Question

QUESTION 1 A . Bintang Jaya Bhd (BJB) is a new company operated in Bukit Batu. As of 30 November 2020, the company cash account

QUESTION 1

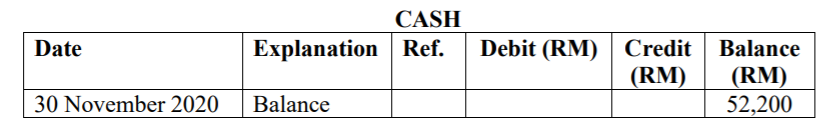

A. Bintang Jaya Bhd (BJB) is a new company operated in Bukit Batu. As of 30 November 2020, the company cash account per its general ledger showed the following balance:

The bank statement from Willy Bank Bhd (WBB) on that date showed the balance as at 30 November 2020 was RM51,860. A comparison of details between the company bank statements and cash account revealed the following facts: 1. The bank collected a note receivable of RM4,000 for BJB on 15 November 2020. 2. The 29 November 2020 receipts amount RM5,400 were deposited in a night deposit vault on 30 November 2020. These deposits were recorded by the bank in December 2020. 3. Checks outstanding on 30 November 2020 totalled RM2,420. 4. On 30 November 2020, the bank statement showed a non-sufficient fund (NSF) charge of RM1,360 for a check received by the company from Yusuff Ismail, a customer, on account.

REQUIRED: Prepare the bank reconciliation as at 30 November 2020 for BJB.

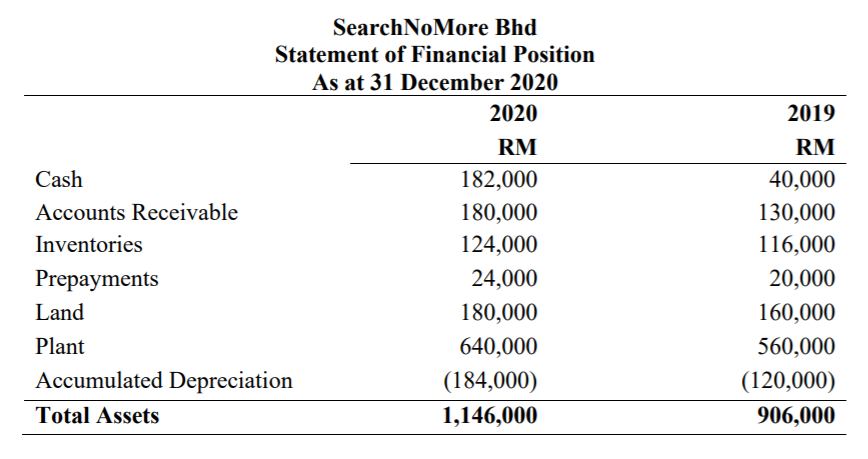

B. The comparative statements of financial position of SearchNoMore Bhd (SNMB) for the year 2020 are as follows:

Additional information:

1. There were no disposals of land or plant during the year.

2. RM60,000 of borrowing was settled through the issue of ordinary shares. There were no other repayments of borrowings.

3. Profit after tax for the year was RM240,000, interest expense was RM28,000 and income tax expense was RM82,000. There were no items of other comprehensive income.

4. RM146,000 of dividend was paid during the year.

5. Sales revenue for the year was RM600,000. There was no other revenue.

REQUIRED:

Prepare the Statement of Cash Flows for SNMB for the year ended 31 December 2020 using indirect method in accordance to MFRS 107 Statement of Cash Flows.

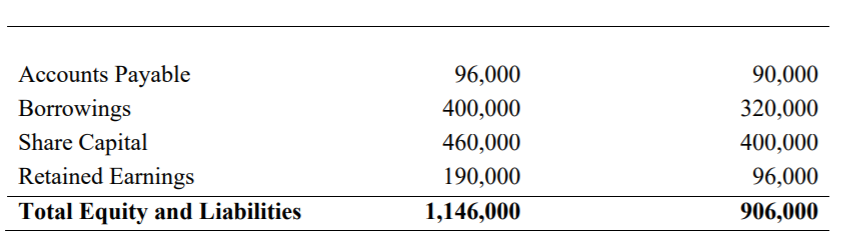

C. On 1 January 2020, Nothing Else Bhd (NEB) had Accounts Receivable RM278,000, Notes Receivable RM60,000 and Allowance for Doubtful Accounts RM26,400. NEB prepares financial statements annually at 31 December. During the year, the following selected transactions occurred:

REQUIRED:

(a) Prepare the appropriate journal entries to record the above transactions for Nothing Else Bhd. Please show your calculations.

(b) Explain the difference between accounts receivable and notes receivable.

QUESTION 2

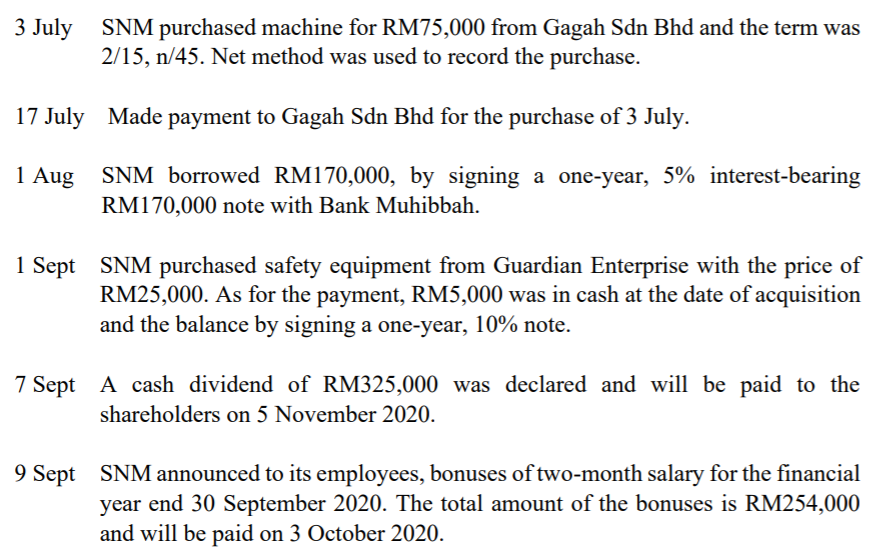

A. The transactions related to liabilities by SNM Bhd (SNM) for the year 2020 are as follows:

Additional information:

