Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 a. Both current ratio and quick ratio are designed to estimate the ability of a business to pay for its current liabilities. Explain

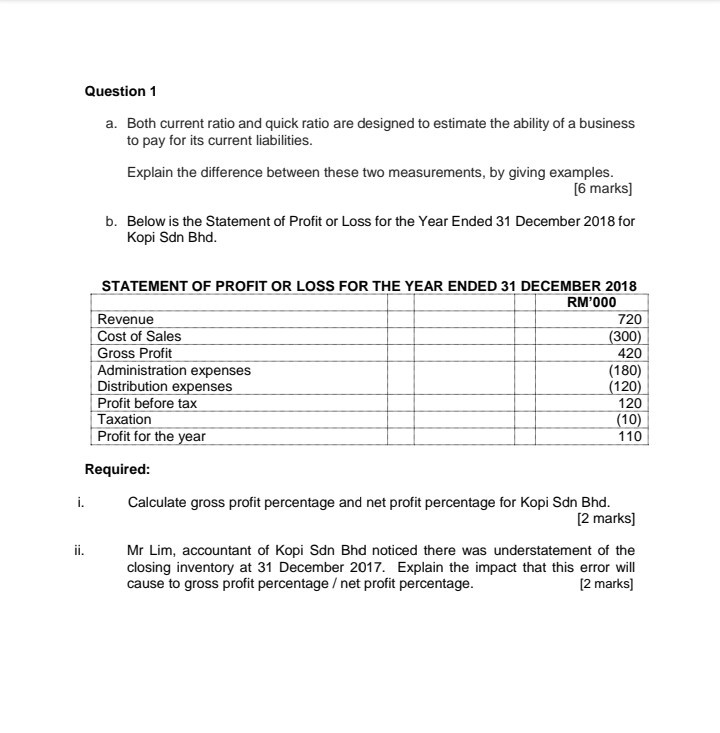

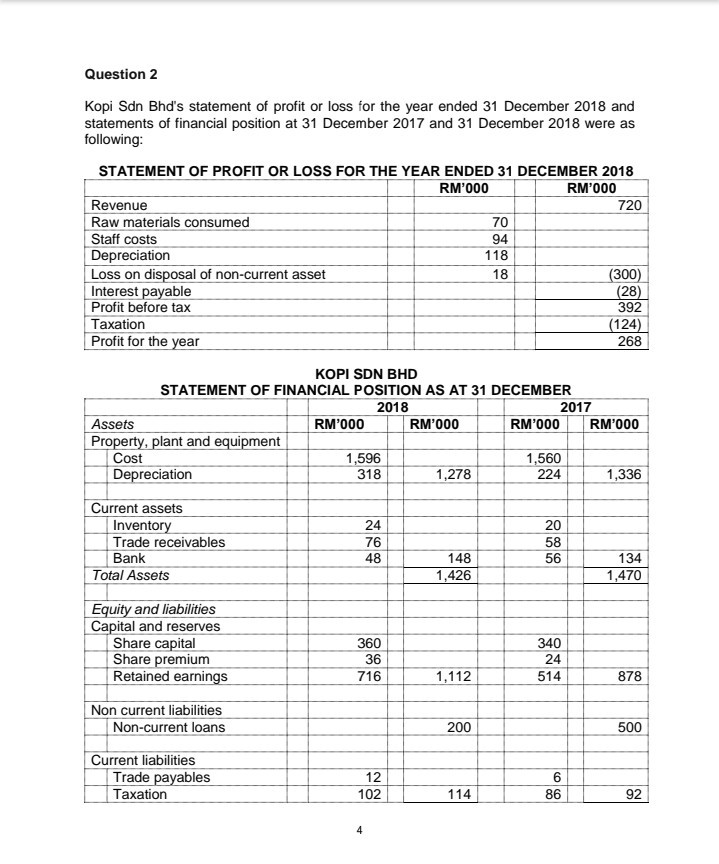

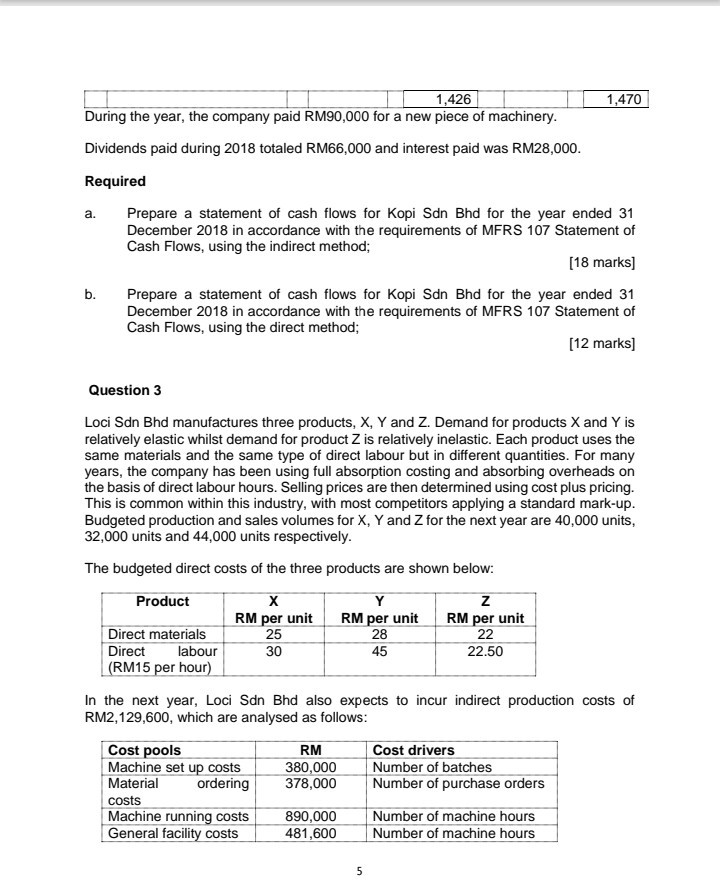

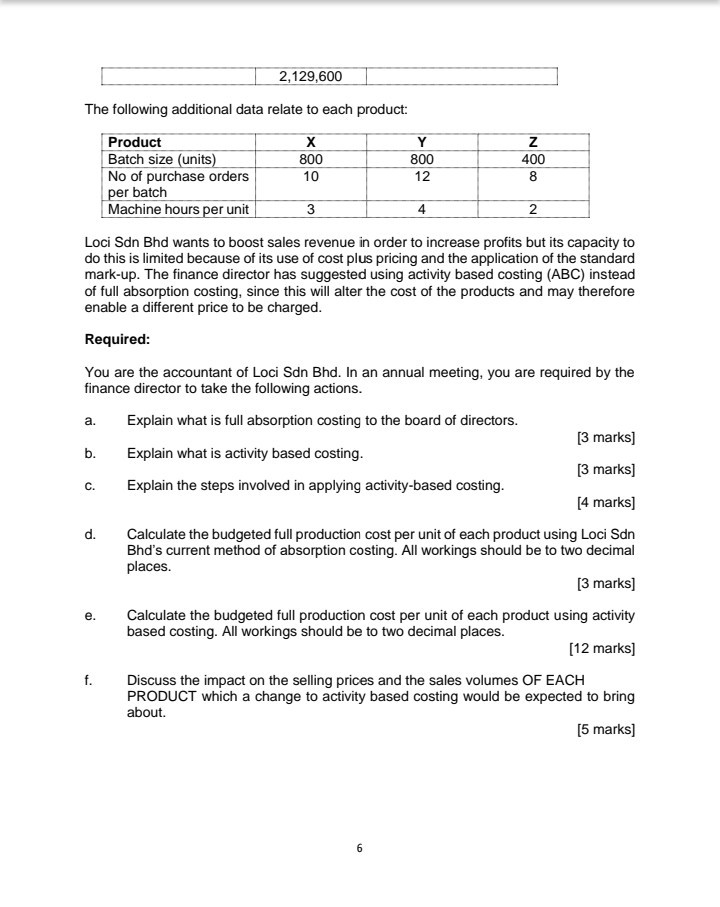

Question 1 a. Both current ratio and quick ratio are designed to estimate the ability of a business to pay for its current liabilities. Explain the difference between these two measurements, by giving examples. [6 marks) b. Below is the Statement of Profit or Loss for the Year Ended 31 December 2018 for Kopi Sdn Bhd. STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 DECEMBER 2018 RM'000 Revenue 720 Cost of Sales (300) Gross Profit 420 Administration expenses (180) Distribution expenses (120) Profit before tax 120 Taxation (10) Profit for the year 110 Required: Calculate gross profit percentage and net profit percentage for Kopi Sdn Bhd. [2 marks] Mr Lim, accountant of Kopi Sdn Bhd noticed there was understatement of the closing inventory at 31 December 2017. Explain the impact that this error will cause to gross profit percentage / net profit percentage. [2 marks] Question 2 Kopi Sdn Bhd's statement of profit or loss for the year ended 31 December 2018 and statements of financial position at 31 December 2017 and 31 December 2018 were as following: STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 DECEMBER 2018 RM'000 RM'000 Revenue 720 Raw materials consumed 70 Staff costs Depreciation Loss on disposal of non-current asset (300) Interest payable (28) Profit before tax 392 Taxation (124) Profit for the year 268 KOPI SDN BHD STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2018 2017 Assets RM'000 RM'000 RM'000 RM'000 Property, plant