Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (a) STM sells a variety of hardware to Alwyn Ltd, a DIY business. A sale is made on 1st March 2021 for 8,000.

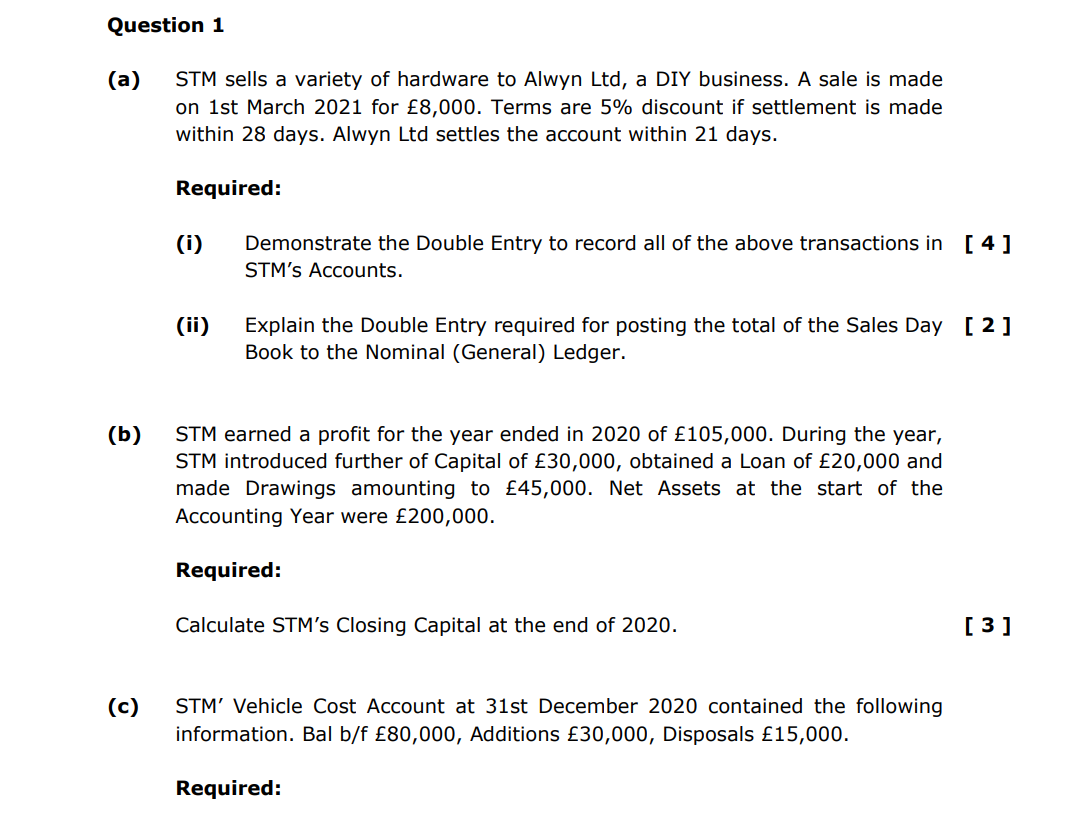

Question 1 (a) STM sells a variety of hardware to Alwyn Ltd, a DIY business. A sale is made on 1st March 2021 for 8,000. Terms are 5% discount if settlement is made within 28 days. Alwyn Ltd settles the account within 21 days. Required: (i) Demonstrate the Double Entry to record all of the above transactions in [4] STM's Accounts. (ii) Explain the Double Entry required for posting the total of the Sales Day [2] Book to the Nominal (General) Ledger. (b) STM earned a profit for the year ended in 2020 of 105,000. During the year, STM introduced further of Capital of 30,000, obtained a Loan of 20,000 and made Drawings amounting to 45,000. Net Assets at the start of the Accounting Year were 200,000. Required: Calculate STM's Closing Capital at the end of 2020. [3] (c) STM' Vehicle Cost Account at 31st December 2020 contained the following information. Bal b/f 80,000, Additions 30,000, Disposals 15,000. Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started