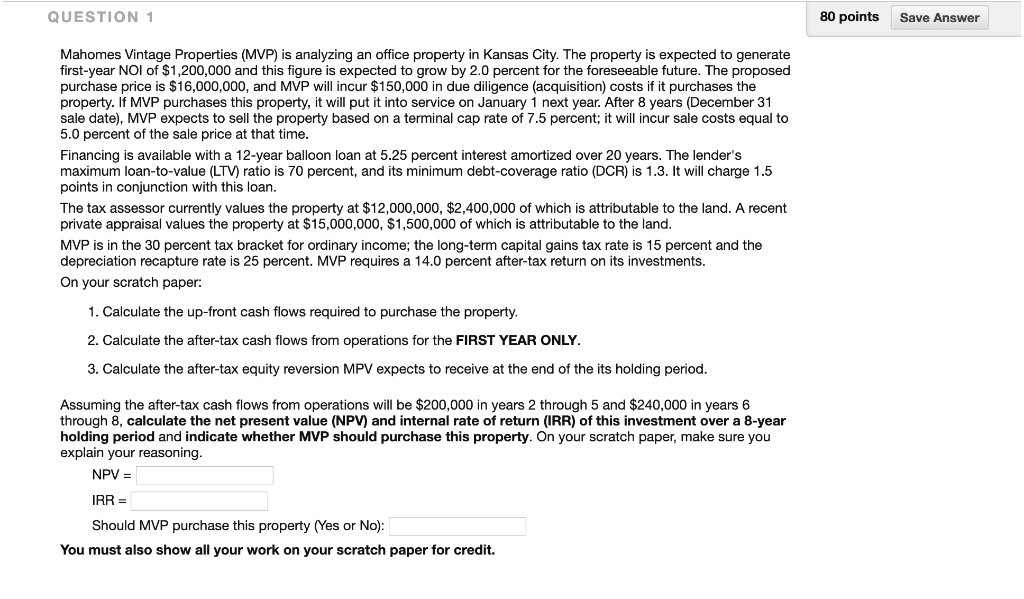

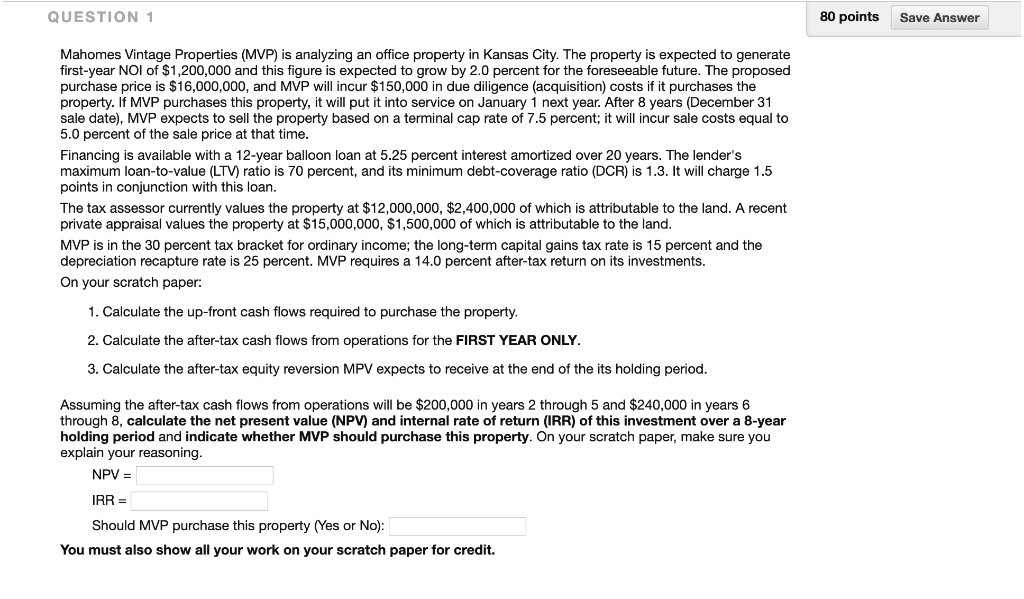

QUESTION 1 80 points Save Answer Mahomes Vintage Properties (MVP) is analyzing an office property in Kansas City. The property is expected to generate first-year NOI of $1,200,000 and this figure is expected to grow by 2.0 percent for the foreseeable future. The proposed purchase price is $16,000,000, and MVP will incur $150,000 in due diligence (acquisition) costs if it purchases the property. If MVP purchases this property, it will put it into service on January 1 next year. After 8 years (December 31 sale date), MVP expects to sell the property based on a terminal cap rate of 7.5 percent; it will incur sale costs equal to 5.0 percent of the sale price at that time. Financing is available with a 12-year balloon loan at 5.25 percent interest amortized over 20 years. The lender's maximum loan-to-value (LTV) ratio is 70 percent, and its minimum debt-coverage ratio (DCR) is 1.3. It will charge 1.5 points in conjunction with this loan. The tax assessor currently values the property at $12,000,000, $2,400,000 of which is attributable to the land. A recent private appraisal values the property at $15,000,000, $1,500,000 of which is attributable to the land. MVP is in the 30 percent tax bracket for ordinary income; the long-term capital gains tax rate is 15 percent and the depreciation recapture rate is 25 percent. MVP requires a 14.0 percent after-tax return on its investments. On your scratch paper: 1. Calculate the up-front cash flows required to purchase the property. 2. Calculate the after-tax cash flows from operations for the FIRST YEAR ONLY. 3. Calculate the after-tax equity reversion MPV expects to receive at the end of the its holding period. Assuming the after-tax cash flows from operations will be $200,000 in years 2 through 5 and $240,000 in years 6 through 8, calculate the net present value (NPV) and internal rate of return (IRR) of this investment over a 8-year holding period and indicate whether MVP should purchase this property. On your scratch paper, make sure you explain your reasoning. NPV = IRR = Should MVP purchase this property (Yes or No): You must also show all