and equipment Cost 1,596 1,560 Depreciation 318 1.278 224 1,336 Current assets Inventory Trade receivables Bank Total Assets 48 148 1,426 134 1,470 Equity and liabilities Capital and reserves Share capital Share premium Retained earnings 360 36 716 340 24 514 1,112 878 Non current liabilities Non-current loans 200 500 Current liabilities Trade payables Taxation 114 86 1,470 1,426 During the year, the company paid RM90,000 for a new piece of machinery. Dividends paid during 2018 totaled RM66,000 and interest paid was RM28,000. Required a. Prepare a statement of cash flows for Kopi Sdn Bhd for the year ended 31 December 2018 in accordance with the requirements of MERS 107 Statement of Cash Flows, using the indirect method; [18 marks) b. Prepare a statement of cash flows for Kopi Sdn Bhd for the year ended 31 December 2018 in accordance with the requirements of MFRS 107 Statement of Cash Flows, using the direct method; (12 marks] Question 3 Loci Sdn Bhd manufactures three products, X, Y and Z. Demand for products X and Y is relatively elastic whilst demand for product Z is relatively inelastic. Each product uses the same materials and the same type of direct labour but in different quantities. For many years, the company has been using full absorption costing and absorbing overheads on the basis of direct labour hours. Selling prices are then determined using cost plus pricing. This is common within this industry, with most competitors applying a standard mark-up. Budgeted production and sales volumes for X, Y and Z for the next year are 40,000 units, 32,000 units and 44,000 units respectively. The budgeted direct costs of the three products are shown below: Product RM per unit RM per unit 28 Direct materials Direct labour (RM15 per hour) RM per unit 22 22.50 30 45 In the next year, Loci