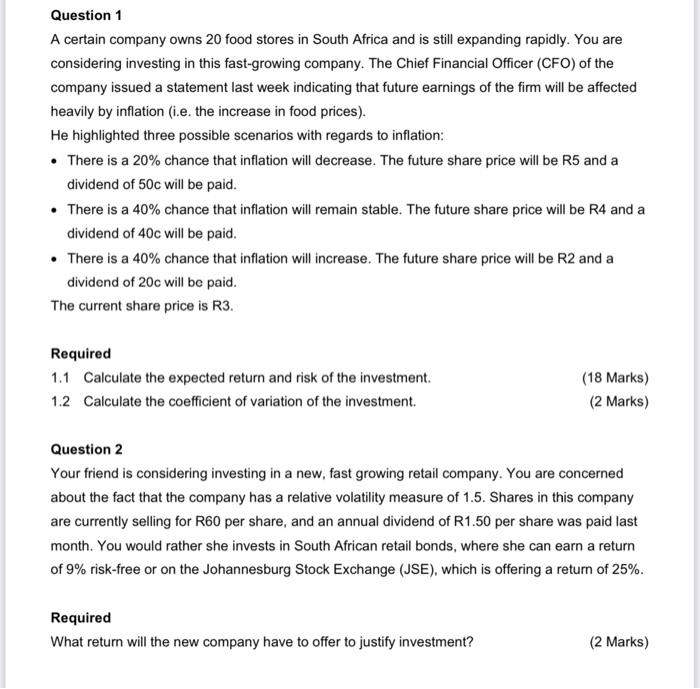

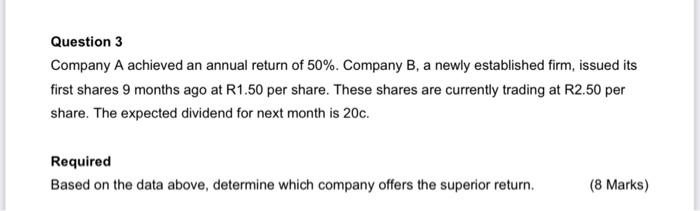

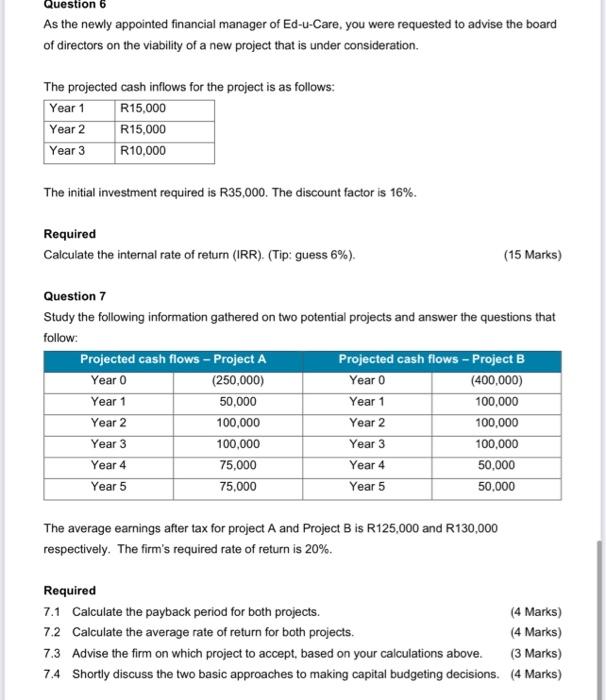

Question 1 A certain company owns 20 food stores in South Africa and is still expanding rapidly. You are considering investing in this fast-growing company. The Chief Financial Officer (CFO) of the company issued a statement last week indicating that future earnings of the firm will be affected heavily by inflation (i.e. the increase in food prices). He highlighted three possible scenarios with regards to inflation: There is a 20% chance that inflation will decrease. The future share price will be R5 and a dividend of 50c will be paid. There is a 40% chance that inflation will remain stable. The future share price will be R4 and a dividend of 40c will be paid. There is a 40% chance that inflation will increase. The future share price will be R2 and a dividend of 20c will be paid. The current share price is R3. Required 1.1 Calculate the expected return and risk of the investment. 1.2 Calculate the coefficient of variation of the investment. (18 Marks) (2 Marks) Question 2 Your friend is considering investing in a new, fast growing retail company. You are concerned about the fact that the company has a relative volatility measure of 1.5. Shares in this company are currently selling for R60 per share, and an annual dividend of R1.50 per share was paid last month. You would rather she invests in South African retail bonds, where she can earn a return of 9% risk-free or on the Johannesburg Stock Exchange (JSE), which is offering a return of 25%. Required What return will the new company have to offer to justify investment? (2 Marks) Question 3 Company A achieved an annual return of 50%. Company B, a newly established firm, issued its first shares 9 months ago at R1.50 per share. These shares are currently trading at R2.50 per share. The expected dividend for next month is 20c. Required Based on the data above, determine which company offers the superior return. (8 Marks) Question 6 As the newly appointed financial manager of Ed-u-Care, you were requested to advise the board of directors on the viability of a new project that is under consideration. The projected cash inflows for the project is as follows: Year 1 R15,000 Year 2 R15,000 Year 3 R10,000 The initial investment required is R35,000. The discount factor is 16%. Required Calculate the internal rate of return (IRR). (Tip: guess 6%). Question 7 Study the following information gathered on two potential projects and answer the questions that follow: Projected cash flows - Project A Year 0 (250,000) Year 1 50,000 Year 2 100,000 Year 3 Year 4 Year 5 100,000 75,000 75,000 (15 Marks) Projected cash flows - Project B Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 (400,000) 100,000 100,000 100,000 50,000 50,000 The average earnings after tax for project A and Project B is R125,000 and R130,000 respectively. The firm's required rate of return is 20%. Required 7.1 Calculate the payback period for both projects. 7.2 Calculate the average rate of return for both projects. 7.3 Advise the firm on which project to accept, based on your calculations above. 7.4 Shortly discuss the two basic approaches to making capital budgeting decisions. (4 Marks) (4 Marks) (3 Marks) (4 Marks) Question 4 You are the financial manager of a small retail firm. You are tasked with evaluating two potential loans from two different banks. Bank A offers a nominal annual interest rate of 15% compounded daily, while Bank B offers a nominal annual interest rate of 10% compounded semi-annually. Required Evaluate the two options in terms of the effective interest rate. Question 5 A firm is considering investing in one of two projects, Project A or Project B. The projected cash inflows for the two projects are as follows: Project A R50,000 R30,000 Year 1 Year 2 Project B Year 1 Year 2 The initial investments required for Project A and Project B are R100,000 and R50,000 respectively. The discount factor is 5%. R25,000 R45,000 (5 Marks) Required 5.1 Calculate the net present value (NPV) for Project A. (4 Marks) (4 Marks) 5.2 Calculate the net present value (NPV) for Project B. 5.3 Advice the firm on which project to accept and which project to reject, based on your NPV calculations. 5.4 Calculate the profitability index (PI) for Project B. 5.5 Advise the firm on whether to accept Project B, based on your PI calculations. (2 Marks) (3 Marks) (2 Marks)