Answered step by step

Verified Expert Solution

Question

1 Approved Answer

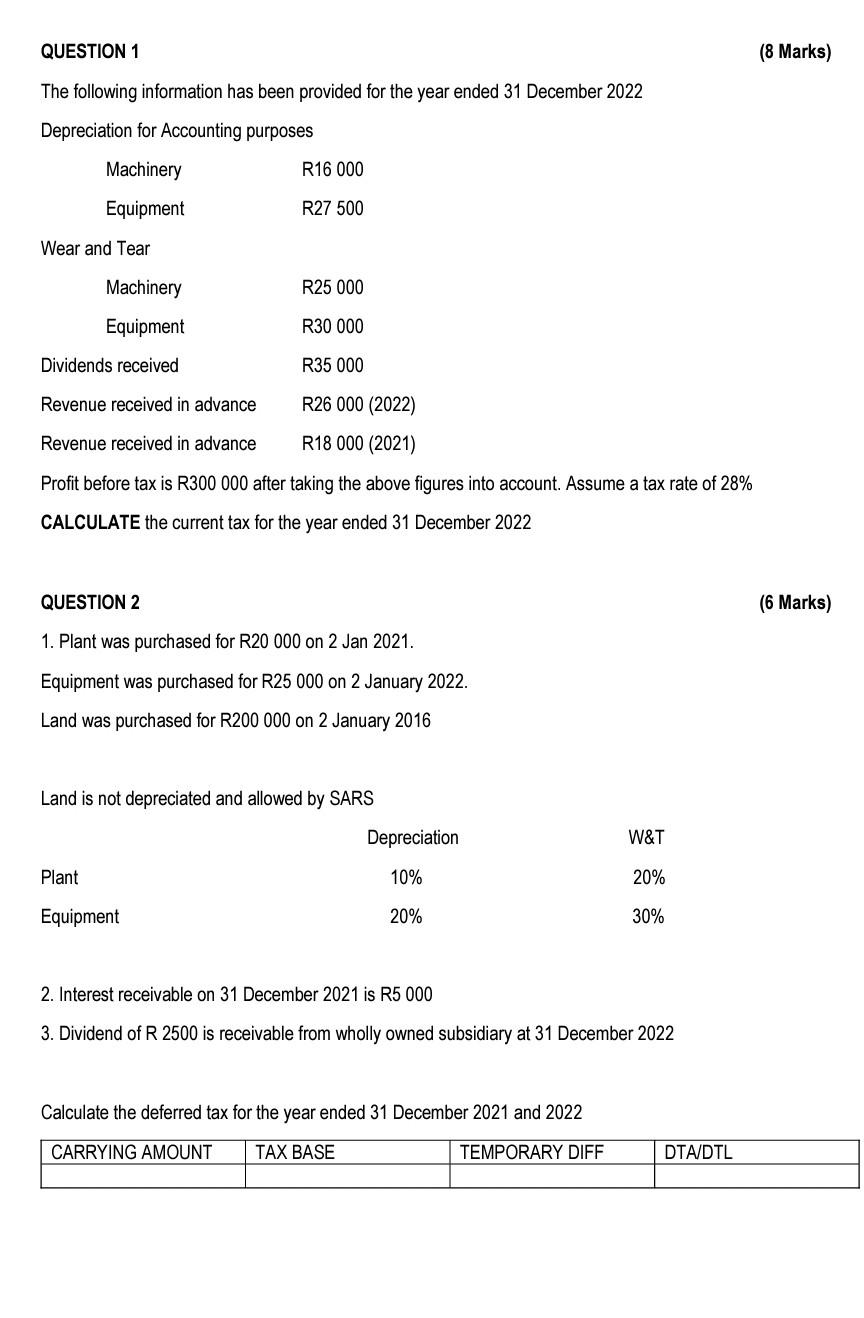

QUESTION 1 (8 The following information has been provided for the year ended 31 December 2022 Depreciation for Accounting purposes Profit before tax is R300000

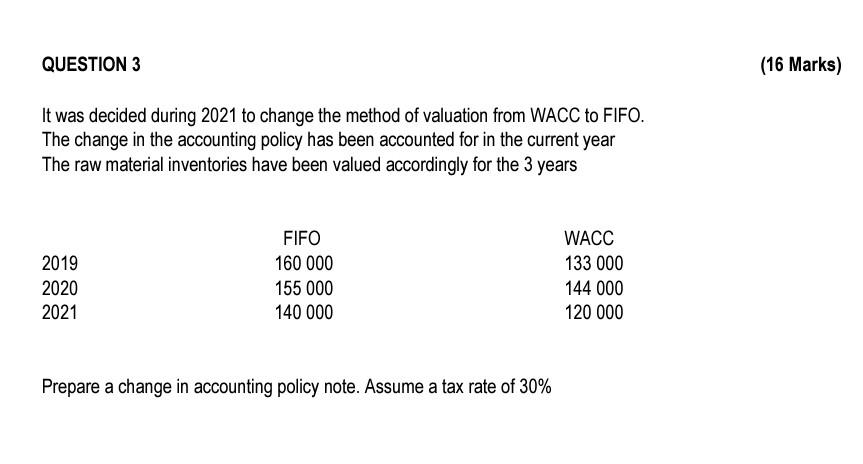

QUESTION 1 (8 The following information has been provided for the year ended 31 December 2022 Depreciation for Accounting purposes Profit before tax is R300000 after taking the above figures into account. Assume a tax rate of 28% CALCULATE the current tax for the year ended 31 December 2022 QUESTION 2 (6 1. Plant was purchased for R20 000 on 2 Jan 2021. Equipment was purchased for R25 000 on 2 January 2022. Land was purchased for R200 000 on 2 January 2016 Land is not depreciated and allowed by SARS 2. Interest receivable on 31 December 2021 is R5 000 3. Dividend of R 2500 is receivable from wholly owned subsidiary at 31 December 2022 Calculate the deferred tax for the year ended 31 December 2021 and 2022 It was decided during 2021 to change the method of valuation from WACC to FIFO. The change in the accounting policy has been accounted for in the current year The raw material inventories have been valued accordingly for the 3 years Prepare a change in accounting policy note. Assume a tax rate of 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started