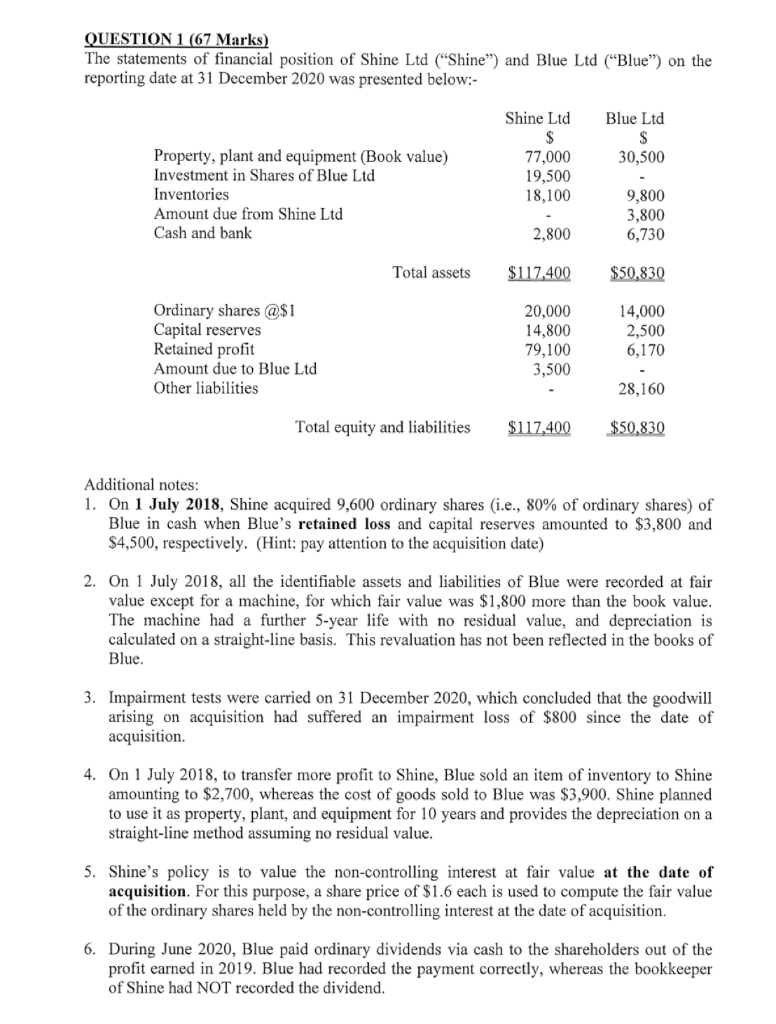

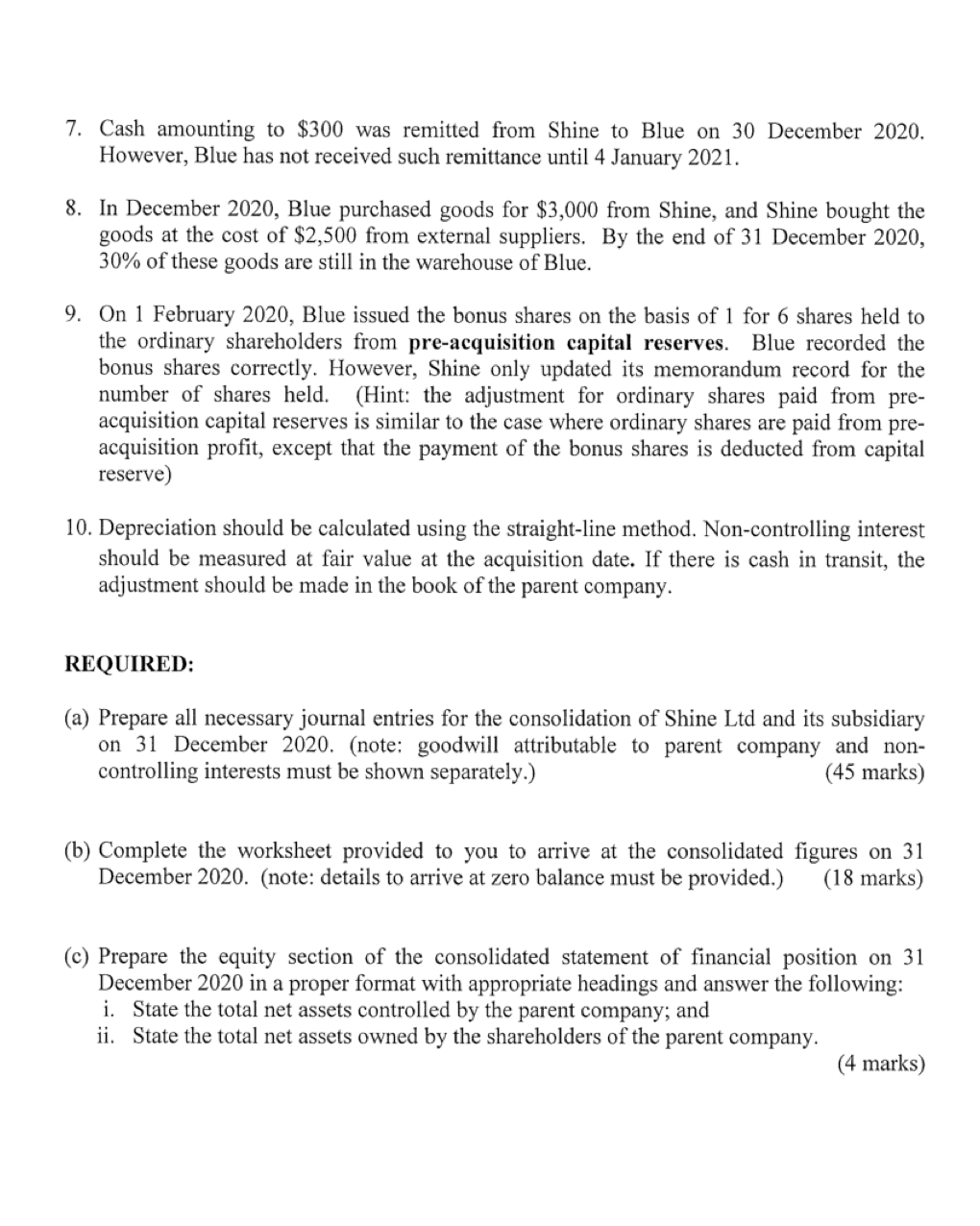

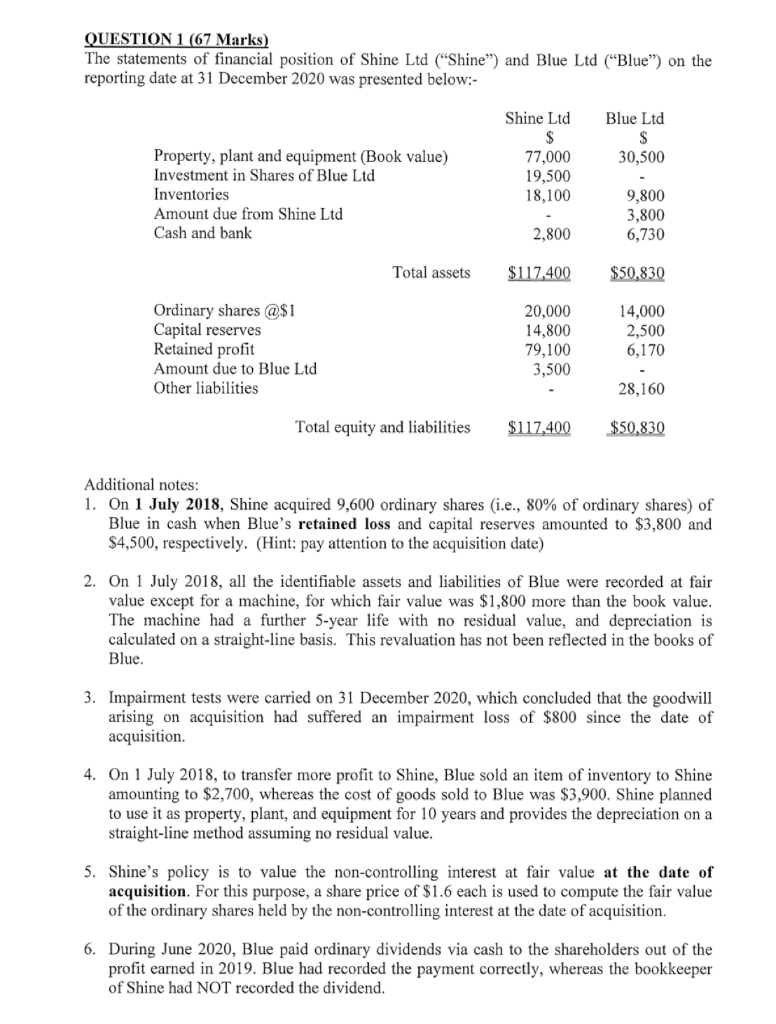

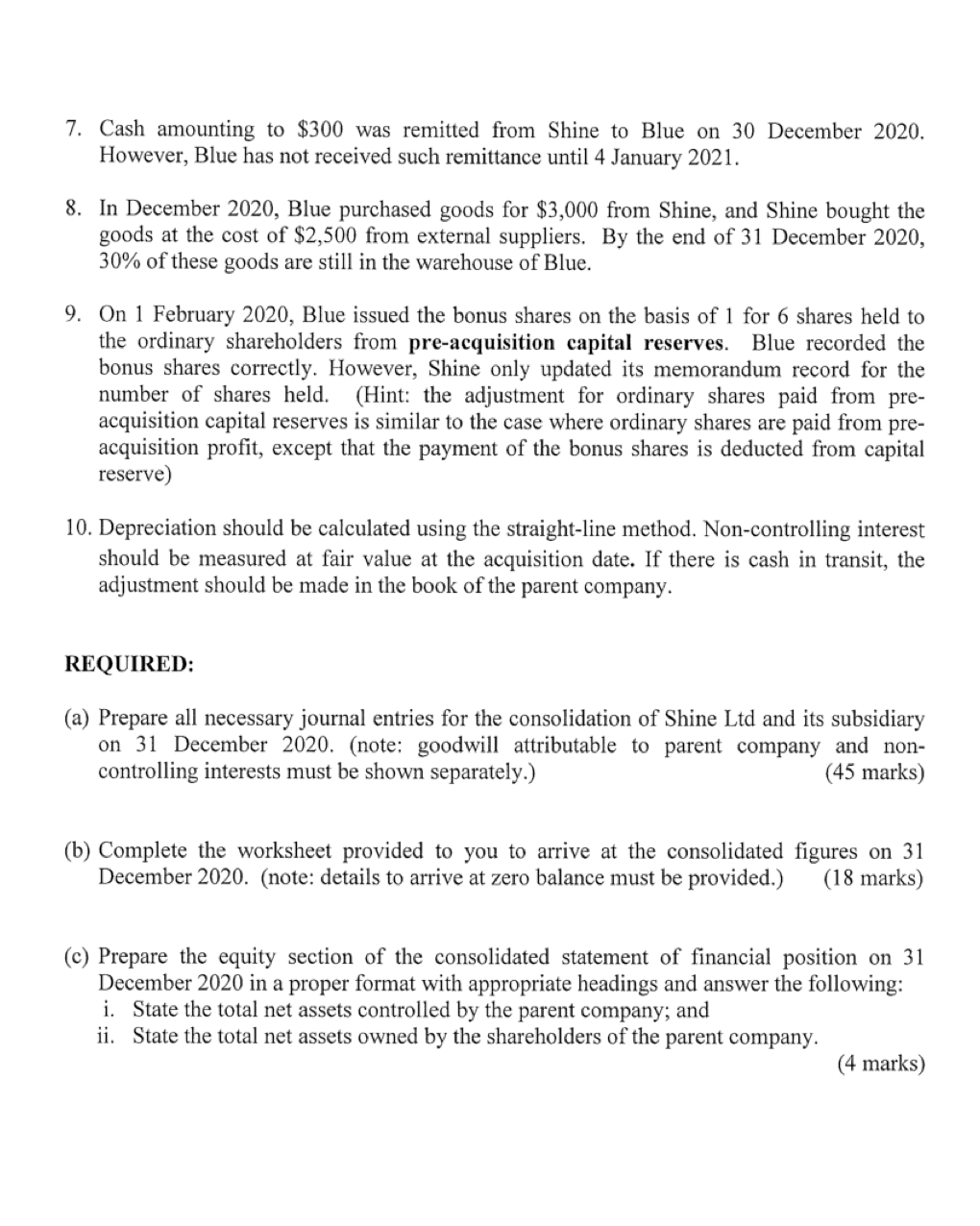

QUESTION 1 (67 Marks) The statements of financial position of Shine Ltd ("Shine") and Blue Ltd (Blue) on the reporting date at 31 December 2020 was presented below:- Shine Ltd $ 77,000 19,500 18,100 Blue Ltd $ 30,500 Property, plant and equipment (Book value) Investment in Shares of Blue Ltd Inventories Amount due from Shine Ltd Cash and bank 9,800 3,800 6,730 2,800 Total assets $117,400 $50,830 Ordinary shares @$1 Capital reserves Retained profit Amount due to Blue Ltd Other liabilities 20,000 14,800 79,100 3,500 14,000 2,500 6,170 28,160 Total equity and liabilities $117,400 $50,830 Additional notes: 1. On 1 July 2018, Shine acquired 9,600 ordinary shares i.e., 80% of ordinary shares) of Blue in cash when Blue's retained loss and capital reserves amounted to $3,800 and $4,500, respectively. (Hint: pay attention to the acquisition date) 2. On 1 July 2018, all the identifiable assets and liabilities of Blue were recorded at fair value except for a machine, for which fair value was $1,800 more than the book value. The machine had a further 5-year life with no residual value, and depreciation is calculated on a straight-line basis. This revaluation has not been reflected in the books of Blue. 3. Impairment tests were carried on 31 December 2020, which concluded that the goodwill arising on acquisition had suffered an impairment loss of $800 since the date of acquisition 4. On 1 July 2018, to transfer more profit to Shine, Blue sold an item of inventory to Shine amounting to $2,700, whereas the cost of goods sold to Blue was $3,900. Shine planned to use it as property, plant, and equipment for 10 years and provides the depreciation on a straight-line method assuming no residual value. 5. Shine's policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, a share price of $1.6 each is used to compute the fair value of the ordinary shares held by the non-controlling interest at the date of acquisition. 6. During June 2020, Blue paid ordinary dividends via cash to the shareholders out of the profit earned in 2019. Blue had recorded the payment correctly, whereas the bookkeeper of Shine had NOT recorded the dividend. 7. Cash amounting to $300 was remitted from Shine to Blue on 30 December 2020. However, Blue has not received such remittance until 4 January 2021. 8. In December 2020, Blue purchased goods for $3,000 from Shine, and Shine bought the goods at the cost of $2,500 from external suppliers. By the end of 31 December 2020, 30% of these goods are still in the warehouse of Blue. 9. On 1 February 2020, Blue issued the bonus shares on the basis of 1 for 6 shares held to the ordinary shareholders from pre-acquisition capital reserves. Blue recorded the bonus shares correctly. However, Shine only updated its memorandum record for the number of shares held. (Hint: the adjustment for ordinary shares paid from pre- acquisition capital reserves is similar to the case where ordinary shares are paid from pre- acquisition profit, except that the payment of the bonus shares is deducted from capital reserve) 10. Depreciation should be calculated using the straight-line method. Non-controlling interest should be measured at fair value at the acquisition date. If there is cash in transit, the adjustment should be made in the book of the parent company. REQUIRED: (a) Prepare all necessary journal entries for the consolidation of Shine Ltd and its subsidiary on 31 December 2020. (note: goodwill attributable to parent company and non- controlling interests must be shown separately.) (45 marks) (b) Complete the worksheet provided to you to arrive at the consolidated figures on 31 December 2020. (note: details to arrive at zero balance must be provided.) (18 marks) (c) Prepare the equity section of the consolidated statement of financial position on 31 December 2020 in a proper format with appropriate headings and answer the following: i. State the total net assets controlled by the parent company; and ii. State the total net assets owned by the shareholders of the parent company. (4 marks) QUESTION 1 (67 Marks) The statements of financial position of Shine Ltd ("Shine") and Blue Ltd (Blue) on the reporting date at 31 December 2020 was presented below:- Shine Ltd $ 77,000 19,500 18,100 Blue Ltd $ 30,500 Property, plant and equipment (Book value) Investment in Shares of Blue Ltd Inventories Amount due from Shine Ltd Cash and bank 9,800 3,800 6,730 2,800 Total assets $117,400 $50,830 Ordinary shares @$1 Capital reserves Retained profit Amount due to Blue Ltd Other liabilities 20,000 14,800 79,100 3,500 14,000 2,500 6,170 28,160 Total equity and liabilities $117,400 $50,830 Additional notes: 1. On 1 July 2018, Shine acquired 9,600 ordinary shares i.e., 80% of ordinary shares) of Blue in cash when Blue's retained loss and capital reserves amounted to $3,800 and $4,500, respectively. (Hint: pay attention to the acquisition date) 2. On 1 July 2018, all the identifiable assets and liabilities of Blue were recorded at fair value except for a machine, for which fair value was $1,800 more than the book value. The machine had a further 5-year life with no residual value, and depreciation is calculated on a straight-line basis. This revaluation has not been reflected in the books of Blue. 3. Impairment tests were carried on 31 December 2020, which concluded that the goodwill arising on acquisition had suffered an impairment loss of $800 since the date of acquisition 4. On 1 July 2018, to transfer more profit to Shine, Blue sold an item of inventory to Shine amounting to $2,700, whereas the cost of goods sold to Blue was $3,900. Shine planned to use it as property, plant, and equipment for 10 years and provides the depreciation on a straight-line method assuming no residual value. 5. Shine's policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, a share price of $1.6 each is used to compute the fair value of the ordinary shares held by the non-controlling interest at the date of acquisition. 6. During June 2020, Blue paid ordinary dividends via cash to the shareholders out of the profit earned in 2019. Blue had recorded the payment correctly, whereas the bookkeeper of Shine had NOT recorded the dividend. 7. Cash amounting to $300 was remitted from Shine to Blue on 30 December 2020. However, Blue has not received such remittance until 4 January 2021. 