Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 ( 6 0 Marks 9 0 Minutes ) Sticky Toffee Traders is owned by Mr Wilson, a sole trader. Mr Wilson is a

QUESTION

Marks

Minutes

Sticky Toffee Traders is owned by Mr Wilson, a sole trader. Mr Wilson is a general trader of various retail goods and has a financial year end of December. You are provided with the following preadjustment trial balance:

STICKY TOFFEE TRADERS

PREADJUSTMENT TRIAL BALANCE AS AT DECEMBER

tabletableRDebittableRCreditReal accounts,CapitalBMotor vehicles at costBAccumulated depreciation: motor vehicles,BComputer equipment at costBAccumulated depreciation: computer equipment,BLand and buildings,BLoan from: Peoples Bank,BMortgage bond: Peoples Bank,BFixed deposit: Peoples Bank,BBankBPetty cash,BInventoryBAccounts receivable,BAccounts payable,BNominal accountsSalesNInterest income,NRent income,NInsurance refund,N

Page

CONSTRUCTION ACCOUNTING III CSAD

ASSIGNMENT

DUE DATE: SEPTEMBER

tablePurchasesNAdvertisingNAccounting fee,NBank charges,NCredit losses,NConsulting fees,NInterest expense,NInsuranceNStationeryNMotor vehicles expenditure,NCourier and postage,NRepairs and maintenance,NSalaries and wages,NSubscriptionsNLegal fees,NDonationsNStaff welfare,NStaff training,N

Additional information:

Insurance includes an amount of R which was paid for a sixmonth period from October

Closing inventory as at December amounted to R

Rent income was received for the period January to February Rent income is fixed monthly payment.

Page

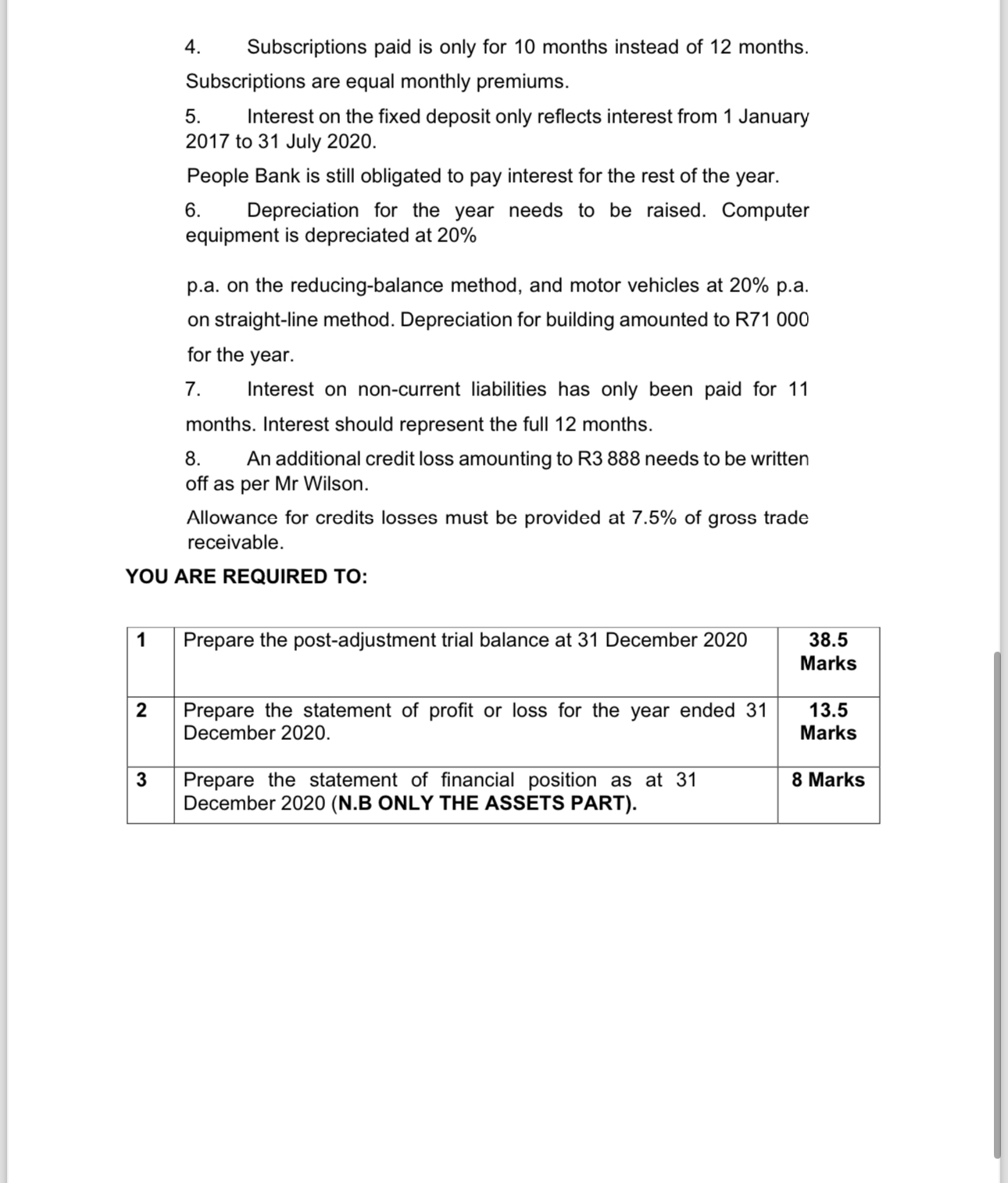

Subscriptions paid is only for months instead of months. Subscriptions are equal monthly premiums.

Interest on the fixed deposit only reflects interest from January to July

People Bank is still obligated to pay interest for the rest of the year.

Depreciation for the year needs to be raised. Computer equipment is depreciated at

pa on the reducingbalance method, and motor vehicles at pa on straightline method. Depreciation for building amounted to R for the year.

Interest on noncurrent liabilities has only been paid for months. Interest should represent the full months.

An additional credit loss amounting to R needs to be written off as per Mr Wilson.

Allowance for credits losses must be provided at of gross trade receivable.

YOU ARE REQUIRED TO:

tablePrepare the postadjustment trial balance at December table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started