Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1: (a) Mention three differences between a Forward and future contract. (b) Differentiate between price and value of a forward contract QUESTION 2:

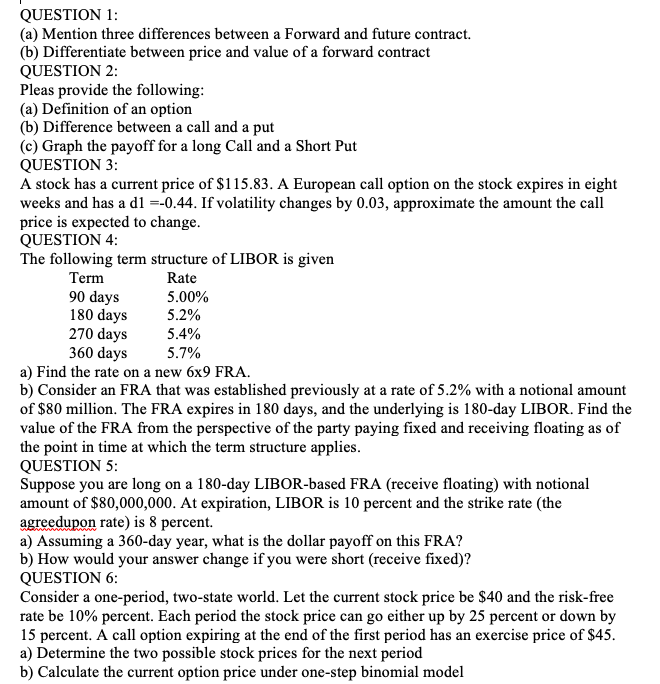

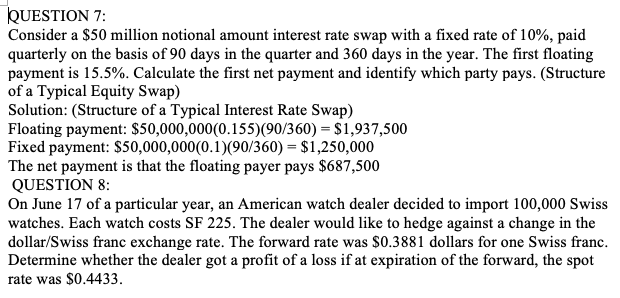

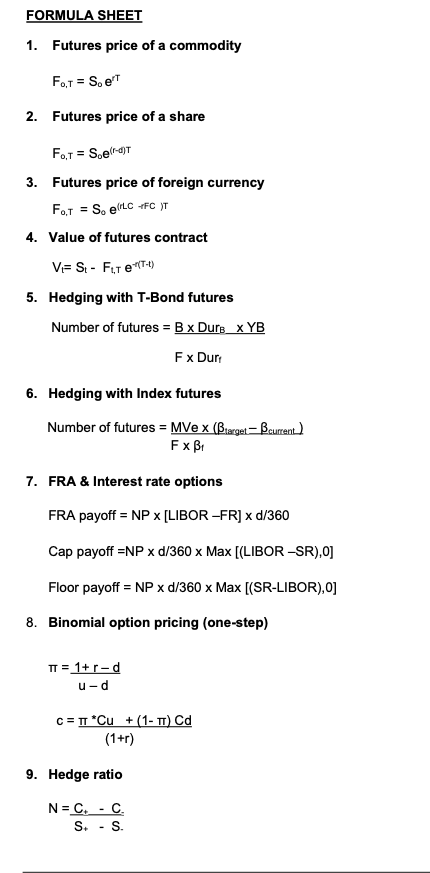

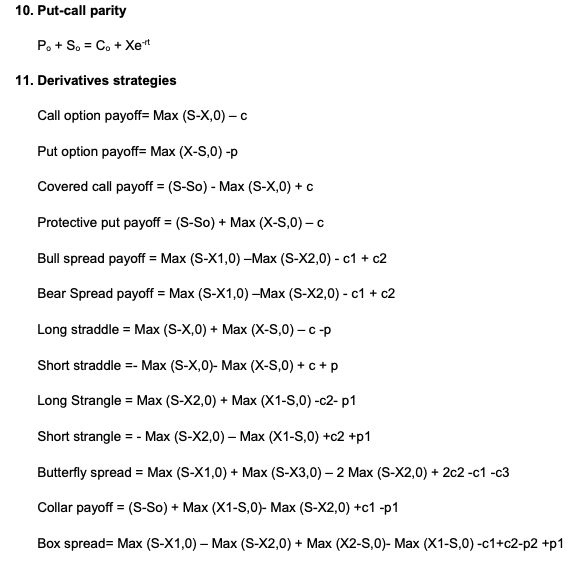

QUESTION 1: (a) Mention three differences between a Forward and future contract. (b) Differentiate between price and value of a forward contract QUESTION 2: Pleas provide the following: (a) Definition of an option (b) Difference between a call and a put (c) Graph the payoff for a long Call and a Short Put QUESTION 3: A stock has a current price of $115.83. A European call option on the stock expires in eight weeks and has a d1=-0.44. If volatility changes by 0.03, approximate the amount the call price is expected to change. QUESTION 4: The following term structure of LIBOR is given Term Rate 90 days 5.00% 180 days 5.2% 270 days 5.4% 360 days 5.7% a) Find the rate on a new 6x9 FRA. b) Consider an FRA that was established previously at a rate of 5.2% with a notional amount of $80 million. The FRA expires in 180 days, and the underlying is 180-day LIBOR. Find the value of the FRA from the perspective of the party paying fixed and receiving floating as of the point in time at which the term structure applies. QUESTION 5: Suppose you are long on a 180-day LIBOR-based FRA (receive floating) with notional amount of $80,000,000. At expiration, LIBOR is 10 percent and the strike rate (the agreedupon rate) is 8 percent. a) Assuming a 360-day year, what is the dollar payoff on this FRA? b) How would your answer change if you were short (receive fixed)? QUESTION 6: Consider a one-period, two-state world. Let the current stock price be $40 and the risk-free rate be 10% percent. Each period the stock price can go either up by 25 percent or down by 15 percent. A call option expiring at the end of the first period has an exercise price of $45. a) Determine the two possible stock prices for the next period b) Calculate the current option price under one-step binomial model QUESTION 7: Consider a $50 million notional amount interest rate swap with a fixed rate of 10%, paid quarterly