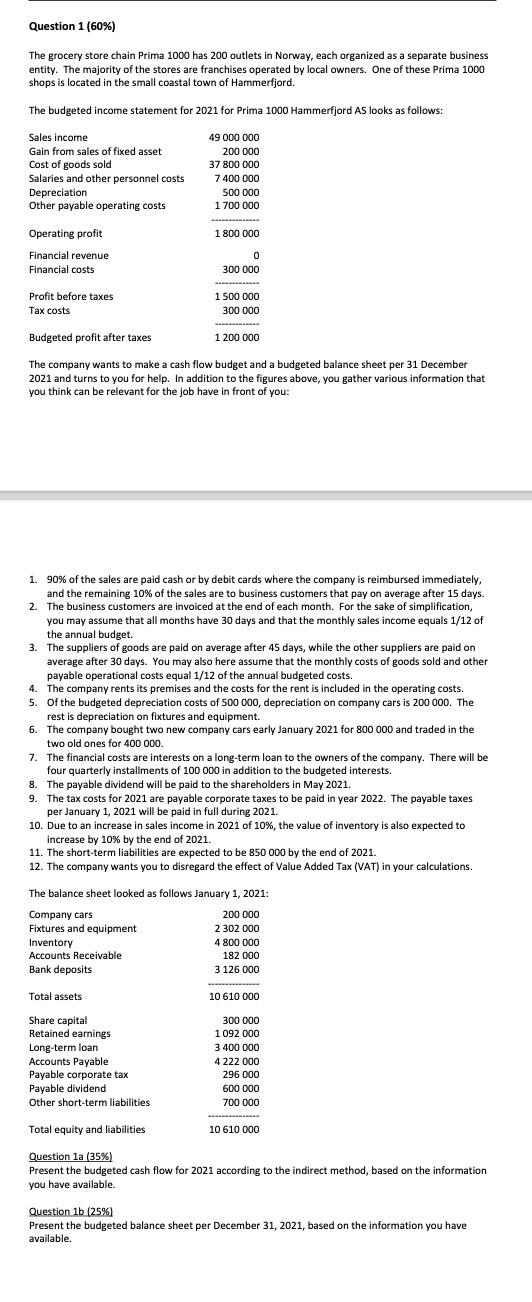

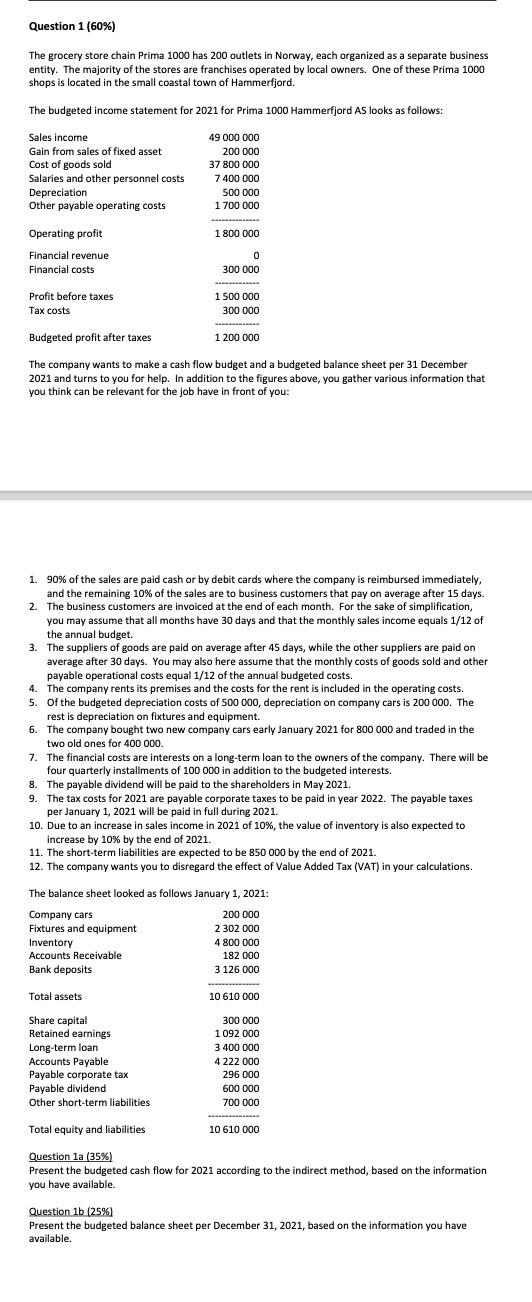

Question 1 (60%) The grocery store chain Prima 1000 has 200 outlets in Norway, each organized as a separate business entity. The majority of the stores are franchises operated by local owners. One of these Prima 1000 shops is located in the small coastal town of Hammerfjord. The budgeted income statement for 2021 for Prima 1000 Hammerfjord AS looks as follows: Sales income Gain from sales of fixed asset Cost of goods sold Salaries and other personnel costs Depreciation Other payable operating costs 49 000 000 200 000 37 800 000 7 400 000 500 000 1 700 000 Operating profit 1 800 000 Financial revenue Financial costs 0 300 000 Profit before taxes Tax costs 1 500 000 300 000 Budgeted profit after taxes 1 200 000 The company wants to make a cash flow budget and a budgeted balance sheet per 31 December 2021 and turns to you for help. In addition to the figures above, you gather various information that you think can be relevant for the job have in front of you: 1. 90% of the sales are paid cash or by debit cards where the company is reimbursed immediately, and the remaining 10% of the sales are to business customers that pay on average after 15 days. 2. The business customers are invoiced at the end of each month. For the sake of simplification, you may assume that all months have 30 days and that the monthly sales income equals 1/12 of the annual budget. 3. The suppliers of goods are paid on average after 45 days, while the other suppliers are paid on average after 30 days. You may also here assume that the monthly costs of goods sold and other payable operational costs equal 1/12 of the annual budgeted costs. 4. The company rents its premises and the costs for the rent is included in the operating costs. 5. Of the budgeted depreciation costs of 500 000, depreciation on company cars is 200 000. The rest is depreciation on fixtures and equipment. 6. The company bought two new company cars early January 2021 for 800 000 and traded in the two old ones for 400 000 7. The financial costs are interests on a long-term loan to the owners of the company. There will be four quarterly installments of 100 000 in addition to the budgeted interests. 8. The payable dividend will be paid to the shareholders in May 2021. 9. The tax costs for 2021 are payable corporate taxes to be paid in year 2022. The payable taxes per January 1, 2021 will be paid in full during 2021. 10. Due to an increase in sales income in 2021 of 10%, the value of inventory is also expected to increase by 10% by the end of 2021. 11. The short-term liabilities are expected to be 850 000 by the end of 2021. 12. The company wants you to disregard the effect of Value Added Tax (VAT) in your calculations. The balance sheet looked as follows January 1, 2021: Company cars 200 000 Fixtures and equipment 2 302 000 Inventory 4 800 000 4 Accounts Receivable 182 000 Bank deposits 3 126 000 Total assets 10 610 000 Share capital 300 000 Retained earnings 1 092 000 Long-term loan 3 400 000 3 Accounts Payable 4222 000 Payable corporate tax 296 000 Payable dividend 600 000 Other short-term liabilities 700 000 Total equity and liabilities 10 610 000 Question 1a (35%) Present the budgeted cash flow for 2021 according to the indirect method, based on the information you have available. Question 1b (25%) Present the budgeted balance sheet per December 31, 2021, based