Answered step by step

Verified Expert Solution

Question

1 Approved Answer

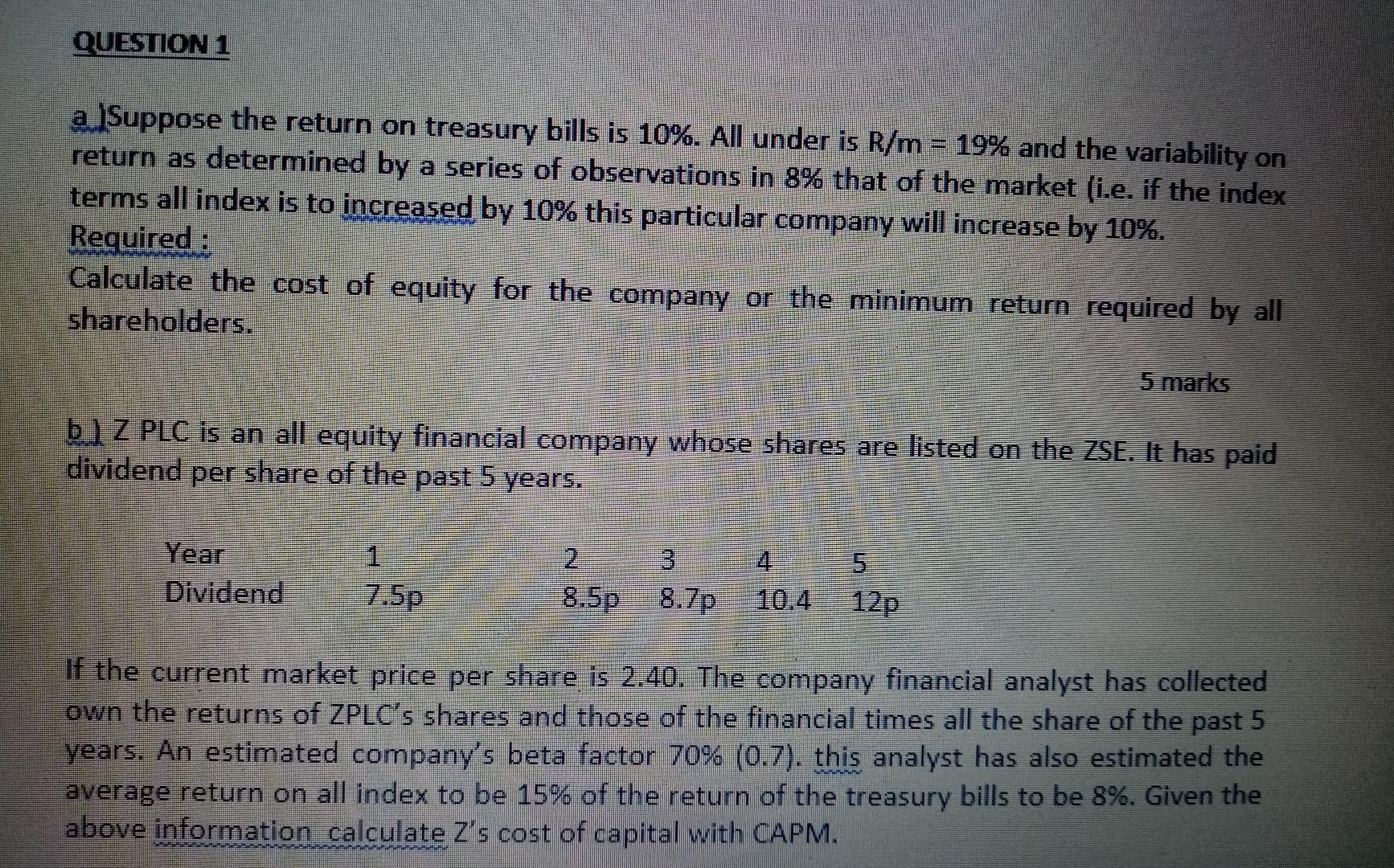

QUESTION 1 a Suppose the return on treasury bills is 10%. All under is R/m = 19% and the variability on return as determined by

QUESTION 1 a Suppose the return on treasury bills is 10%. All under is R/m = 19% and the variability on return as determined by a series of observations in 8% that of the market (i.e. if the index terms all index is to increased by 10% this particular company will increase by 10%. Required: Calculate the cost of equity for the company or the minimum return required by all shareholders. 5 marks b) Z PLC is an all equity financial company whose shares are listed on the ZSE. It has paid dividend per share of the past 5 years. Year Dividend 2 3 8.5p8.7p 7.5p 12p If the current market price per share is 2.40. The company financial analyst has collected own the returns of ZPLC's shares and those of the financial times all the share of the past 5 years. An estimated company's beta factor 70% (0.7). this analyst has also estimated the average return on all index to be 15% of the return of the treasury bills to be 8%. Given the above information calculate Z's cost of capital with CAPM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started