Answered step by step

Verified Expert Solution

Question

1 Approved Answer

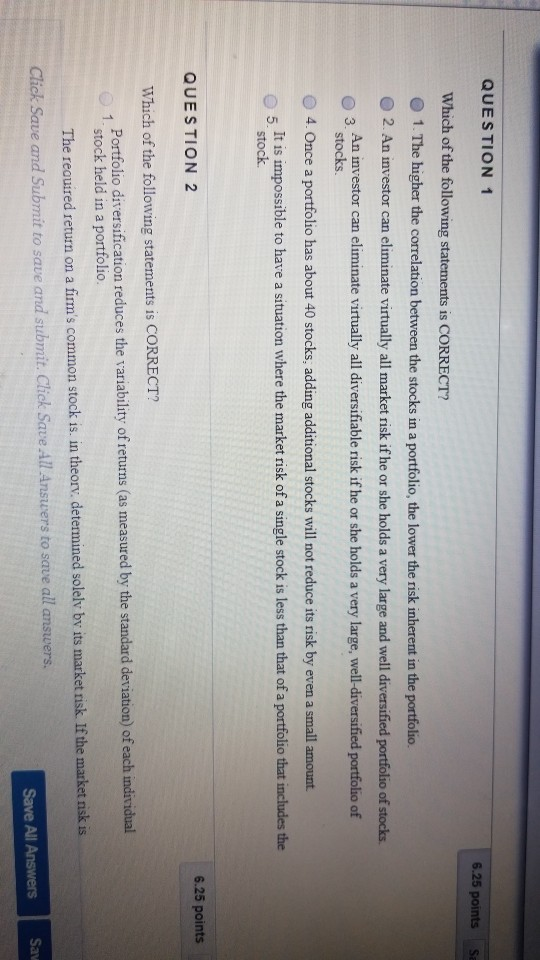

QUESTION 1 6.25 points Sa Which of the following statements is CORRECT? 1. The higher the correlation between the stocks in a portfolio, the lower

QUESTION 1 6.25 points Sa Which of the following statements is CORRECT? 1. The higher the correlation between the stocks in a portfolio, the lower the risk inherent in the portfolio 2. An investor can eliminate virtually all market risk if he or she holds a very large and well diversified portfolio of stocks 3 An investor can eliminate virtually all diversifiable risk if he or she holds a very large, well-diversified portfolio of stocks. 4. Once a portfolio has about 40 stocks, adding additional stocks will not reduce its risk by even a small amount It is impossible to have a situation where the market risk of a single stock is less than that of a portfolio that includes the 5. stock QUESTION 2 6.25 points 1 Which of the following statements is CORRECT? Portfolio diversification reduces the variability of returns (as measured by the standard deviation) of each individual stock held in a portfolio The required return on a firm's common stock is in theory, determined solely by its market risk. If the market risk is Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Sav

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started