Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 (51 marks) Power Source Limited is a large manufacturing company with a 31 December yearend. The company uses its superior production processes, professional

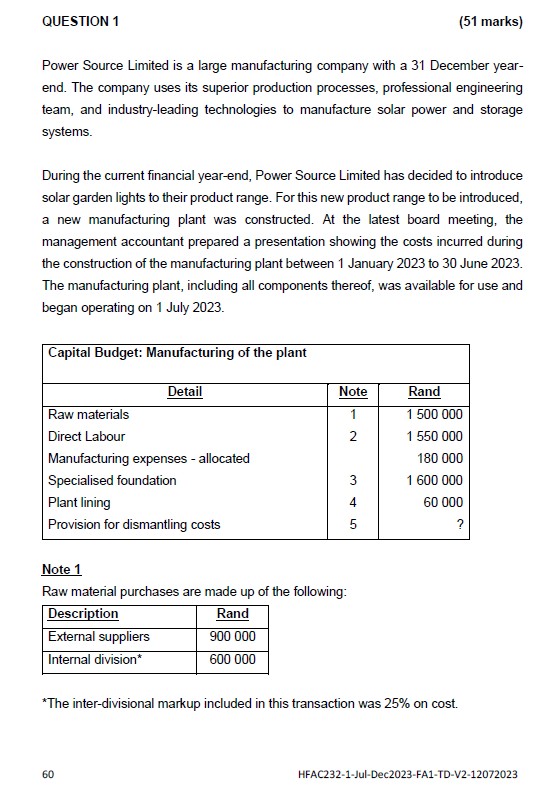

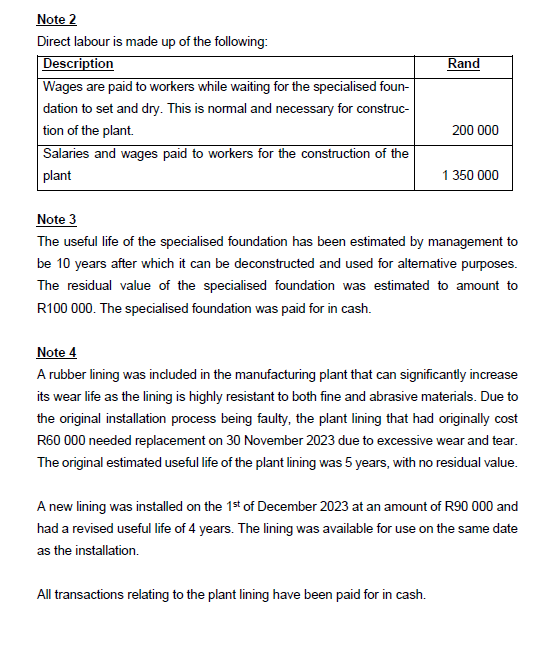

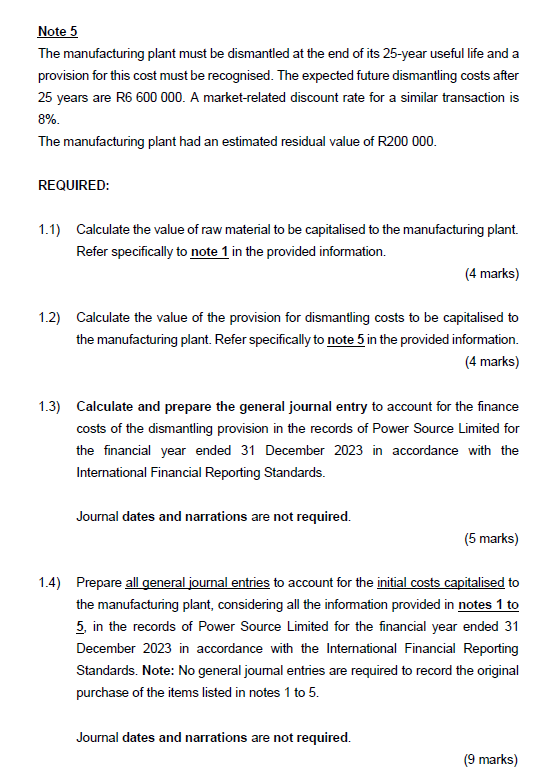

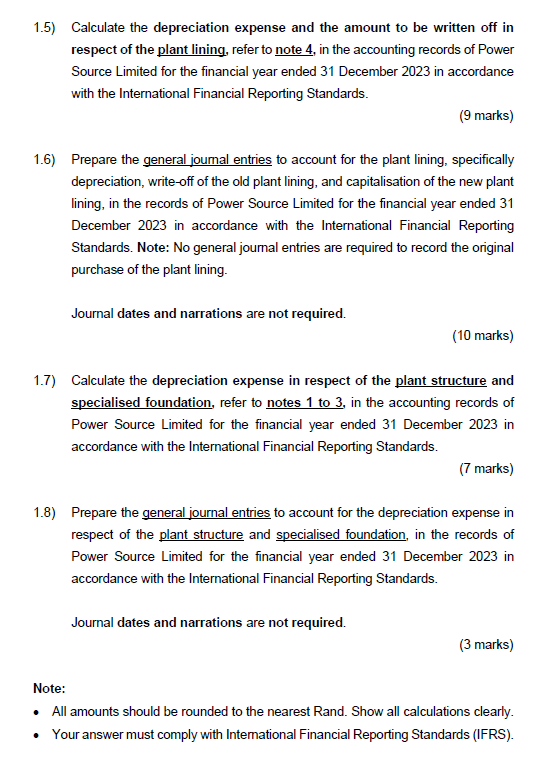

QUESTION 1 (51 marks) Power Source Limited is a large manufacturing company with a 31 December yearend. The company uses its superior production processes, professional engineering team, and industry-leading technologies to manufacture solar power and storage systems. During the current financial year-end, Power Source Limited has decided to introduce solar garden lights to their product range. For this new product range to be introduced, a new manufacturing plant was constructed. At the latest board meeting, the management accountant prepared a presentation showing the costs incurred during the construction of the manufacturing plant between 1 January 2023 to 30 June 2023 . The manufacturing plant, including all components thereof, was available for use and began operating on 1 July 2023. Note 1 Raw material purchases are made up of the following: The inter-divisional markup included in this transaction was 25% on cost. Note 2 Direct labour is made up of the following: Note 3 The useful life of the specialised foundation has been estimated by management to be 10 years after which it can be deconstructed and used for altemative purposes. The residual value of the specialised foundation was estimated to amount to R100 000. The specialised foundation was paid for in cash. Note 4 A rubber lining was included in the manufacturing plant that can significantly increase its wear life as the lining is highly resistant to both fine and abrasive materials. Due to the original installation process being faulty, the plant lining that had originally cost R60 000 needed replacement on 30 November 2023 due to excessive wear and tear. The original estimated useful life of the plant lining was 5 years, with no residual value. A new lining was installed on the 1st of December 2023 at an amount of R90 000 and had a revised useful life of 4 years. The lining was available for use on the same date as the installation. All transactions relating to the plant lining have been paid for in cash. 1.5) Calculate the depreciation expense and the amount to be written off in respect of