Question: Question 1 a . NRG Energy, Inc. ( NRG ) is an energy company with a market debt - equity ratio of 2 . Suppose

Question

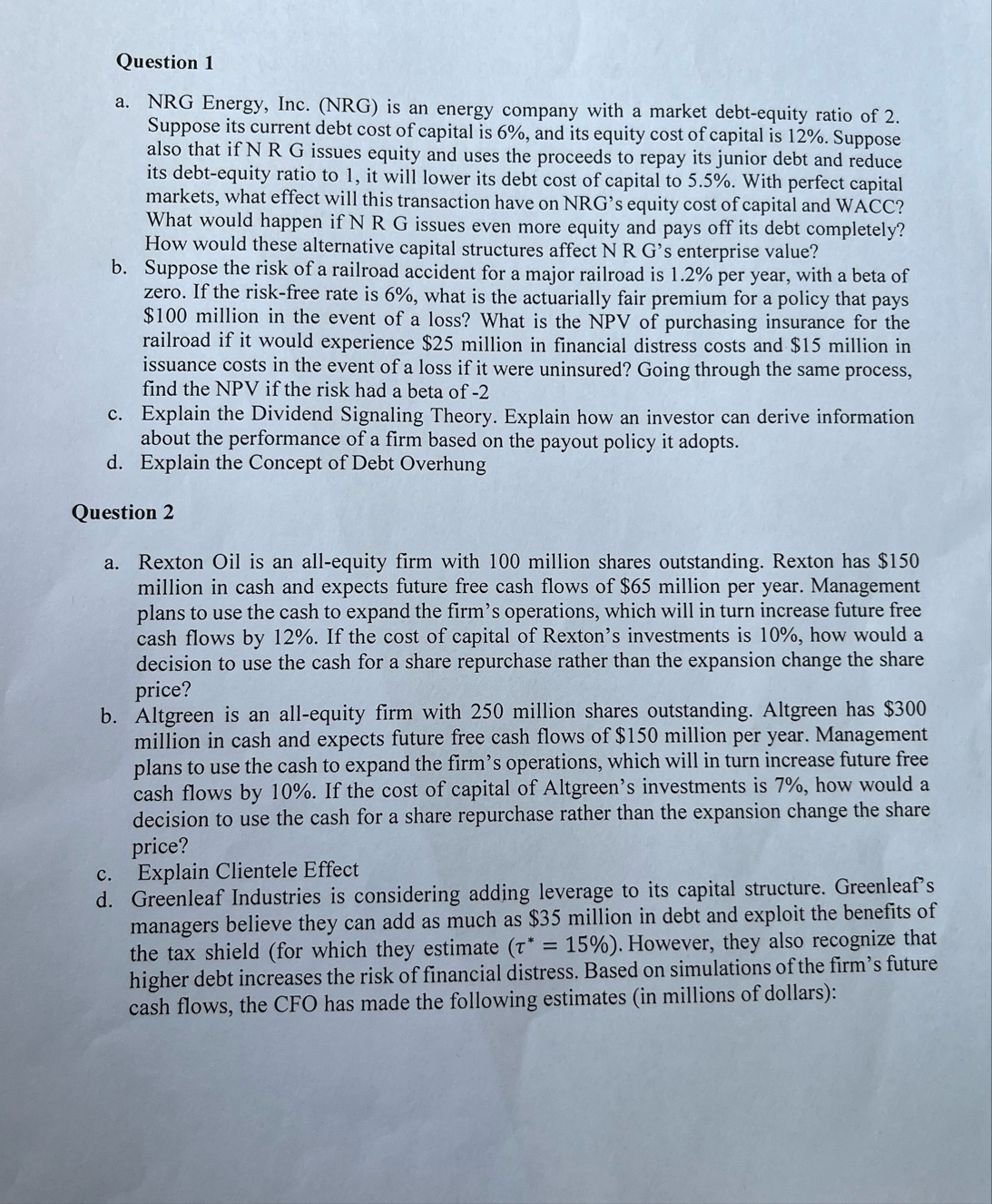

a NRG Energy, Inc. NRG is an energy company with a market debtequity ratio of Suppose its current debt cost of capital is and its equity cost of capital is Suppose also that if N R G issues equity and uses the proceeds to repay its junior debt and reduce its debtequity ratio to it will lower its debt cost of capital to With perfect capital markets, what effect will this transaction have on NRGs equity cost of capital and WACC? What would happen if N R G issues even more equity and pays off its debt completely? How would these alternative capital structures affect N R Gs enterprise value?

b Suppose the risk of a railroad accident for a major railroad is per year, with a beta of zero. If the riskfree rate is what is the actuarially fair premium for a policy that pays $ million in the event of a loss? What is the NPV of purchasing insurance for the railroad if it would experience $ million in financial distress costs and $ million in issuance costs in the event of a loss if it were uninsured? Going through the same process, find the NPV if the risk had a beta of

c Explain the Dividend Signaling Theory. Explain how an investor can derive information about the performance of a firm based on the payout policy it adopts.

d Explain the Concept of Debt Overhung

Question

a Rexton Oil is an allequity firm with million shares outstanding. Rexton has $ million in cash and expects future free cash flows of $ million per year. Management plans to use the cash to expand the firm's operations, which will in turn increase future free cash flows by If the cost of capital of Rexton's investments is how would a decision to use the cash for a share repurchase rather than the expansion change the share price?

b Altgreen is an allequity firm with million shares outstanding. Altgreen has $ million in cash and expects future free cash flows of $ million per year. Management plans to use the cash to expand the firm's operations, which will in turn increase future free cash flows by If the cost of capital of Altgreen's investments is how would a decision to use the cash for a share repurchase rather than the expansion change the share price?

c Explain Clientele Effect

d Greenleaf Industries is considering adding leverage to its capital structure. Greenleaf's managers believe they can add as much as $ million in debt and exploit the benefits of the tax shield for which they estimate However, they also recognize that higher debt increases the risk of financial distress. Based on simulations of the firm's future cash flows, the CFO has made the following estimates in millions of dollars:tableDebtInterest taxshieldFinancial distress costs

What is the optimal debt choice for Greenleaf?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock