Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (8 points) 1. Angry, Apple, and Tree were partners who shared profits and losses on a 3:2.5 basis, respectively. They were beginning to

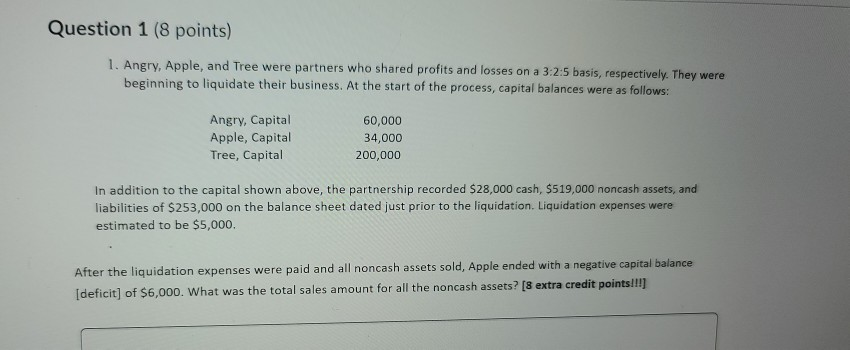

Question 1 (8 points) 1. Angry, Apple, and Tree were partners who shared profits and losses on a 3:2.5 basis, respectively. They were beginning to liquidate their business. At the start of the process, capital balances were as follows: Angry, Capital Apple, Capital Tree, Capital 60,000 34,000 200,000 In addition to the capital shown above, the partnership recorded $28,000 cash, $519,000 noncash assets, and liabilities of $253,000 on the balance sheet dated just prior to the liquidation. Liquidation expenses were estimated to be $5,000. After the liquidation expenses were paid and all noncash assets sold, Apple ended with a negative capital balance [deficit of $6,000. What was the total sales amount for all the noncash assets? [8 extra credit pointsill]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started