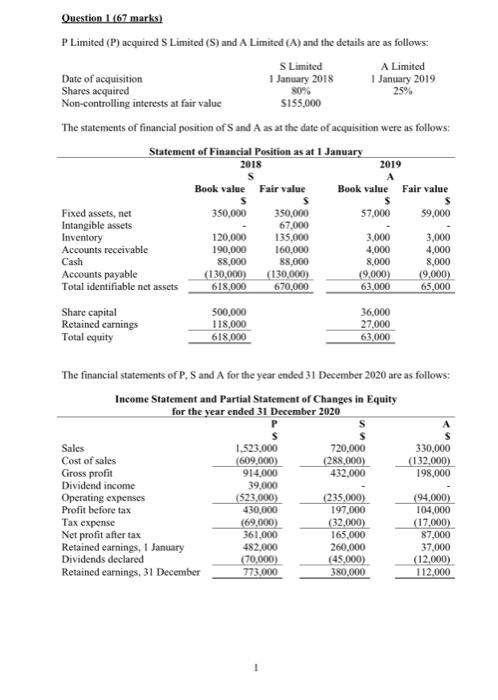

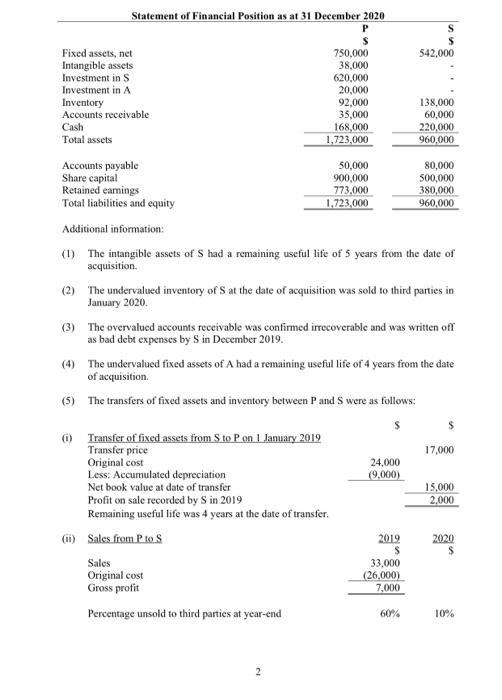

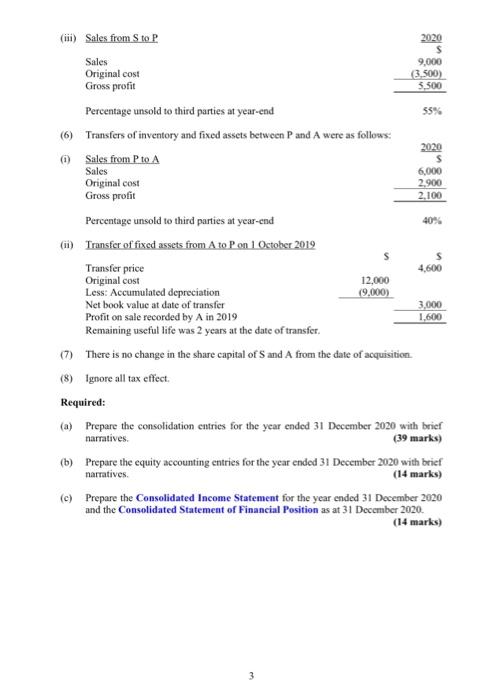

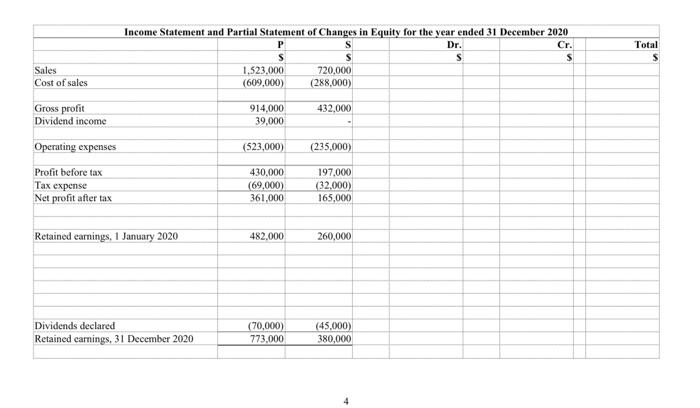

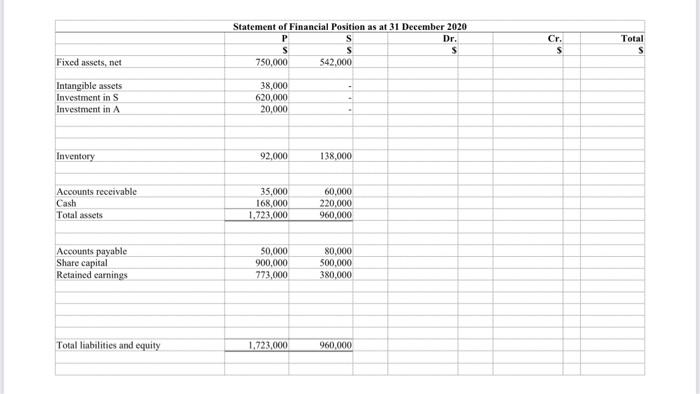

Question 1 (67 marks) P Limited (P) acquired S Limited (S) and A Limited (A) and the details are as follows: S Limited A Limited Date of acquisition 1 January 2018 1 January 2019 Shares acquired 80% 25% Non-controlling interests at fair value SI55.000 The statements of financial position of S and A as at the date of acquisition were as follows: Statement of Financial Position as at 1 January 2018 2019 Book value Fair value Book value Fair value $ Fixed assets, net 350,000 350,000 57,000 59,000 Intangible assets 67,000 Inventory 120,000 135.000 3.000 3,000 Accounts receivable 190,000 160,000 4,000 Cash 88,000 88,000 8,000 Accounts payable (130,000) (130,000) (9,000) (9.000) Total identifiable net assets 618,000 670.000 63.000 65,000 $ 4,000 8,000 Share capital Retained earnings Total equity 500,000 118,000 618,000 36,000 27.000 63.000 The financial statements of P, S and A for the year ended 31 December 2020 are as follows: Income Statement and Partial Statement of Changes in Equity for the year ended 31 December 2020 720,000 (288,000) 432.000 330,000 (132,000) 198,000 Sales Cost of sales Gross profit Dividend income Operating expenses Profit before tax Tax expense Net profit after tax Retained earnings, 1 January Dividends declared Retained earnings, 31 December 1.523,000 (609.000) 914,000 39,000 (523,000) 430,000 (69,000) 361.000 482.000 (70.000) 773.000 235,000) 197,000 (32,000) 165,000 260,000 (45,000) 380.000 (94.000) 104,000 (17,000) 87,000 37,000 (12.000) 112,000 1 Statement of Financial Position as at 31 December 2020 Fixed assets, net 750,000 542,000 Intangible assets 38,000 Investment in s 620,000 Investment in A 20,000 Inventory 92,000 138,000 Accounts receivable 35,000 60,000 Cash 168,000 220,000 Total assets 1,723,000 960,000 Accounts payable 50,000 80,000 Share capital 900,000 500,000 Retained earnings 773,000 380,000 Total liabilities and equity 1,723,000 960,000 Additional information: (1) The intangible assets of S had a remaining useful life of 5 years from the date of acquisition (2) The undervalued inventory of S at the date of acquisition was sold to third parties in January 2020. (3) The overvalued accounts receivable was confirmed irrecoverable and was written off as bad debt expenses by S in December 2019. (4) The undervalued fixed assets of A had a remaining