Sdn Bhd also expects to incur indirect production costs of RM2,129,600, which are analysed as follows: RM 380,000 378,000 Cost drivers Number of batches Number of purchase orders Cost pools Machine set up costs Material ordering costs Machine running costs General facility costs 890,000 481,600 Number of machine hours Number of machine hours 2,129,600 The following additional data relate to each product: 800 Product Batch size (units) No of purchase orders per batch Machine hours per unit 800 10 12 NEN Loci Sdn Bhd wants to boost sales revenue in order to increase profits but its capacity to do this is limited because of its use of cost plus pricing and the application of the standard mark-up. The finance director has suggested using activity based costing (ABC) instead of full absorption costing, since this will alter the cost of the products and may therefore enable a different price to be charged. Required: You are the accountant of Loci Sdn Bhd. In an annual meeting, you are required by the finance director to take the following actions. a. Explain what is full absorption costing to the board of directors. b. Explain what is activity based costing. [3 marks] [3 marks) Explain the steps involved in applying activity-based costing. [4 marks] d. Calculate the budgeted full production cost per unit of each product using Loci Sdn Bhd's current method of absorption costing. All workings should be to two decimal places. [3 marks] e. Calculate the budgeted full production cost per unit of each product using activity based costing. All workings should be to two decimal places. (12 marks] Discuss the impact on the selling prices and the sales volumes OF EACH PRODUCT which a change to activity based costing would be expected to bring about. (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started