1. The financial year end for SNM Bhd is on 30 September.

2. The taxable income for the year ended 30 September 2020 is RM2,500,000 with an effective tax rate of 24%. The tax is payable to the Inland Revenue Board.

REQUIRED: (Round all figures to the nearest RM)

(a) Prepare the journal entries to record the transactions above.

(b) Prepare the necessary adjusting entries at 30 September 2020.

B. MMA Bhd (MMA) is currently promoting its new product, a handheld vacuum cleaner. To achieve its targeted sales, MMA offers its customer a redemption of a portable video player in exchange for RM20 with every purchase of the handheld vacuum cleaner. The promotions began on 1 July 2020 and ends on 31 January 2021. For the purpose of redemptions, MMA purchased 6,400 units of portable video player on June 2020 with a cost price of RM45 per unit by cash. The company also managed to sell 8,000 units of the handheld vacuum cleaner during the financial year of 31 December 2020. The sales price of the handheld vacuum cleaner is RM550 per unit. It is estimated that 80% of the customers who have bought the handheld vacuum cleaner will make the redemptions. However, as at 31 December 2020, only 70% of the customers had redeemed.

Additional information:

1. All sales were made by cash.

2. The financial year end for MMA is on 31 December.

3. Assume that each unit of handheld vacuum cleaner was sold to one customer.

REQUIRED:

(a) Prepare the journal entries that should be recorded in the year 2020.

(b) Determine the following balances and how they should be reported by MMA Bhd as at 31 December 2020:

i. Inventory of premiums

ii. Premium liability

C. SRJ Bhd (SRJ) has two divisions in two different business segments. The first division is in the medical devices manufacturing business. In July 2020, the company was presented with a lawsuit by a group of customers. The customers claimed that SRJ has provided them with inaccurate blood glucose readers that have jeopardised their health and life. Based on the evidence and advice by the companys legal team, it is possible for SRJ to lose the lawsuit. However, until the end of December 2020, the timing and amount of the lawsuit is yet to be estimated. The next proceeding shall be proceeded in the year 2021. The second division of SRJ is located in country B. The main business activity of this division is producing manual transmission for car industry. However, due to changes of consumers preference toward automatic transmission car and lack of demand on manual transmission vehicles, the company is planning to close the division to avoid future losses. The board of directors has announced the plan to close the division in a press conference held on February 2020. A detail plan has been prepared with the expected date of closure is by the end of November 2020. The estimated restructuring costs is RM45,000,000.

Additional information: The financial year end for SRJ Bhd is on 31 December.

REQUIRED: Discuss the appropriate accounting treatment for each of the above situations faced by SRJ Bhd in the financial year 2020 by referring to MFRS 137 Provisions, Contingent Liabilities and Contingent Assets.

CASH Explanation Ref. Date Debit (RM) Credit (RM) Balance (RM) 52,200 30 November 2020 Balance SearchNoMore Bhd Statement of Financial Position As at 31 December 2020 2020 2019 RM Cash Accounts Receivable Inventories Prepayments Land Plant Accumulated Depreciation Total Assets 182,000 180,000 124,000 24,000 180,000 640,000 (184,000) 1,146,000 RM 40,000 130,000 116,000 20,000 160,000 560,000 (120,000) 906,000 Accounts Payable Borrowings Share Capital Retained Earnings Total Equity and Liabilities 96,000 400,000 460,000 190,000 1,146,000 90,000 320,000 400,000 96,000 906,000 20 January 2020 NEB sold RM48,000 of merchandise to Matters Bhd (MB), terms n/30. 20 February 2020 MB forwarded a notice to NEB asking for longer credit period for the sales amounting RM48,000 in previous month. NEB agreed to extend the credit period and convert the remaining balance of account receivable to 9%, 90-day note receivable. 19 May 2020 NEB managed to collect MB note receivable in full. 25 August 2020 NEB converted a RM8,000 account receivable of Wayward Bhd (WB) to 7%, 90-day note receivable in settlement of a past due balance on account. 25 November 2020 The WB note receivable was dishonored. WB is not bankrupt and future payment is anticipated. 3 July SNM purchased machine for RM75,000 from Gagah Sdn Bhd and the term was 2/15, n/45. Net method was used to record the purchase. 17 July Made payment to Gagah Sdn Bhd for the purchase of 3 July. 1 Aug SNM borrowed RM170,000, by signing a one-year, 5% interest-bearing RM170,000 note with Bank Muhibbah. 1 Sept SNM purchased safety equipment from Guardian Enterprise with the price of RM25,000. As for the payment, RM5,000 was in cash at the date of acquisition and the balance by signing a one-year, 10% note. 7 Sept A cash dividend of RM325,000 was declared and will be paid to the shareholders on 5 November 2020. 9 Sept SNM announced to its employees, bonuses of two-month salary for the financial year end 30 September 2020. The total amount of the bonuses is RM254,000 and will be paid on 3 October 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started