useful life of 4 years from the date of acquisition (5) The transfers of fixed assets and inventory between Pand S were as follows: $ 17.000 24,000 (9,000) 15,000 2,000 (1) Transfer of fixed assets from S to P on 1 January 2019 Transfer price Original cost Less: Accumulated depreciation Net book value at date of transfer Profit on sale recorded by S in 2019 Remaining useful life was 4 years at the date of transfer. (0) Sales from Ptos Sales Original cost Gross profit Percentage unsold to third parties at year-end 2012 2020 S 33.000 (26,000) 7,000 60% 10% 2 (iii) Sales from Stop 2020 S Sales 9,000 Original cost (3.500) Gross profit 5.500 Percentage unsold to third parties at year-end 55 (6) Transfers of inventory and fixed assets between P and A were as follows: 2020 m Sales from P to A s Sales 6,000 Original cost 2.900 Gross profit 2.100 Percentage unsold to third parties at year-end 40% (m) Transfer of fixed assets from A to Pon 1 October 2019 Transfer price 4.600 Original cost 12,000 Less: Accumulated depreciation (9,000) Net book value at date of transfer 3,000 Profit on sale recorded by A in 2019 1.600 Remaining useful life was 2 years at the date of transfer (7) There is no change in the share capital of S and A from the date of acquisition (8) Ignore all tax effect Required: (a) Prepare the consolidation entries for the year ended 31 December 2020 with brief narratives (39 marks) (b) Prepare the equity accounting entries for the year ended 31 December 2020 with brief narratives (14 marks) (c) Prepare the Consolidated Income Statement for the year ended 31 December 2020 and the Consolidated Statement of Financial Position as at 31 December 2020 (14 marks) 3 Income Statement and Partial Statement of Changes in Equity for the year ended 31 December 2020 Dr. Cr. S $ 1.523.000 720,000 (609,000) (288,000) Total S Sales Cost of sales 432.000 Gross profit Dividend income 914,000 39,000 Operating expenses (523,000) (235,000) Profit before tax Tax expense Net profit after tax 430,000 (69,000) 361,000 197,000 (32.000) 165,000 Retained earnings. 1 January 2020 482,000 260,000 Dividends declared Retained carings, 31 December 2020 (70,000) 773.000 (45.000) 380,000 Statement of Financial Position as at 31 December 2020 P Dr. s 750,000 542,000 Cr. s Total S Fixed assets, net Intangible assets Investment in S Investment in A 38,000 620,000 20,000 Inventory 92,000 138,000 Accounts receivable Cash Total assets 35,000 168,000 1,723,000 60,000 220,000 960,000 Accounts payable Share capital Retained