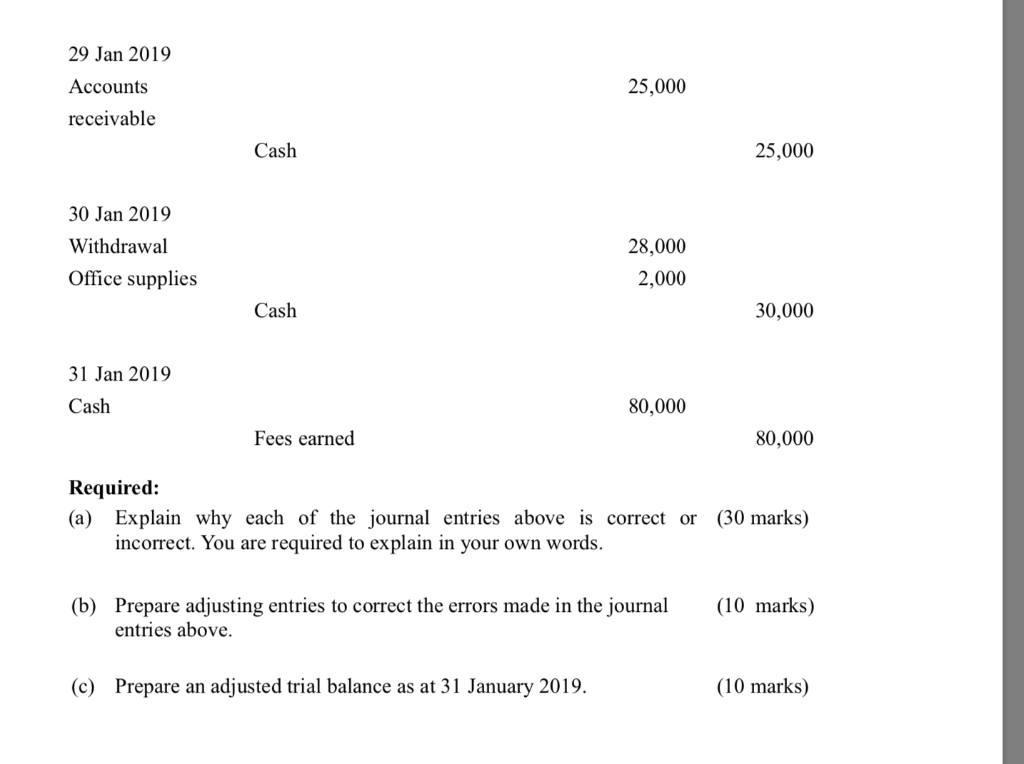

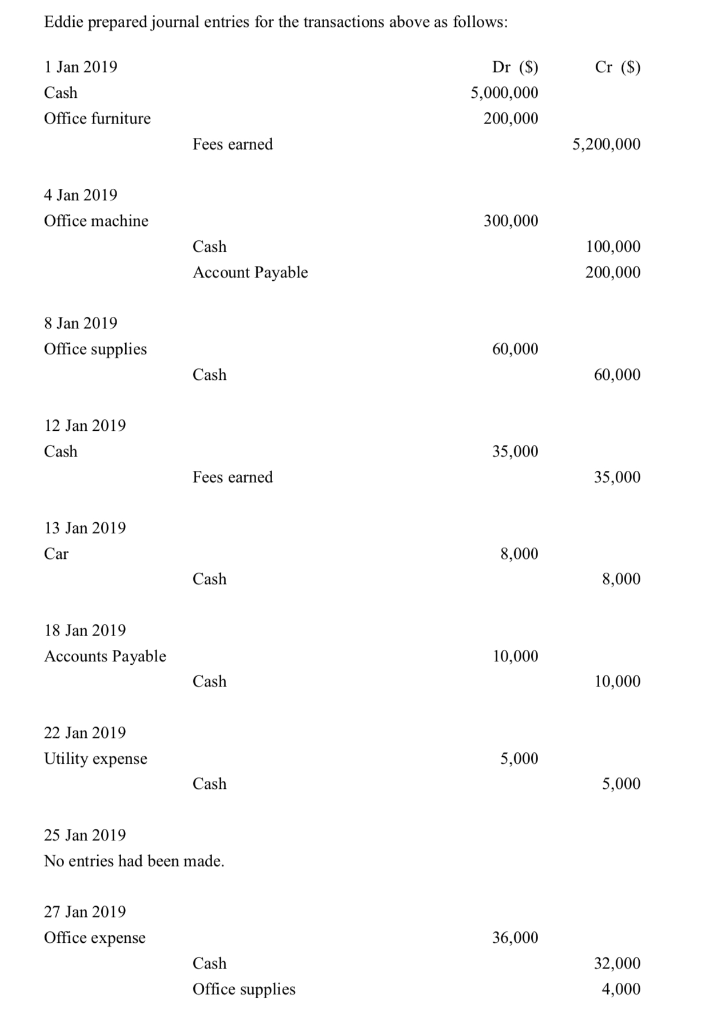

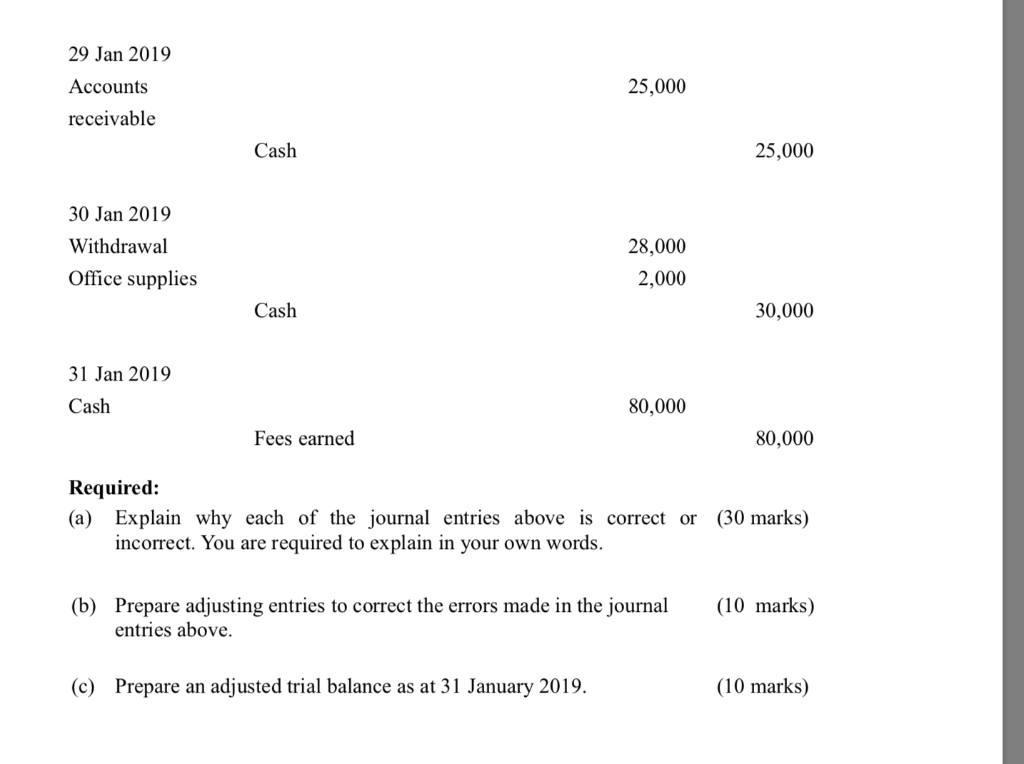

Question 1 (50 marks) Eddie Chan commenced a consultancy firm on 1 Jan 2019. The following transactions occurred in Jan 2019: Jan Transactions Eddie, the sole proprietor, invested cash of $5,000,000 and office furniture of $200,000 into the new business. Purchased office machine valued at $300,000. The firm paid $100,000 in cash and issued a note payable for the remaining balance. Purchased office supplies of $60,000 on credit. Provided services to a client for $60,000, of which $35,000 were collected in cash. Cash of $8,000 was paid from Eddie's saving account to purchase a car for his personal use. Paid cash of $10,000 to settle the account payable created in transaction on 8 January (Note: partial payment only). Utility expenses of $5,000 were paid in cash. The utility expenses were used for his own living expense. Eddie brought a motor van into the business. The motor van valued at $80,000. Purchased new office equipment of $36,000 by paying $32,000 in cash. The remaining balance was settled by office supplies of $4,000 to the seller. Received cash for the outstanding balance of account receivable created