Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 I. NRG Energy, Inc. ( NRG ) is an energy company with a market debt - equity ratio of 2 . Suppose its

Question

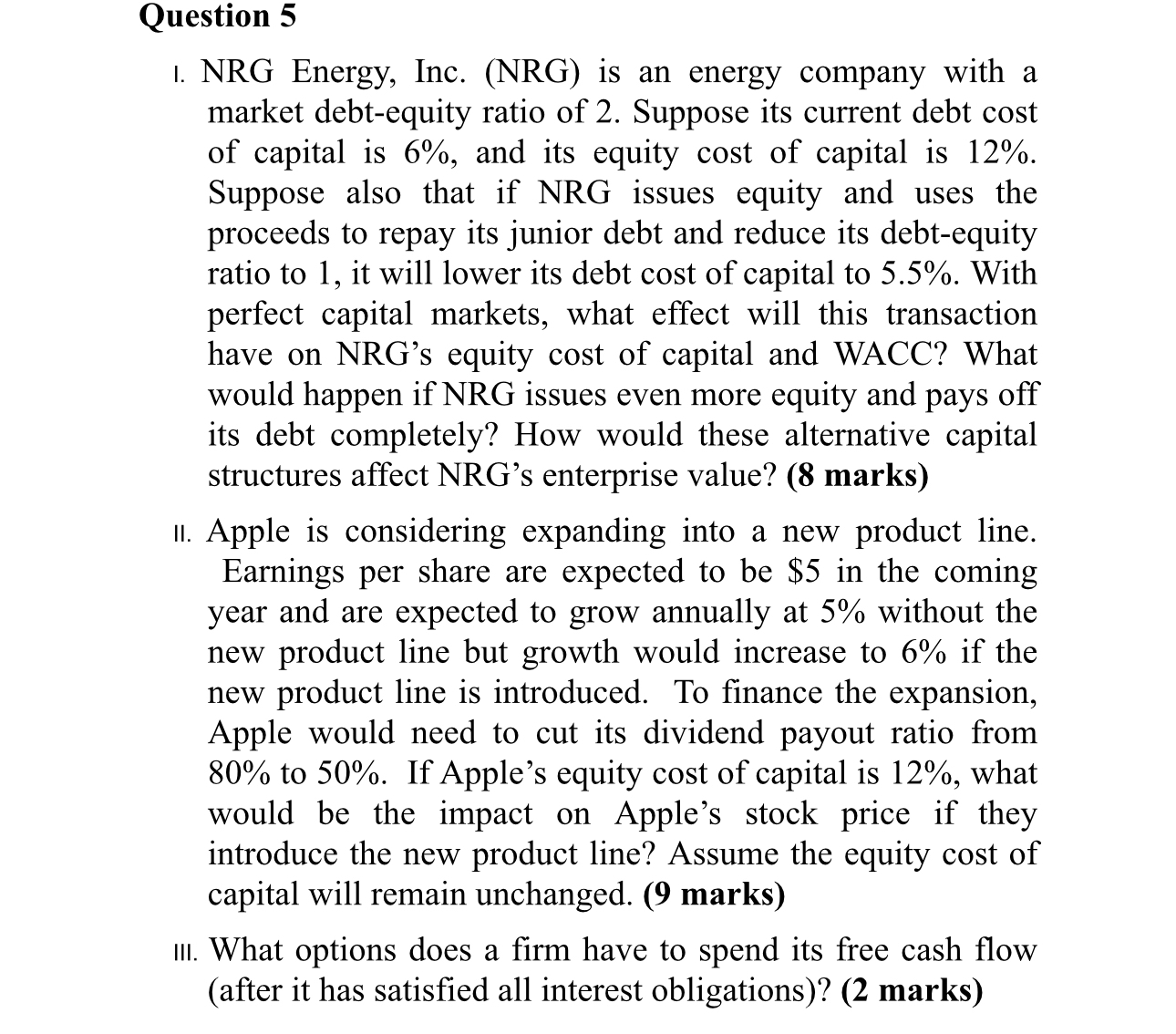

I. NRG Energy, Inc. NRG is an energy company with a market debtequity ratio of Suppose its current debt cost of capital is and its equity cost of capital is Suppose also that if NRG issues equity and uses the proceeds to repay its junior debt and reduce its debtequity ratio to it will lower its debt cost of capital to With perfect capital markets, what effect will this transaction have on NRGs equity cost of capital and WACC? What would happen if NRG issues even more equity and pays off its debt completely? How would these alternative capital structures affect NRGs enterprise value? marks

II Apple is considering expanding into a new product line. Earnings per share are expected to be $ in the coming year and are expected to grow annually at without the new product line but growth would increase to if the new product line is introduced. To finance the expansion, Apple would need to cut its dividend payout ratio from to If Apple's equity cost of capital is what would be the impact on Apple's stock price if they introduce the new product line? Assume the equity cost of capital will remain unchanged. marks

III. What options does a firm have to spend its free cash flow after it has satisfied all interest obligations marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started