Question

Question 1 (8 marks) An investor takes many long positions in futures contracts at F0 = $93 at the beginning of day 1. The initial

Question 1 (8 marks)

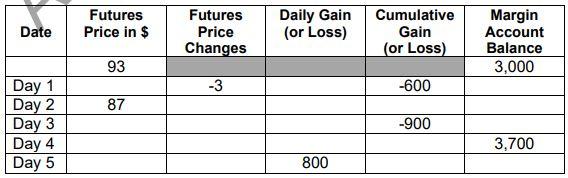

An investor takes many long positions in futures contracts at F0 = $93 at the beginning of day 1. The initial margin is $1,500 per contract and the maintenance margin is $1,000 per contract. The table below shows the futures prices at the end of each trading day. The margin account is adjusted to reflect the investors gain or loss at the end of each trading day. We assume that (1) the investor does not withdraw any balance in the margin account in excess of the initial margin and that (2) if the balance in the margin account falls below or is equal to the maintenance margin, there is a margin call and the investor must top up the margin account at the beginning of the next day. The investor closes out her position at the end of day 5.

(a) Use the table below to determine how many contracts does the investor have and the size of each contract? (2 marks)

(b) Complete the table below. (4 marks)

(c) Which futures price at the end of day 4 would give the investor an incentive to default? (2 marks)

Date Futures Price in $ Futures Price Changes Daily Gain (or Loss) Cumulative Gain (or Loss) Margin Account Balance 3,000 93 -3 -600 87 Day 1 Day 2 Day 3 Day 4 Day 5 -900 3,700 800 Date Futures Price in $ Futures Price Changes Daily Gain (or Loss) Cumulative Gain (or Loss) Margin Account Balance 3,000 93 -3 -600 87 Day 1 Day 2 Day 3 Day 4 Day 5 -900 3,700 800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started