in transaction dated on 12 January. Eddie withdrew cash of $30,000 and office supplies of $2,000 from the firm for his personal use. Received cash of $80,000 from a customer for services to be provided on 14 February 2019. Page 1 of 4 Eddie prepared journal entries for the transactions above as follows: Cr ($) 1 Jan 2019 Cash Office furniture Dr ($) 5,000,000 200,000 Fees earned 5,200,000 4 Jan 2019 Office machine 300,000 Cash Account Payable 100,000 200,000 8 Jan 2019 Office supplies 60,000 Cash 60,000 12 Jan 2019 Cash 35,000 Fees earned 35,000 13 Jan 2019 Car 8,000 Cash 8,000 18 Jan 2019 Accounts Payable 10,000 Cash 10,000 22 Jan 2019 Utility expense 5,000 Cash 5,000 25 Jan 2019 No entries had been made. 27 Jan 2019 Office expense 36,000 Cash Office supplies 32,000 4,000 29 Jan 2019 Accounts receivable 25,000 Cash 25,000 30 Jan 2019 Withdrawal Office supplies 28,000 2,000 Cash 30,000 31 Jan 2019 Cash 80,000 Fees earned 80,000 Required: (a) Explain why each of the journal entries above is corrector (30 marks) incorrect. You are required to explain in your own words. (b) Prepare adjusting entries to correct the errors made in the journal entries above. (10 marks) (c) Prepare an adjusted trial balance as at 31 January 2019. (10 marks)