the plant lining, refer to note 4 , in the accounting records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. (9 marks) 1.6) Prepare the general joumal entries to account for the plant lining, specifically depreciation, write-off of the old plant lining, and capitalisation of the new plant lining, in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Note: No general journal entries are required to record the original purchase of the plant lining. Journal dates and narrations are not required. (10 marks) 1.7) Calculate the depreciation expense in respect of the plant structure and specialised foundation, refer to notes 1 to 3 , in the accounting records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. (7 marks) 1.8) Prepare the general journal entries to account for the depreciation expense in respect of the plant structure and specialised foundation, in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Journal dates and narrations are not required. (3 marks) Note: - All amounts should be rounded to the nearest Rand. Show all calculations clearly. - Your answer must comply with International Financial Reporting Standards (IFRS). Note 5 The manufacturing plant must be dismantled at the end of its 25 -year useful life and a provision for this cost must be recognised. The expected future dismantling costs after 25 years are R6 600000 . A market-related discount rate for a similar transaction is 8%. The manufacturing plant had an estimated residual value of R200 000 . REQUIRED: 1.1) Calculate the value of raw material to be capitalised to the manufacturing plant. Refer specifically to note 1 in the provided information. (4 marks) 1.2) Calculate the value of the provision for dismantling costs to be capitalised to the manufacturing plant. Refer specifically to note 5 in the provided information. (4 marks) 1.3) Calculate and prepare the general journal entry to account for the finance costs of the dismantling provision in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Journal dates and narrations are not required. (5 marks) 1.4) Prepare all general journal entries to account for the initial costs capitalised to the manufacturing plant, considering all the information provided in notes 1 to 5, in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Note: No general journal entries are required to record the original purchase of the items listed in notes 1 to 5 . Journal dates and narrations are not required. (9 marks)