your work on your scratch paper for credit. QUESTION 1 80 points Save Answer Mahomes Vintage Properties (MVP) is analyzing an office property in Kansas City. The property is expected to generate first-year NOI of $1,200,000 and this figure is expected to grow by 2.0 percent for the foreseeable future. The proposed purchase price is $16,000,000, and MVP will incur $150,000 in due diligence (acquisition) costs if it purchases the property. If MVP purchases this property, it will put it into service on January 1 next year. After 8 years (December 31 sale date), MVP expects to sell the property based on a terminal cap rate of 7.5 percent; it will incur sale costs equal to 5.0 percent of the sale price at that time. Financing is available with a 12-year balloon loan at 5.25 percent interest amortized over 20 years. The lender's maximum loan-to-value (LTV) ratio is 70 percent, and its minimum debt-coverage ratio (DCR) is 1.3. It will charge 1.5 points in conjunction with this loan. The tax assessor currently values the property at $12,000,000, $2,400,000 of which is attributable to the land. A recent private appraisal values the property at $15,000,000, $1,500,000 of which is attributable to the land. MVP is in the 30 percent tax bracket for ordinary income; the long-term capital gains tax rate is 15 percent and the depreciation recapture rate is 25 percent. MVP requires a 14.0 percent after-tax return on its investments. On your scratch paper: 1. Calculate the up-front cash flows required to purchase the property. 2. Calculate the after-tax cash flows from operations for the FIRST YEAR ONLY. 3. Calculate the after-tax equity reversion MPV expects to receive at the end of the its holding period. Assuming the after-tax cash flows from operations will be $200,000 in years 2 through 5 and $240,000 in years 6 through 8, calculate the net present value (NPV) and internal rate of return (IRR) of this investment over a 8-year holding period and indicate whether MVP should purchase this property. On your scratch paper, make sure you explain your reasoning. NPV = IRR = Should MVP purchase this property (Yes or No): You must also show all your work on your scratch paper for credit