on the basis of 90 days in the quarter and 360 days in the year. The first floating payment is 15.5%. Calculate the first net payment and identify which party pays. (Structure of a Typical Equity Swap) Solution: (Structure of a Typical Interest Rate Swap) Floating payment: $50,000,000(0.155) (90/360) = $1,937,500 Fixed payment: $50,000,000 (0.1) (90/360) = $1,250,000 The net payment is that the floating payer pays $687,500 QUESTION 8: On June 17 of a particular year, an American watch dealer decided to import 100,000 Swiss watches. Each watch costs SF 225. The dealer would like to hedge against a change in the dollar/Swiss franc exchange rate. The forward rate was $0.3881 dollars for one Swiss franc. Determine whether the dealer got a profit of a loss if at expiration of the forward, the spot rate was $0.4433. FORMULA SHEET 1. Futures price of a commodity FoT = So erT 2. Futures price of a share Fo,T = Soer-d)T 3. Futures price of foreign currency FoT So erLC +FC )T = 4. Value of futures contract V= St - FLT e*(T-t) 5. Hedging with T-Bond futures Number of futures = B x DurB x YB Fx Durr 6. Hedging with Index futures Number of futures = MVex (target-current) Fx r 7. FRA & Interest rate options FRA payoff = NP x [LIBOR -FR] x d/360 Cap payoff =NP x d/360 x Max [(LIBOR-SR),0] Floor payoff = NP x d/360 x Max [(SR-LIBOR), 0] 8. Binomial option pricing (one-step) T=1+r-d u-d = *Cu + (1-) Cd (1+r) 9. Hedge ratio N = C. - C. S+ - S. 10. Put-call parity Po + So = Co + Xe 11. Derivatives strategies Call option payoff= Max (S-X,0) - c Put option payoff= Max (X-S,0) -p Covered call payoff = (S-So) - Max (S-X,0) + c Protective put payoff = (S-So) + Max (X-S,0) - c Bull spread payoff = Max (S-X1,0) -Max (S-X2,0) - c1 + c2 Bear Spread payoff = Max (S-X1,0) -Max (S-X2,0) - c1 + c2 Long straddle = Max (S-X,0) + Max (X-S,0) -c -p Short straddle-Max (S-X,0)- Max (X-S,0) + c + p Long Strangle Max (S-X2,0) + Max (X1-S,0)-c2-p1 Short strangle = -Max (S-X2,0) - Max (X1-S,0)+c2+p1 Butterfly spread = Max (S-X1,0) + Max (S-X3,0) - 2 Max (S-X2,0) + 2c2-c1 -c3 Collar payoff = (S-So) + Max (X1-S,0)- Max (S-X2,0) +c1-p1 Box spread= Max (S-X1,0) - Max (S-X2,0) + Max (X2-S,0)- Max (X1-S,0)-c1+c2-p2 +p1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started