Question

Question #1 - (9 marks): The date is Dec 31, 2021 and you have been hired to do the accounting for a local restaurant, Chop

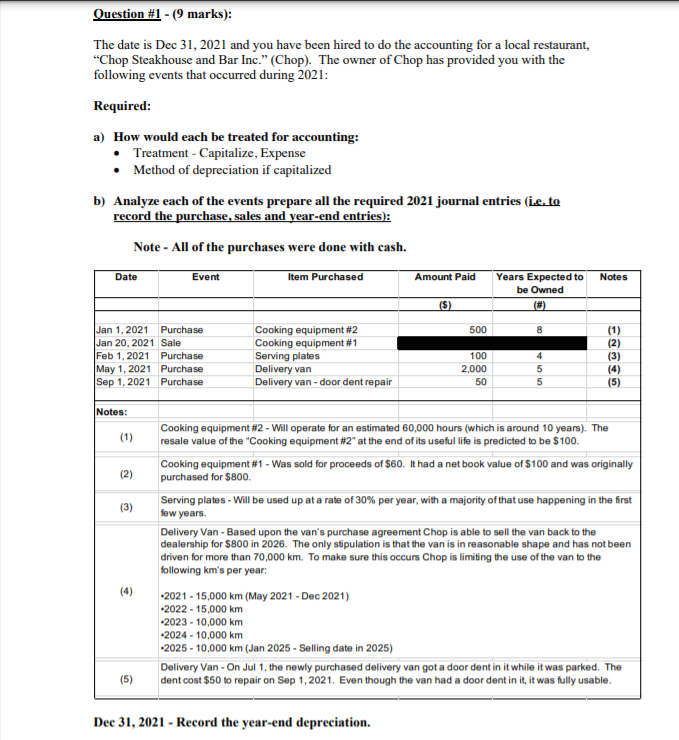

Question #1 - (9 marks): The date is Dec 31, 2021 and you have been hired to do the accounting for a local restaurant, Chop Steakhouse and Bar Inc. (Chop). The owner of Chop has provided you with the following events that occurred during 2021: Required: a) How would each be treated for accounting: Treatment - Capitalize, Expense Method of depreciation if capitalized b) Analyze each of the events prepare all the required 2021 journal entries (i.e. to record the purchase, sales and year-end entries): Note - All of the purchases were done with cash. Dec 31, 2021 - Record the year-end depreciation. Date Event Item Purchased Amount Paid Years Expected to be Owned Notes ($) (#) Jan 1, 2021 Purchase Cooking equipment #2 500 8 (1) Jan 20, 2021 Sale Cooking equipment #1 - - (2) Feb 1, 2021 Purchase Serving plates 100 4 (3) May 1, 2021 Purchase Delivery van 2,000 5 (4) Sep 1, 2021 Purchase Delivery van - door dent repair 50 5 (5) Notes: (1) (2) (3) (4) (5) Delivery Van - On Jul 1, the newly purchased delivery van got a door dent in it while it was parked. The dent cost $50 to repair on Sep 1, 2021. Even though the van had a door dent in it, it was fully usable. Cooking equipment #2 - Will operate for an estimated 60,000 hours (which is around 10 years). The resale value of the Cooking equipment #2 at the end of its useful life is predicted to be $100. Cooking equipment #1 - Was sold for proceeds of $60. It had a net book value of $100 and was originally purchased for $800. Serving plates - Will be used up at a rate of 30% per year, with a majority of that use happening in the first few years. Delivery Van - Based upon the vans purchase agreement Chop is able to sell the van back to the dealership for $800 in 2026. The only stipulation is that the van is in reasonable shape and has not been driven for more than 70,000 km. To make sure this occurs Chop is limiting the use of the van to the following kms per year: 2021 - 15,000 km (May 2021 - Dec 2021) 2022 - 15,000 km 2023 - 10,000 km 2024 - 10,000 km 2025 - 10,000 km (Jan 2025 - Selling date in 2025)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started