Question

QUESTION 1 [50 Marks] Use the following information to answer Questions A, B C, and D ABC Corporation has identified a project with a capital

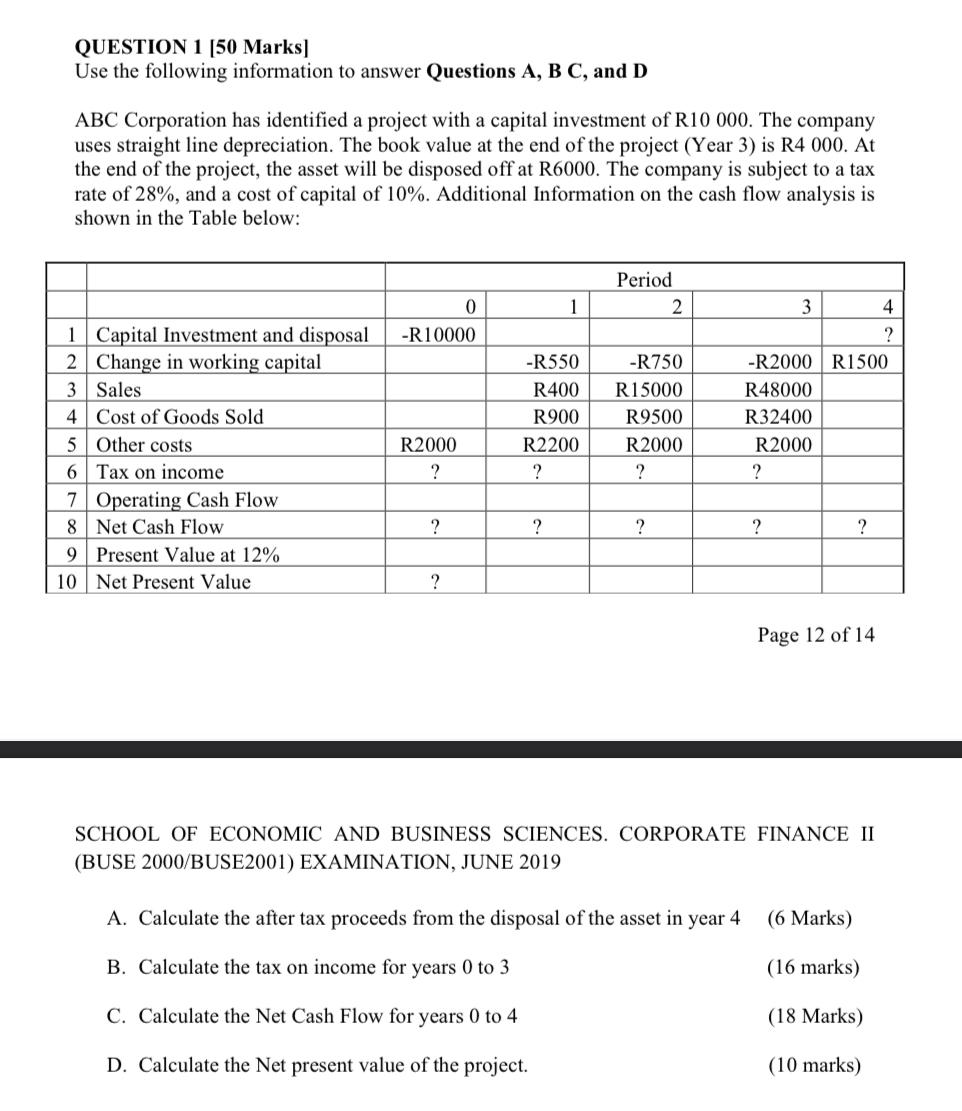

QUESTION 1 [50 Marks] Use the following information to answer Questions A, B C, and D ABC Corporation has identified a project with a capital investment of R10 000. The company uses straight line depreciation. The book value at the end of the project (Year 3) is R4 000. At the end of the project, the asset will be disposed off at R6000. The company is subject to a tax rate of 28%, and a cost of capital of 10%. Additional Information on the cash flow analysis is shown in the Table below: Period 01234 1 Capital Investment and disposal -R10000 2 Change in working capital 3 Sales 4 Cost of Goods Sold 5 Other costs R2000 6 Tax on income ? 7 Operating Cash Flow 8 Net Cash Flow ? 9 Present Value at 12% 10 Net Present Value ? -R550 -R750 -R2000 R400 R15000 R48000 R900 R9500 R32400 R2200 R2000 R2000 ? ? ? ? ? ? ? R1500 ?

A. Calculate the after tax proceeds from the disposal of the asset in year 4 B. Calculate the tax on income for years 0 to 3 C. Calculate the Net Cash Flow for years 0 to 4 D. Calculate the Net present value of the project.

QUESTION 1 (50 Marks] Use the following information to answer Questions A, B C, and D ABC Corporation has identified a project with a capital investment of R10 000. The company uses straight line depreciation. The book value at the end of the project (Year 3) is R4 000. At the end of the project, the asset will be disposed off at R6000. The company is subject to a tax rate of 28%, and a cost of capital of 10%. Additional Information on the cash flow analysis is shown in the Table below: Period 0 1 2 3 4 -R10000 ? -R550 -R750 -R2000 R1500 R400 R 15000 R48000 R900 R9500 R32400 R2000 R2200 R2000 R2000 1 Capital Investment and disposal 2 Change in working capital 3 Sales 4 Cost of Goods Sold 5 Other costs 6 Tax on income 7 Operating Cash Flow 8 Net Cash Flow 9 Present Value at 12% 10 Net Present Value ? ? ? ? ? ? ? ? ? ? Page 12 of 14 SCHOOL OF ECONOMIC AND BUSINESS SCIENCES. CORPORATE FINANCE II (BUSE 2000/BUSE2001) EXAMINATION, JUNE 2019 A. Calculate the after tax proceeds from the disposal of the asset in year 4 (6 Marks) B. Calculate the tax on income for years 0 to 3 (16 marks) C. Calculate the Net Cash Flow for years 0 to 4 (18 Marks) D. Calculate the Net present value of the project. (10 marks) QUESTION 1 (50 Marks] Use the following information to answer Questions A, B C, and D ABC Corporation has identified a project with a capital investment of R10 000. The company uses straight line depreciation. The book value at the end of the project (Year 3) is R4 000. At the end of the project, the asset will be disposed off at R6000. The company is subject to a tax rate of 28%, and a cost of capital of 10%. Additional Information on the cash flow analysis is shown in the Table below: Period 0 1 2 3 4 -R10000 ? -R550 -R750 -R2000 R1500 R400 R 15000 R48000 R900 R9500 R32400 R2000 R2200 R2000 R2000 1 Capital Investment and disposal 2 Change in working capital 3 Sales 4 Cost of Goods Sold 5 Other costs 6 Tax on income 7 Operating Cash Flow 8 Net Cash Flow 9 Present Value at 12% 10 Net Present Value ? ? ? ? ? ? ? ? ? ? Page 12 of 14 SCHOOL OF ECONOMIC AND BUSINESS SCIENCES. CORPORATE FINANCE II (BUSE 2000/BUSE2001) EXAMINATION, JUNE 2019 A. Calculate the after tax proceeds from the disposal of the asset in year 4 (6 Marks) B. Calculate the tax on income for years 0 to 3 (16 marks) C. Calculate the Net Cash Flow for years 0 to 4 (18 Marks) D. Calculate the Net present value of the project. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started