Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 A. OMC Bhd is a manufacturer and distributor of fuels and lubricants. The firm planned to pay a dividend of RM5 per

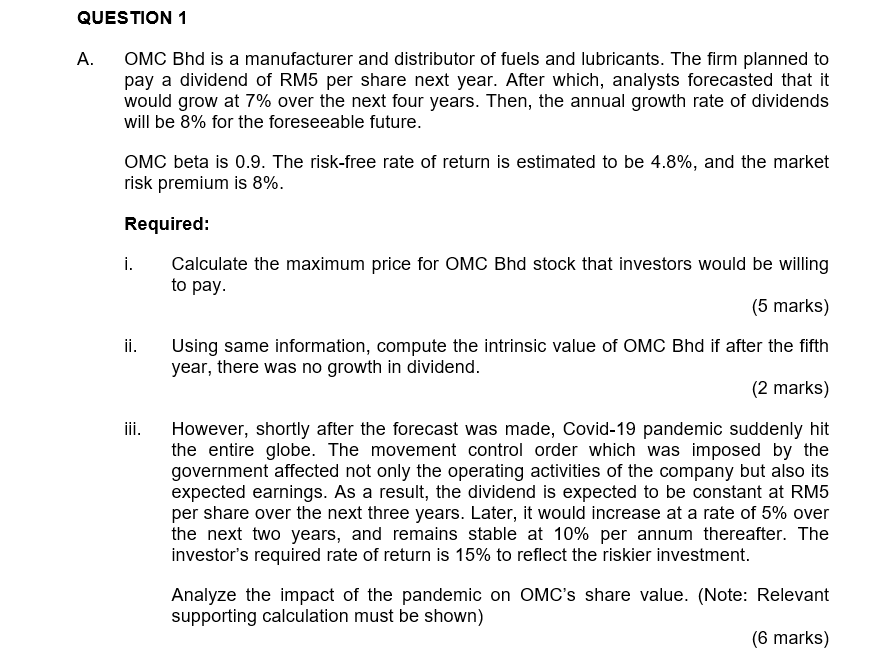

QUESTION 1 A. OMC Bhd is a manufacturer and distributor of fuels and lubricants. The firm planned to pay a dividend of RM5 per share next year. After which, analysts forecasted that it would grow at 7% over the next four years. Then, the annual growth rate of dividends will be 8% for the foreseeable future. OMC beta is 0.9. The risk-free rate of return is estimated to be 4.8%, and the market risk premium is 8%. Required: i. ii. iii. Calculate the maximum price for OMC Bhd stock that investors would be willing to pay. (5 marks) Using same information, compute the intrinsic value of OMC Bhd if after the fifth year, there was no growth in dividend. (2 marks) However, shortly after the forecast was made, Covid-19 pandemic suddenly hit the entire globe. The movement control order which was imposed by the government affected not only the operating activities of the company but also its expected earnings. As a result, the dividend is expected to be constant at RM5 per share over the next three years. Later, it would increase at a rate of 5% over the next two years, and remains stable at 10% per annum thereafter. The investor's required rate of return is 15% to reflect the riskier investment. Analyze the impact of the pandemic on OMC's share value. (Note: Relevant supporting calculation must be shown) (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the maximum price for OMC ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started