Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (a) You are the financial analyst of GG Sdn. Bhd. The director of the company has asked you to analyse two proposed

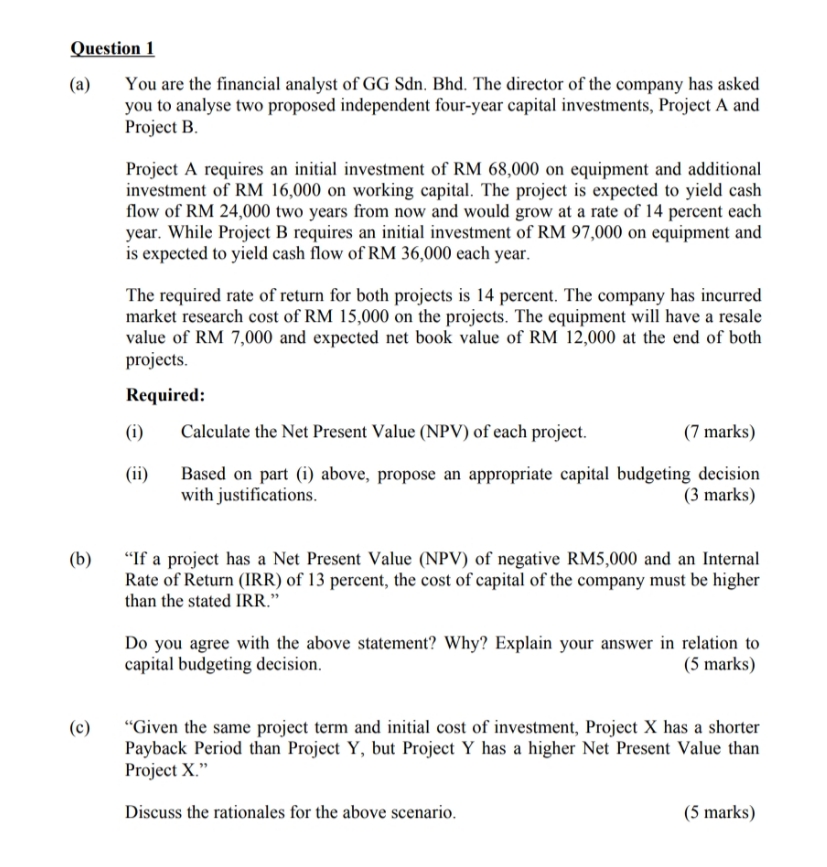

Question 1 (a) You are the financial analyst of GG Sdn. Bhd. The director of the company has asked you to analyse two proposed independent four-year capital investments, Project A and Project B. (b) (c) Project A requires an initial investment of RM 68,000 on equipment and additional investment of RM 16,000 on working capital. The project is expected to yield cash flow of RM 24,000 two years from now and would grow at a rate of 14 percent each year. While Project B requires an initial investment of RM 97,000 on equipment and is expected to yield cash flow of RM 36,000 each year. The required rate of return for both projects is 14 percent. The company has incurred market research cost of RM 15,000 on the projects. The equipment will have a resale value of RM 7,000 and expected net book value of RM 12,000 at the end of both projects. Required: (i) (ii) Calculate the Net Present Value (NPV) of each project. (7 marks) Based on part (i) above, propose an appropriate capital budgeting decision with justifications. (3 marks) "If a project has a Net Present Value (NPV) of negative RM5,000 and an Internal Rate of Return (IRR) of 13 percent, the cost of capital of the company must be higher than the stated IRR." Do you agree with the above statement? Why? Explain your answer in relation to capital budgeting decision. (5 marks) "Given the same project term and initial cost of investment, Project X has a shorter Payback Period than Project Y, but Project Y has a higher Net Present Value than Project X." Discuss the rationales for the above scenario. (5 marks)

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Capital Budgeting Analysis a Project Analysis i Net Present Value NPV Calculation Project A Year 0 Initial Investment RM 68000 16000 RM 840...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started