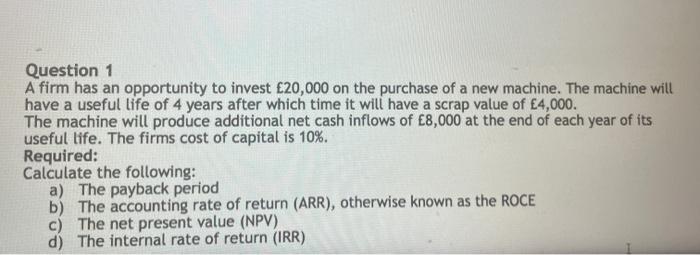

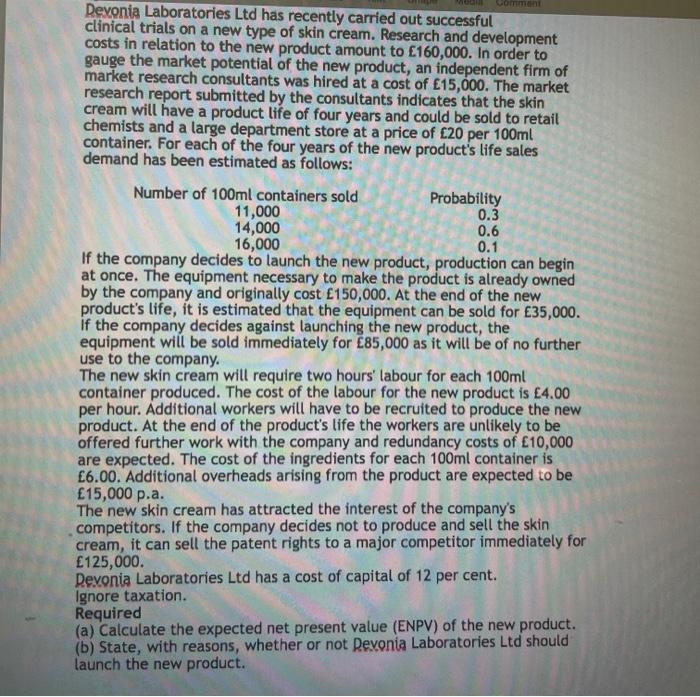

Question 1 A firm has an opportunity to invest 20,000 on the purchase of a new machine. The machine will have a useful life of 4 years after which time it will have a scrap value of 4,000. The machine will produce additional net cash inflows of 8,000 at the end of each year of its useful life. The firms cost of capital is 10%. Required: Calculate the following: a) The payback period b) The accounting rate of return (ARR), otherwise known as the ROCE c) The net present value (NPV) d) The internal rate of return (IRR) Devonia Laboratories Ltd has recently carried out successful clinical trials on a new type of skin cream. Research and development costs in relation to the new product amount to 160,000. In order to gauge the market potential of the new product, an independent firm of market research consultants was hired at a cost of 15,000. The market research report submitted by the consultants indicates that the skin cream will have a product life of four years and could be sold to retail chemists and a large department store at a price of 20 per 100ml container. For each of the four years of the new product's life sales demand has been estimated as follows: Number of 100ml containers sold Probability 11,000 0.3 14,000 0.6 16,000 0.1 If the company decides to launch the new product, production can begin at once. The equipment necessary to make the product is already owned by the company and originally cost 150,000. At the end of the new product's life, it is estimated that the equipment can be sold for 35,000. if the company decides against launching the new product, the equipment will be sold immediately for 85,000 as it will be of no further use to the company. The new skin cream will require two hours' labour for each 100ml container produced. The cost of the labour for the new product is 4.00 per hour. Additional workers will have to be recruited to produce the new product. At the end of the product's life the workers are unlikely to be offered further work with the company and redundancy costs of 10,000 are expected. The cost of the ingredients for each 100ml container is 6.00. Additional overheads arising from the product are expected to be 15,000 p.a. The new skin cream has attracted the interest of the company's competitors. If the company decides not to produce and sell the skin cream, it can sell the patent rights to a major competitor immediately for 125,000 Devonia Laboratories Ltd has a cost of capital of 12 per cent. Ignore taxation. Required (a) Calculate the expected net present value (ENPV) of the new product. (b) State, with reasons, whether or not Revonia Laboratories Ltd should launch the new product