Answered step by step

Verified Expert Solution

Question

1 Approved Answer

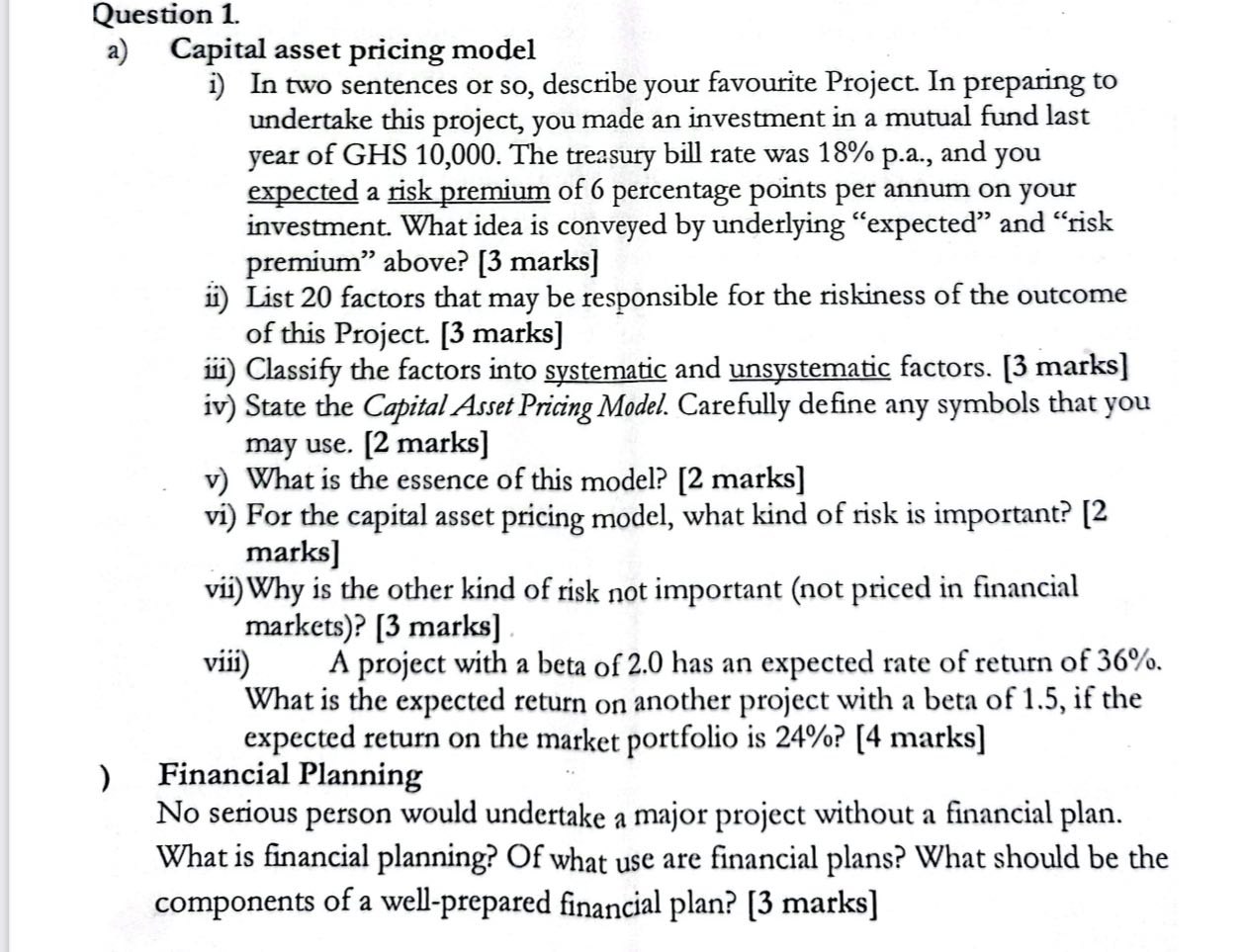

Question 1 . a ) Capital asset pricing model i ) In two sentences or so , describe your favourite Project. In preparing to undertake

Question

a Capital asset pricing model

i In two sentences or so describe your favourite Project. In preparing to

undertake this project, you made an investment in a mutual fund last

year of GHS The treasury bill rate was pa and you

expected a risk premium of percentage points per annum on your

investment. What idea is conveyed by underlying "expected" and "risk

premium" above? marks

ii List factors that may be responsible for the riskiness of the outcome

of this Project. marks

iii Classify the factors into systematic and unsystematic factors. marks

iv State the Capital Asset Pricing Model. Carefully define any symbols that you

may use. marks

v What is the essence of this model? marks

vi For the capital asset pricing model, what kind of risk is important?

marks

vii Why is the other kind of risk not important not priced in financial

markets marks

viii A project with a beta of has an expected rate of return of

What is the expected return on another project with a beta of if the

expected return on the market portfolio is marks

Financial Planning

No serious person would undertake a major project without a financial plan.

What is financial planning? Of what use are financial plans? What should be the

components of a wellprepared financial plan? marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started