on the information you have available. Question 1 (60%) The grocery store chain Prima 1000 has 200 outlets in Norway, each organized as a separate business entity. The majority of the stores are franchises operated by local owners. One of these Prima 1000 shops is located in the small coastal town of Hammerfjord. The budgeted income statement for 2021 for Prima 1000 Hammerfjord AS looks as follows: Sales income Gain from sales of fixed asset Cost of goods sold Salaries and other personnel costs Depreciation Other payable operating costs 49 000 000 200 000 37 800 000 7 400 000 500 000 1 700 000 Operating profit 1 800 000 Financial revenue Financial costs 0 300 000 Profit before taxes Tax costs 1 500 000 300 000 Budgeted profit after taxes 1 200 000 The company wants to make a cash flow budget and a budgeted balance sheet per 31 December 2021 and turns to you for help. In addition to the figures above, you gather various information that you think can be relevant for the job have in front of you: 1. 90% of the sales are paid cash or by debit cards where the company is reimbursed immediately, and the remaining 10% of the sales are to business customers that pay on average after 15 days. 2. The business customers are invoiced at the end of each month. For the sake of simplification, you may assume that all months have 30 days and that the monthly sales income equals 1/12 of the annual budget. 3. The suppliers of goods are paid on average after 45 days, while the other suppliers are paid on average after 30 days. You may also here assume that the monthly costs of goods sold and other payable operational costs equal 1/12 of the annual budgeted costs. 4. The company rents its premises and the costs for the rent is included in the operating costs. 5. Of the budgeted depreciation costs of 500 000, depreciation on company cars is 200 000. The rest is depreciation on fixtures and equipment. 6. The company bought two new company cars early January 2021 for 800 000 and traded in the two old ones for 400 000 7. The financial costs are interests on a long-term loan to the owners of the company. There will be four quarterly installments of 100 000 in addition to the budgeted interests. 8. The payable dividend will be paid to the shareholders in May 2021. 9. The tax costs for 2021 are payable corporate taxes to be paid in year 2022. The payable taxes per January 1, 2021 will be paid in full during 2021. 10. Due to an increase in sales income in 2021 of 10%, the value of inventory is also expected to increase by 10% by the end of 2021. 11. The short-term liabilities are expected to be 850 000 by the end of 2021. 12. The company wants you to disregard the effect of Value Added Tax (VAT) in your calculations. The balance sheet looked as follows January 1, 2021: Company cars 200 000 Fixtures and equipment 2 302 000 Inventory 4 800 000 4 Accounts Receivable 182 000 Bank deposits 3 126 000 Total assets 10 610 000 Share capital 300 000 Retained earnings 1 092 000 Long-term loan 3 400 000 3 Accounts Payable 4222 000 Payable corporate tax 296 000 Payable dividend 600 000 Other short-term liabilities 700 000 Total equity and liabilities 10 610 000 Question 1a (35%) Present the budgeted cash flow for 2021 according to the indirect method, based on the information you have available. Question 1b (25%) Present the budgeted balance sheet per December 31, 2021, based on the information you have available