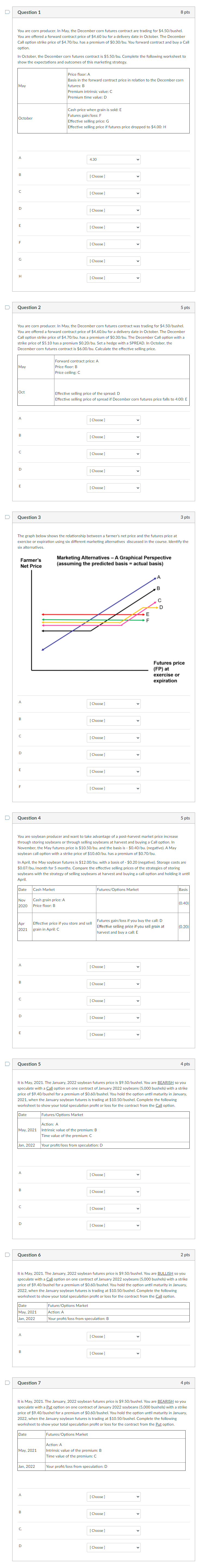

Question 1 8 pts You are corn producer. In May, the December corn futures contract are trading for $4.50/bushel. You are offered a forward contract price of $4.60 bu for a delivery date in October. The December Call option strike price of $4.70/bu. has a premium of $0.30/bu. You forward contract and buy a Call option. In October, the December corn futures contract is $5.50/bu. Complete the following worksheet to show the expectations and outcomes of this marketing strategy. May Price floor: A Basis in the forward contract price in relation to the December corn futures: B Premium intrinsic value: C Premium time value: D October Cash price when grain is sold: E Futures gain/loss: F Effective selling price: G Effective selling price if futures price dropped to $4.00: H A 4.30 B. [Choose] [Choose] D [Choose ] [Choose ] F [Choose ] G [Choose ] H [Choose ] Question 2 5 pts You are corn producer. In May, the December corn futures contract was trading for $4.50/bushel. You are offered a forward contract price of $4.60.bu for a delivery date in October. The December Call option strike price of $4.70/bu. has a premium of $0.30/bu. The December Call option with a strike price of $5.10 has a premium $0.20/bu. Set a hedge with a SPREAD. In October, the December corn futures contract is $6.00/bu. Calculate the effective selling price. May Forward contract price: A Price floor: B Price ceiling: C Oct Effective selling price of the spread: D Effective selling price of spread if December corn futures price falls to 4:00: E A [Choose ] B [ Choose ] [Choose] D [Choose ] E [Choose] Question 3 3 pts The graph below shows the relationship between a farmer's net price and the futures price at exercise or expiration using six different marketing alternatives discussed in the course. Identify the six alternatives. Farmer's Net Price Marketing Alternatives - A Graphical Perspective (assuming the predicted basis = actual basis) B F Futures price (FP) at exercise or expiration A [Choose ] B [Choose] [Choose ] D [Choose ] E [Choose ] [Choose] > Question 4 5 pts You are soybean producer and want to take advantage of a post-harvest market price increase through storing soybeans or through selling soybeans at harvest and buying a Call option. In November, the May futures price is $10.50/bu. and the basis is - $0.40/bu. (negative). A May soybean call option with a strike price of $10.60/bu. has a premium of $0.70/bu. In April, the May soybean futures is $12.00/bu. with a basis of - $0.20 (negative). Storage costs are $0.07/bu./month for 5 months. Compare the effective selling prices of the strategies of storing soybeans with the strategy of selling soybeans at harvest and buying a call option and holding it until April Date Cash Market Futures/Options Market Basis Nov 2020 Cash grain price: A Price floor: B (0.40) Apr 2021 Effective price if you store and sell grain in April: C Futures gain/loss if you buy the call: D Effective selling price if you sell grain at harvest and buy a call: E (0.20) A [Choose] B [Choose ] [Choose ] D [Choose ] E [Choose] Question 5 4 pts It is May, 2021. The January, 2022 soybean futures price is $9.50/bushel. You are BEARISH so you speculate with a Call option on one contract of January 2022 soybeans (5,000 bushels) with a strike price of $9.40/bushel for a premium of $0.60/bushel. You hold the option until maturity in January, 2021, when the January soybean futures is trading at $10.50/bushel. Complete the following worksheet to show your total speculation profit or loss for the contract from the Call option. Date Futures/Options Market May, 2021 Action: A Intrinsic value of the premium: B Time value the premium: Jan, 2022 Your profit/loss from speculation: D A [Choose ] B Choose ] [Choose D [Choose ] Question 6 2 pts It is May, 2021. The January, 2022 soybean futures price is $9.50/bushel. You are BULLISH so you speculate with a Call option on one contract of January 2022 soybeans (5,000 bushels) with a strike price of $9.40/bushel for a premium of $0.60/bushel. You hold the option until maturity in January, 2022, when the January soybean futures is trading at $10.50/bushel. Complete the following worksheet to show your total speculation profit or loss for the contract from the Call option. Date Future/Options Market Action: A May, 2021 Jan, 2022 Your profit/loss from speculation: B A [Choose] B [Choose] Question 7 4 pts It is May, 2021. The January, 2022 soybean futures price is $9.50/bushel. You are BEARISH so you speculate with a Put option on one contract of January 2022 soybeans (5,000 bushels) with a strike price of $9.40/bushel for a premium of $0.60/bushel. You hold the option until maturity in January, 2022, when the January soybean futures is trading at $10.50/bushel. Complete the following worksheet to show your total speculation profit or loss for the contract from the Put option. Date Futures/Options Market May, 2021 Action: A Intrinsic value of the premium: B Time value of the premium: C Jan, 2022 Your profit/loss from speculation: D A [Choose ] B [Choose ] C. [Choose ] D Choose] Question 1 8 pts You are corn producer. In May, the December corn futures contract are trading for $4.50/bushel. You are offered a forward contract price of $4.60 bu for a delivery date in October. The December Call option strike price of $4.70/bu. has a premium of $0.30/bu. You forward contract and buy a Call option. In October, the December corn futures contract is $5.50/bu. Complete the following worksheet to show the expectations and outcomes of this marketing strategy. May Price floor: A Basis in the forward contract price in relation to the December corn futures: B Premium intrinsic value: C Premium time value: D October Cash price when grain is sold: E Futures gain/loss: F Effective selling price: G Effective selling price if futures price dropped to $4.00: H A 4.30 B. [Choose] [Choose] D [Choose ] [Choose ] F [Choose ] G [Choose ] H [Choose ] Question 2 5 pts You are corn producer. In May, the December corn futures contract was trading for $4.50/bushel. You are offered a forward contract price of $4.60.bu for a delivery date in October. The December Call option strike price of $4.70/bu. has a premium of $0.30/bu. The December Call option with a strike price of $5.10 has a premium $0.20/bu. Set a hedge with a SPREAD. In October, the December corn futures contract is $6.00/bu. Calculate the effective selling price. May Forward contract price: A Price floor: B Price ceiling: C Oct Effective selling price of the spread: D Effective selling price of spread if December corn futures price falls to 4:00: E A [Choose ] B [ Choose ] [Choose] D [Choose ] E [Choose] Question 3 3 pts The graph below shows the relationship between a farmer's net price and the futures price at exercise or expiration using six different marketing alternatives discussed in the course. Identify the six alternatives. Farmer's Net Price Marketing Alternatives - A Graphical Perspective (assuming the predicted basis = actual basis) B F Futures price (FP) at exercise or expiration A [Choose ] B [Choose] [Choose ] D [Choose ] E [Choose ] [Choose] > Question 4 5 pts You are soybean producer and want to take advantage of a post-harvest market price increase through storing soybeans or through selling soybeans at harvest and buying a Call option. In November, the May futures price is $10.50/bu. and the basis is - $0.40/bu. (negative). A May soybean call option with a strike price of $10.60/bu. has a premium of $0.70/bu. In April, the May soybean futures is $12.00/bu. with a basis of - $0.20 (negative). Storage costs are $0.07/bu./month for 5 months. Compare the effective selling prices of the strategies of storing soybeans with the strategy of selling soybeans at harvest and buying a call option and holding it until April Date Cash Market Futures/Options Market Basis Nov 2020 Cash grain price: A Price floor: B (0.40) Apr 2021 Effective price if you store and sell grain in April: C Futures gain/loss if you buy the call: D Effective selling price if you sell grain at harvest and buy a call: E (0.20) A [Choose] B [Choose ] [Choose ] D [Choose ] E [Choose] Question 5 4 pts It is May, 2021. The January, 2022 soybean futures price is $9.50/bushel. You are BEARISH so you speculate with a Call option on one contract of January 2022 soybeans (5,000 bushels) with a strike price of $9.40/bushel for a premium of $0.60/bushel. You hold the option until maturity in January, 2021, when the January soybean futures is trading at $10.50/bushel. Complete the following worksheet to show your total speculation profit or loss for the contract from the Call option. Date Futures/Options Market May, 2021 Action: A Intrinsic value of the premium: B Time value the premium: Jan, 2022 Your profit/loss from speculation: D A [Choose ] B Choose ] [Choose D [Choose ] Question 6 2 pts It is May, 2021. The January, 2022 soybean futures price is $9.50/bushel. You are BULLISH so you speculate with a Call option on one contract of January 2022 soybeans (5,000 bushels) with a strike price of $9.40/bushel for a premium of $0.60/bushel. You hold the option until maturity in January, 2022, when the January soybean futures is trading at $10.50/bushel. Complete the following worksheet to show your total speculation profit or loss for the contract from the Call option. Date Future/Options Market Action: A May, 2021 Jan, 2022 Your profit/loss from speculation: B A [Choose] B [Choose] Question 7 4 pts It is May, 2021. The January, 2022 soybean futures price is $9.50/bushel. You are BEARISH so you speculate with a Put option on one contract of January 2022 soybeans (5,000 bushels) with a strike price of $9.40/bushel for a premium of $0.60/bushel. You hold the option until maturity in January, 2022, when the January soybean futures is trading at $10.50/bushel. Complete the following worksheet to show your total speculation profit or loss for the contract from the Put option. Date Futures/Options Market May, 2021 Action: A Intrinsic value of the premium: B Time value of the premium: C Jan, 2022 Your profit/loss from speculation: D A [Choose ] B [Choose ] C. [Choose ] D Choose]