earnings 50,000 900,000 773,000 80,000 500,000 380,000 Total liabilities and equity 1.723,000 960.000 Question 1 (67 marks) P Limited (P) acquired S Limited (S) and A Limited (A) and the details are as follows: S Limited A Limited Date of acquisition 1 January 2018 1 January 2019 Shares acquired 80% 25% Non-controlling interests at fair value SI55.000 The statements of financial position of S and A as at the date of acquisition were as follows: Statement of Financial Position as at 1 January 2018 2019 Book value Fair value Book value Fair value $ Fixed assets, net 350,000 350,000 57,000 59,000 Intangible assets 67,000 Inventory 120,000 135.000 3.000 3,000 Accounts receivable 190,000 160,000 4,000 Cash 88,000 88,000 8,000 Accounts payable (130,000) (130,000) (9,000) (9.000) Total identifiable net assets 618,000 670.000 63.000 65,000 $ 4,000 8,000 Share capital Retained earnings Total equity 500,000 118,000 618,000 36,000 27.000 63.000 The financial statements of P, S and A for the year ended 31 December 2020 are as follows: Income Statement and Partial Statement of Changes in Equity for the year ended 31 December 2020 720,000 (288,000) 432.000 330,000 (132,000) 198,000 Sales Cost of sales Gross profit Dividend income Operating expenses Profit before tax Tax expense Net profit after tax Retained earnings, 1 January Dividends declared Retained earnings, 31 December 1.523,000 (609.000) 914,000 39,000 (523,000) 430,000 (69,000) 361.000 482.000 (70.000) 773.000 235,000) 197,000 (32,000) 165,000 260,000 (45,000) 380.000 (94.000) 104,000 (17,000) 87,000 37,000 (12.000) 112,000 1 Statement of Financial Position as at 31 December 2020 Fixed assets, net 750,000 542,000 Intangible assets 38,000 Investment in s 620,000 Investment in A 20,000 Inventory 92,000 138,000 Accounts receivable 35,000 60,000 Cash 168,000 220,000 Total assets 1,723,000 960,000 Accounts payable 50,000 80,000 Share capital 900,000 500,000 Retained earnings 773,000 380,000 Total liabilities and equity 1,723,000 960,000 Additional information: (1) The intangible assets of S had a remaining useful life of 5 years from the date of acquisition (2) The undervalued inventory of S at the date of acquisition was sold to third parties in January 2020. (3) The overvalued accounts receivable was confirmed irrecoverable and was written off as bad debt expenses by S in December 2019. (4) The undervalued fixed assets of A had a remaining useful life of 4 years from the date of acquisition (5) The transfers of fixed assets and inventory between Pand S were as follows: $ 17.000 24,000 (9,000) 15,000 2,000 (1) Transfer of fixed assets from S to P on 1 January 2019 Transfer price Original cost Less: Accumulated depreciation Net book value at date of transfer Profit on sale recorded by S in 2019 Remaining useful life was 4 years at the date of transfer. (0) Sales from Ptos Sales Original cost Gross profit Percentage unsold to third parties at year-end 2012 2020 S 33.000 (26,000) 7,000 60% 10% 2 (iii) Sales from Stop 2020 S Sales 9,000 Original cost (3.500) Gross profit 5.500 Percentage unsold to third parties at year-end 55 (6) Transfers of inventory and fixed assets between P and A were as follows: 2020 m Sales from P to A s Sales 6,000 Original cost 2.900 Gross profit 2.100 Percentage unsold to third parties at year-end 40% (m) Transfer of fixed assets from A to Pon 1 October 2019 Transfer price 4.600 Original cost 12,000 Less: Accumulated depreciation (9,000) Net book value at date of transfer 3,000 Profit on sale recorded by A in 2019 1.600 Remaining useful life was 2 years at the date of transfer (7) There is no change in the share capital of S and A from the date of acquisition (8) Ignore all tax effect Required: (a) Prepare the consolidation entries for the year ended 31 December 2020 with brief narratives (39 marks) (b) Prepare the equity accounting entries for the year ended 31 December 2020 with brief narratives (14 marks) (c) Prepare the Consolidated Income Statement for the year ended 31 December 2020 and the Consolidated Statement of Financial Position as at 31 December 2020 (14 marks) 3 Income Statement and Partial Statement of Changes in Equity for the year ended 31 December 2020 Dr. Cr. S $ 1.523.000 720,000 (609,000) (288,000) Total S Sales Cost of sales 432.000 Gross profit Dividend income 914,000 39,000 Operating expenses (523,000) (235,000) Profit before tax Tax expense Net profit after tax 430,000 (69,000) 361,000 197,000 (32.000) 165,000 Retained earnings. 1 January 2020 482,000 260,000 Dividends declared Retained carings, 31 December 2020 (70,000) 773.000 (45.000) 380,000 Statement of Financial Position as at 31 December 2020 P Dr. s 750,000 542,000 Cr. s Total S Fixed assets, net Intangible assets Investment in S Investment in A 38,000 620,000 20,000 Inventory 92,000 138,000 Accounts receivable Cash Total assets 35,000 168,000 1,723,000 60,000 220,000 960,000 Accounts payable Share capital Retained earnings 50,000 900,000 773,000 80,000 500,000 380,000 Total liabilities and equity 1.723,000 960.000