QUESTION 1 (51 marks) Power Source Limited is a large manufacturing company with a 31 December yearend. The company uses its superior production processes, professional engineering team, and industry-leading technologies to manufacture solar power and storage systems. During the current financial year-end, Power Source Limited has decided to introduce solar garden lights to their product range. For this new product range to be introduced, a new manufacturing plant was constructed. At the latest board meeting, the management accountant prepared a presentation showing the costs incurred during the construction of the manufacturing plant between 1 January 2023 to 30 June 2023 . The manufacturing plant, including all components thereof, was available for use and began operating on 1 July 2023. Note 1 Raw material purchases are made up of the following: The inter-divisional markup included in this transaction was 25% on cost. Note 2 Direct labour is made up of the following: Note 3 The useful life of the specialised foundation has been estimated by management to be 10 years after which it can be deconstructed and used for altemative purposes. The residual value of the specialised foundation was estimated to amount to R100 000. The specialised foundation was paid for in cash. Note 4 A rubber lining was included in the manufacturing plant that can significantly increase its wear life as the lining is highly resistant to both fine and abrasive materials. Due to the original installation process being faulty, the plant lining that had originally cost R60 000 needed replacement on 30 November 2023 due to excessive wear and tear. The original estimated useful life of the plant lining was 5 years, with no residual value. A new lining was installed on the 1st of December 2023 at an amount of R90 000 and had a revised useful life of 4 years. The lining was available for use on the same date as the installation. All transactions relating to the plant lining have been paid for in cash. 1.5) Calculate the depreciation expense and the amount to be written off in respect of the plant lining, refer to note 4 , in the accounting records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. (9 marks) 1.6) Prepare the general joumal entries to account for the plant lining, specifically depreciation, write-off of the old plant lining, and capitalisation of the new plant lining, in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Note: No general journal entries are required to record the original purchase of the plant lining. Journal dates and narrations are not required. (10 marks) 1.7) Calculate the depreciation expense in respect of the plant structure and specialised foundation, refer to notes 1 to 3 , in the accounting records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. (7 marks) 1.8) Prepare the general journal entries to account for the depreciation expense in respect of the plant structure and specialised foundation, in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Journal dates and narrations are not required. (3 marks) Note: - All amounts should be rounded to the nearest Rand. Show all calculations clearly. - Your answer must comply with International Financial Reporting Standards (IFRS). Note 5 The manufacturing plant must be dismantled at the end of its 25 -year useful life and a provision for this cost must be recognised. The expected future dismantling costs after 25 years are R6 600000 . A market-related discount rate for a similar transaction is 8%. The manufacturing plant had an estimated residual value of R200 000 . REQUIRED: 1.1) Calculate the value of raw material to be capitalised to the manufacturing plant. Refer specifically to note 1 in the provided information. (4 marks) 1.2) Calculate the value of the provision for dismantling costs to be capitalised to the manufacturing plant. Refer specifically to note 5 in the provided information. (4 marks) 1.3) Calculate and prepare the general journal entry to account for the finance costs of the dismantling provision in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Journal dates and narrations are not required. (5 marks) 1.4) Prepare all general journal entries to account for the initial costs capitalised to the manufacturing plant, considering all the information provided in notes 1 to 5, in the records of Power Source Limited for the financial year ended 31 December 2023 in accordance with the International Financial Reporting Standards. Note: No general journal entries are required to record the original purchase of the items listed in notes 1 to 5 . Journal dates and narrations are not required. (9 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started