Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (a) The ownership of majority voting rights in itself may not be a decisive factor of control in IFRS 10 Consolidated Financial Statements.

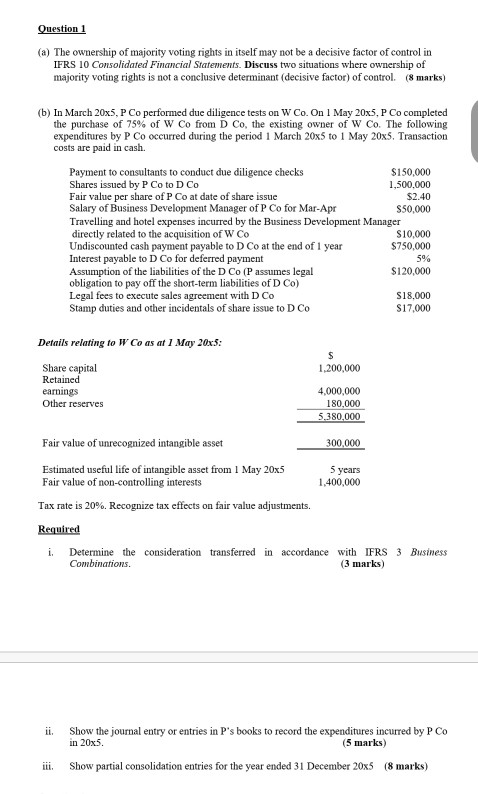

Question 1 (a) The ownership of majority voting rights in itself may not be a decisive factor of control in IFRS 10 Consolidated Financial Statements. Discuss two situations where ownership of majority voting rights is not a conclusive determinant (decisive factor) of control. (8 marks) (b) In March 20x5, P Co performed due diligence tests on W Co. On 1 May 20x5, P Co completed the purchase of 75% of W Co from D Co, the existing owner of W Co. The following expenditures by P Co occurred during the period 1 March 20x5 to 1 May 20x5. Transaction costs are paid in cash. Payment to consultants to conduct due diligence checks $150.000 Shares issued by P Co to D Co 1,500,000 Fair value per share of P Coat date of share issue $2.40 Salary of Business Development Manager of P Co for Mar-Apr $50,000 Travelling and hotel expenses incurred by the Business Development Manager directly related to the acquisition of W Co $10,000 Undiscounted cash payment payable to D Co at the end of 1 year $750,000 Interest payable to D Co for deferred payment Assumption of the liabilities of the D Co (P assumes legal $120,000 obligation to pay off the short-term liabilities of D Co) Legal fees to execute sales agreement with D Co $18,000 Stamp duties and other incidentals of share issue to D Co $17.000 596 Details relating to w Co as at 1 May 20x3: 1,200,000 Share capital Retained earnings Other reserves 4,000,000 180,000 5.380,000 Fair value of unrecognized intangible asset 300,000 Estimated useful life of intangible asset from 1 May 20x5 Fair value of non-controlling interests 5 years 1,400,000 Tax rate is 20%. Recognize tax effects on fair value adjustments. Required i. Determine the consideration transferred Combinations. in accordance with IFRS 3 Business (3 marks) ii. Show the journal entry or entries in P's books to record the expenditures incurred by P Co in 20x5 (5 marks) iii Show partial consolidation entries for the year ended 31 December 2005 (8 marks) Question 1 (a) The ownership of majority voting rights in itself may not be a decisive factor of control in IFRS 10 Consolidated Financial Statements. Discuss two situations where ownership of majority voting rights is not a conclusive determinant (decisive factor) of control. (8 marks) (b) In March 20x5, P Co performed due diligence tests on W Co. On 1 May 20x5, P Co completed the purchase of 75% of W Co from D Co, the existing owner of W Co. The following expenditures by P Co occurred during the period 1 March 20x5 to 1 May 20x5. Transaction costs are paid in cash. Payment to consultants to conduct due diligence checks $150.000 Shares issued by P Co to D Co 1,500,000 Fair value per share of P Coat date of share issue $2.40 Salary of Business Development Manager of P Co for Mar-Apr $50,000 Travelling and hotel expenses incurred by the Business Development Manager directly related to the acquisition of W Co $10,000 Undiscounted cash payment payable to D Co at the end of 1 year $750,000 Interest payable to D Co for deferred payment Assumption of the liabilities of the D Co (P assumes legal $120,000 obligation to pay off the short-term liabilities of D Co) Legal fees to execute sales agreement with D Co $18,000 Stamp duties and other incidentals of share issue to D Co $17.000 596 Details relating to w Co as at 1 May 20x3: 1,200,000 Share capital Retained earnings Other reserves 4,000,000 180,000 5.380,000 Fair value of unrecognized intangible asset 300,000 Estimated useful life of intangible asset from 1 May 20x5 Fair value of non-controlling interests 5 years 1,400,000 Tax rate is 20%. Recognize tax effects on fair value adjustments. Required i. Determine the consideration transferred Combinations. in accordance with IFRS 3 Business (3 marks) ii. Show the journal entry or entries in P's books to record the expenditures incurred by P Co in 20x5 (5 marks) iii Show partial consolidation entries for the year ended 31 December 2005 (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started