8. In December 2020, Blue purchased goods for $3,000 from Shine, and Shine bought the goods at the cost of $2,500 from external suppliers. By the end of 31 December 2020, 30% of these goods are still in the warehouse of Blue. 9. On 1 February 2020, Blue issued the bonus shares on the basis of 1 for 6 shares held to the ordinary shareholders from pre-acquisition capital reserves. Blue recorded the bonus shares correctly. However, Shine only updated its memorandum record for the number of shares held. (Hint: the adjustment for ordinary shares paid from pre- acquisition capital reserves is similar to the case where ordinary shares are paid from pre- acquisition profit, except that the payment of the bonus shares is deducted from capital reserve) 10. Depreciation should be calculated using the straight-line method. Non-controlling interest should be measured at fair value at the acquisition date. If there is cash in transit, the adjustment should be made in the book of the parent company. REQUIRED: (a) Prepare all necessary journal entries for the consolidation of Shine Ltd and its subsidiary on 31 December 2020. (note: goodwill attributable to parent company and non- controlling interests must be shown separately.) (45 marks) (b) Complete the worksheet provided to you to arrive at the consolidated figures on 31 December 2020. (note: details to arrive at zero balance must be provided.) (18 marks) (c) Prepare the equity section of the consolidated statement of financial position on 31 December 2020 in a proper format with appropriate headings and answer the following: i. State the total net assets controlled by the parent company; and ii. State the total net assets owned by the shareholders of the parent company. (4 marks)