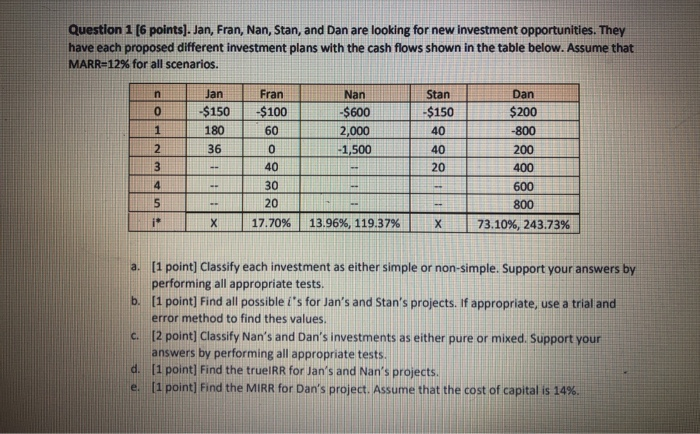

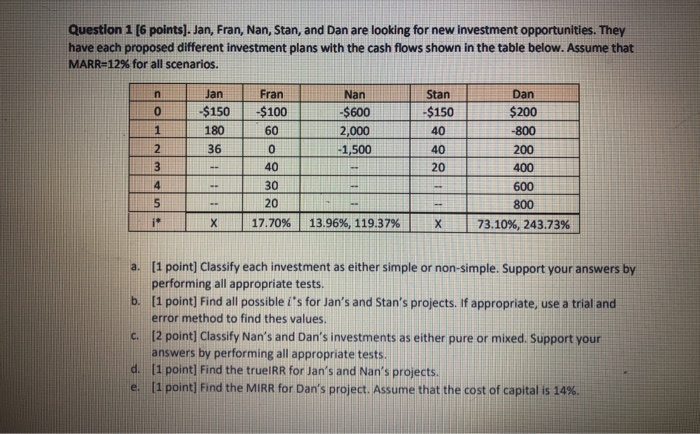

Question 1 [6 points). Jan, Fran, Nan, Stan, and Dan are looking for new investment opportunities. They have each proposed different investment plans with the cash flows shown in the table below. Assume that MARR=12% for all scenarios. n 0 Jan -$150 180 36 Fran -$100 60 Nan -$600 2,000 -1,500 Stan -$150 40 1 2 3 0 40 40 20 Dan $200 -800 200 400 600 800 73.10%, 243.73% 4 5 30 20 17.70% i 13.96%, 119.37% a. [1 point] Classify each investment as either simple or non-simple. Support your answers by performing all appropriate tests. b. [1 point) Find all possible i's for Jan's and Stan's projects. If appropriate, use a trial and error method to find thes values. [2 point] Classify Nan's and Dan's investments as either pure or mixed. Support your answers by performing all appropriate tests. d. [1 point] Find the true RR for Jan's and Nan's projects. e. [1 point) Find the MIRR for Dan's project. Assume that the cost of capital is 14%. C. Question 1 [6 points). Jan, Fran, Nan, Stan, and Dan are looking for new investment opportunities. They have each proposed different investment plans with the cash flows shown in the table below. Assume that MARR=12% for all scenarios. n 0 Jan -$150 180 36 Nan -$600 2,000 -1,500 Stan -$150 40 1 2 3 Fran -$100 60 0 40 30 20 17.70% 40 20 Dan $200 -800 200 400 600 800 73.10%, 243.73% 4 5 w i 13.96%, 119.37% a. [1 point] Classify each investment as either simple or non-simple. Support your answers by performing all appropriate tests. b. [1 point) Find all possible i's for Jan's and Stan's projects. If appropriate, use a trial and error method to find thes values. [2 point] Classify Nan's and Dan's investments as either pure or mixed. Support your answers by performing all appropriate tests. d. [1 point] Find the true RR for Jan's and Nan's projects. e. [1 point) Find the MIRR for Dan's project. Assume that the cost of capital is 14%. C. Question 1 [6 points). Jan, Fran, Nan, Stan, and Dan are looking for new investment opportunities. They have each proposed different investment plans with the cash flows shown in the table below. Assume that MARR=12% for all scenarios. n 0 Jan -$150 180 36 Fran -$100 60 Nan -$600 2,000 -1,500 Stan -$150 40 1 2 3 0 40 40 20 Dan $200 -800 200 400 600 800 73.10%, 243.73% 4 5 30 20 17.70% i 13.96%, 119.37% a. [1 point] Classify each investment as either simple or non-simple. Support your answers by performing all appropriate tests. b. [1 point) Find all possible i's for Jan's and Stan's projects. If appropriate, use a trial and error method to find thes values. [2 point] Classify Nan's and Dan's investments as either pure or mixed. Support your answers by performing all appropriate tests. d. [1 point] Find the true RR for Jan's and Nan's projects. e. [1 point) Find the MIRR for Dan's project. Assume that the cost of capital is 14%. C. Question 1 [6 points). Jan, Fran, Nan, Stan, and Dan are looking for new investment opportunities. They have each proposed different investment plans with the cash flows shown in the table below. Assume that MARR=12% for all scenarios. n 0 Jan -$150 180 36 Nan -$600 2,000 -1,500 Stan -$150 40 1 2 3 Fran -$100 60 0 40 30 20 17.70% 40 20 Dan $200 -800 200 400 600 800 73.10%, 243.73% 4 5 w i 13.96%, 119.37% a. [1 point] Classify each investment as either simple or non-simple. Support your answers by performing all appropriate tests. b. [1 point) Find all possible i's for Jan's and Stan's projects. If appropriate, use a trial and error method to find thes values. [2 point] Classify Nan's and Dan's investments as either pure or mixed. Support your answers by performing all appropriate tests. d. [1 point] Find the true RR for Jan's and Nan's projects. e. [1 point) Find the MIRR for Dan's project. Assume that the cost of capital is 14%. C