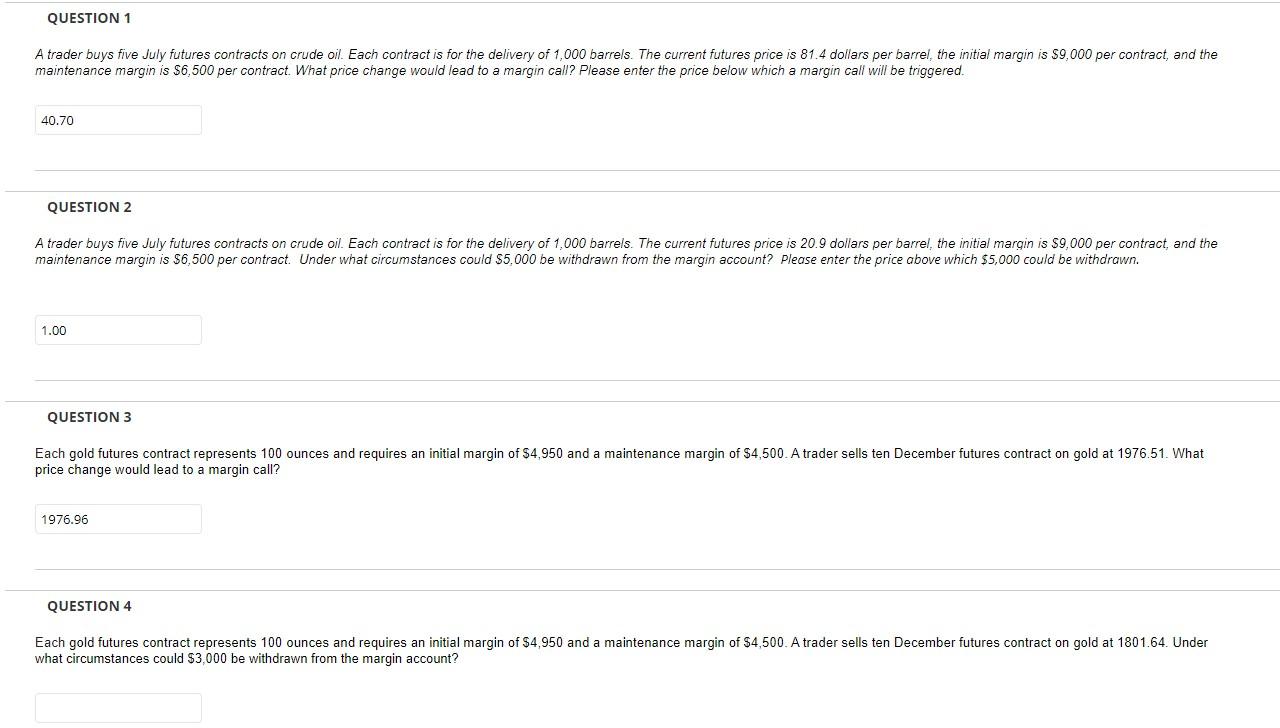

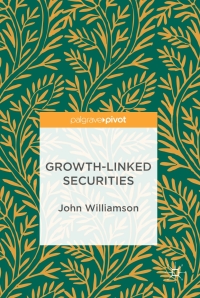

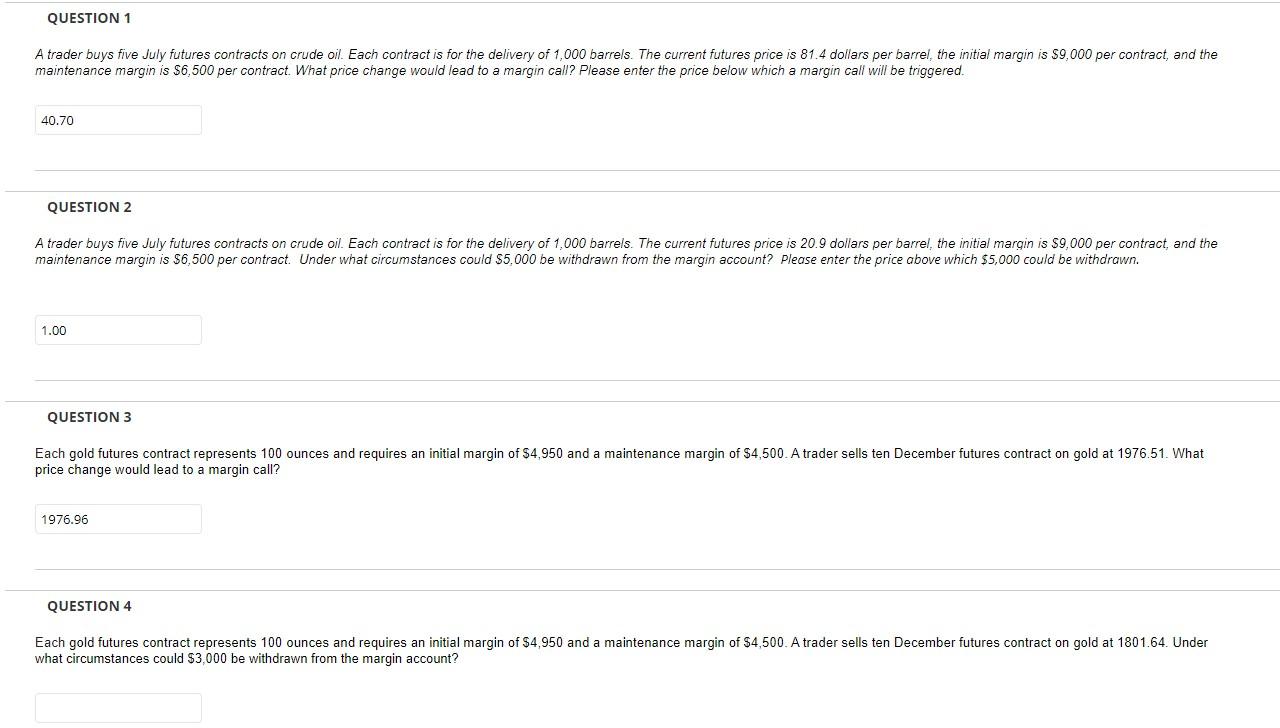

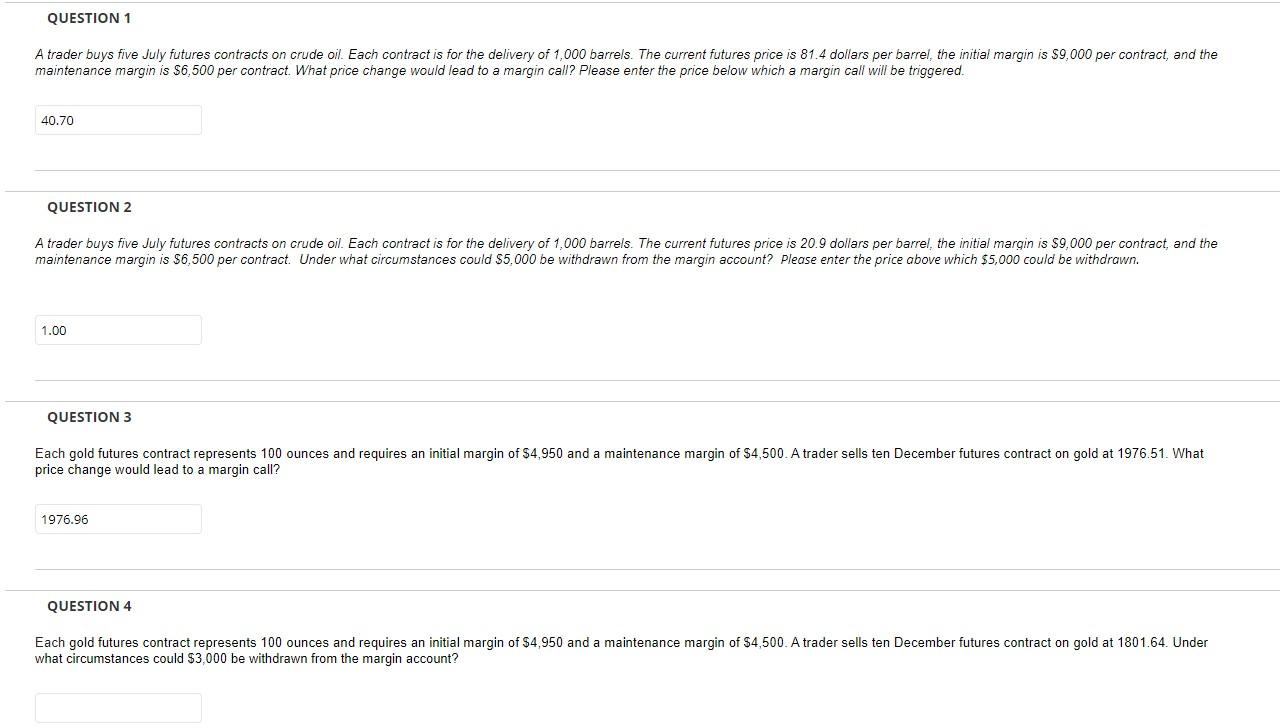

QUESTION 1 A trader buys five July futures contracts on crude oil. Each contract is for the delivery of 1,000 barrels. The current futures price is 81.4 dollars per barrel, the initial margin is $9,000 per contract, and the maintenance margin is $6,500 per contract. What price change would lead to a margin call? Please enter the price below which a margin cali will be triggered. 40.70 QUESTION 2 A trader buys five July futures contracts on crude oil. Each contract is for the delivery of 1,000 barrels. The current futures price is 20.9 dollars per barrel, the initial margin is $9.000 per contract, and the maintenance margin is $6,500 per contract. Under what circumstances could $5,000 be withdrawn from the margin account? Please enter the price above which $5,000 could be withdrawn. 