Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (a) (25 points) Describe the 'leverage effect' first noted in Black (1976) and explain whether a GARCH(1,1) model of stock returns can or

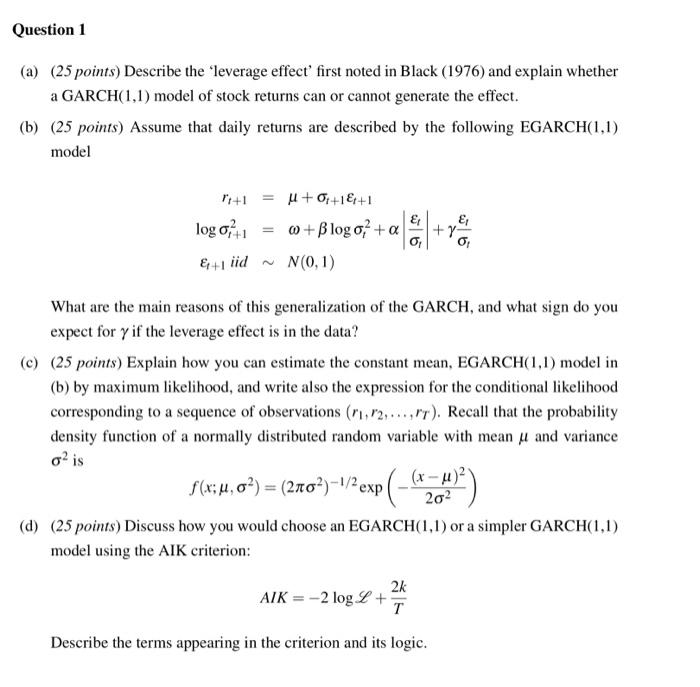

Question 1 (a) (25 points) Describe the 'leverage effect' first noted in Black (1976) and explain whether a GARCH(1,1) model of stock returns can or cannot generate the effect. (b) (25 points) Assume that daily returns are described by the following EGARCH(1,1) model ri+1 + 0r+1&++1 Et @ +B log of + a Of Et .2 log OF+1 &+1 iid N(0,1) What are the main reasons of this generalization of the GARCH, and what sign do you expect for y if the leverage effect is in the data? (c) (25 points) Explain how you can estimate the constant mean, EGARCH(1,1) model in (b) by maximum likelihood, and write also the expression for the conditional likelihood corresponding to a sequence of observations (r1, r2,...,rT). Recall that the probability rt). Recall that the probability density function of a normally distributed random variable with mean u and variance o is (x )` f(x;u, o?) = (2x0)-1/exp( -H) 202 (d) (25 points) Discuss how you would choose an EGARCH(1,1) or a simpler GARCH(1,1) model using the AIK criterion: 2k AIK = 2 logL + T Describe the terms appearing in the criterion and its logic.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started