1.00 QUESTION 3 Each gold futures contract represents 100 ounces and requires an initial margin of 54,950 and a maintenance margin of $4,500. A trader sells ten December futures contract on gold at 1976.51. What price change would lead to a margin call? 1976.96 QUESTION 4 Each gold futures contract represents 100 ounces and requires an initial margin of $4,950 and a maintenance margin of $4,500. A trader sells ten December futures contract on gold at 1801.64. Under what circumstances could $3,000 be withdrawn from the margin account? QUESTION 1 A trader buys five July futures contracts on crude oil. Each contract is for the delivery of 1,000 barrels. The current futures price is 81.4 dollars per barrel, the initial margin is $9,000 per contract, and the maintenance margin is $6,500 per contract. What price change would lead to a margin call? Please enter the price below which a margin cali will be triggered. 40.70 QUESTION 2 A trader buys five July futures contracts on crude oil. Each contract is for the delivery of 1,000 barrels. The current futures price is 20.9 dollars per barrel, the initial margin is $9.000 per contract, and the maintenance margin is $6,500 per contract. Under what circumstances could $5,000 be withdrawn from the margin account? Please enter the price above which $5,000 could be withdrawn. 1.00 QUESTION 3 Each gold futures contract represents 100 ounces and requires an initial margin of 54,950 and a maintenance margin of $4,500. A trader sells ten December futures contract on gold at 1976.51. What price change would lead to a margin call? 1976.96 QUESTION 4 Each gold futures contract represents 100 ounces and requires an initial margin of $4,950 and a maintenance margin of $4,500. A trader sells ten December futures contract on gold at 1801.64. Under what circumstances could $3,000 be withdrawn from the margin account