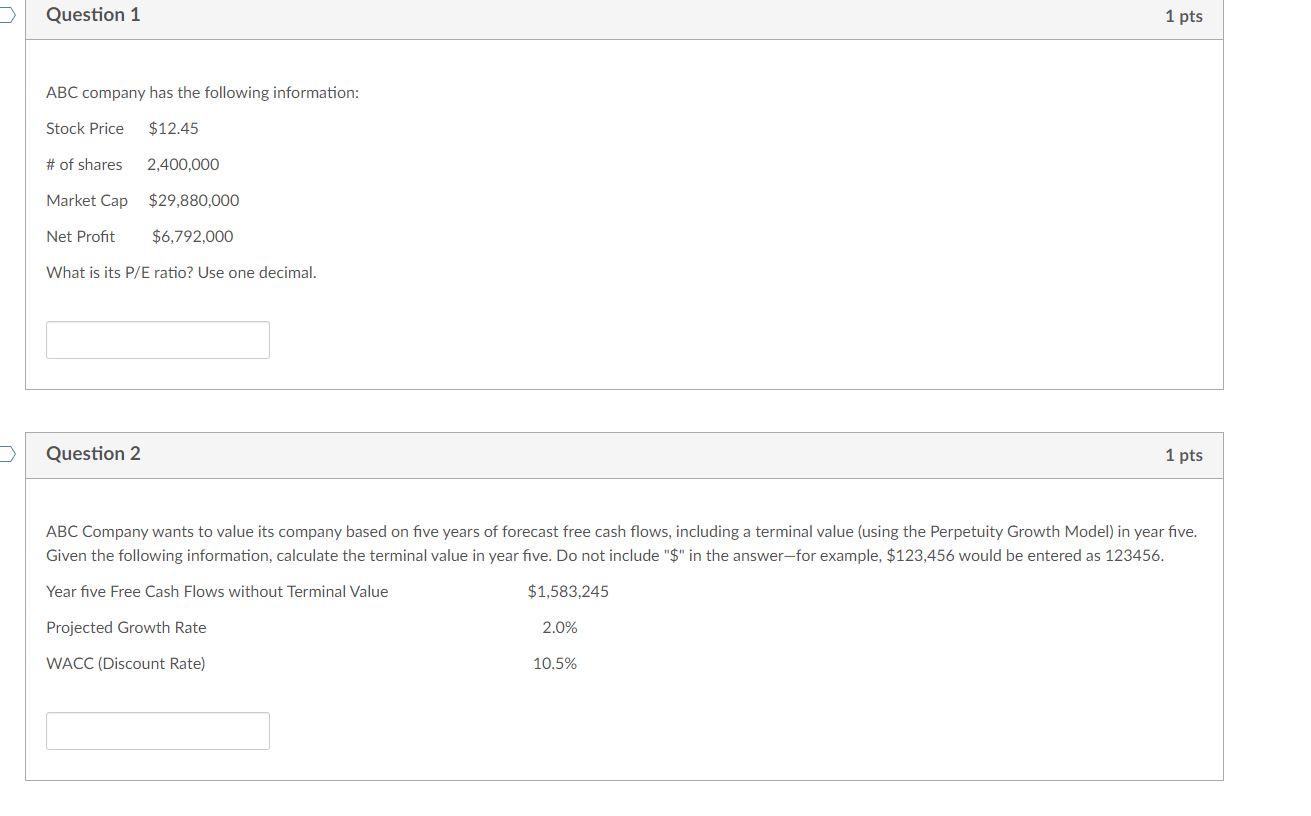

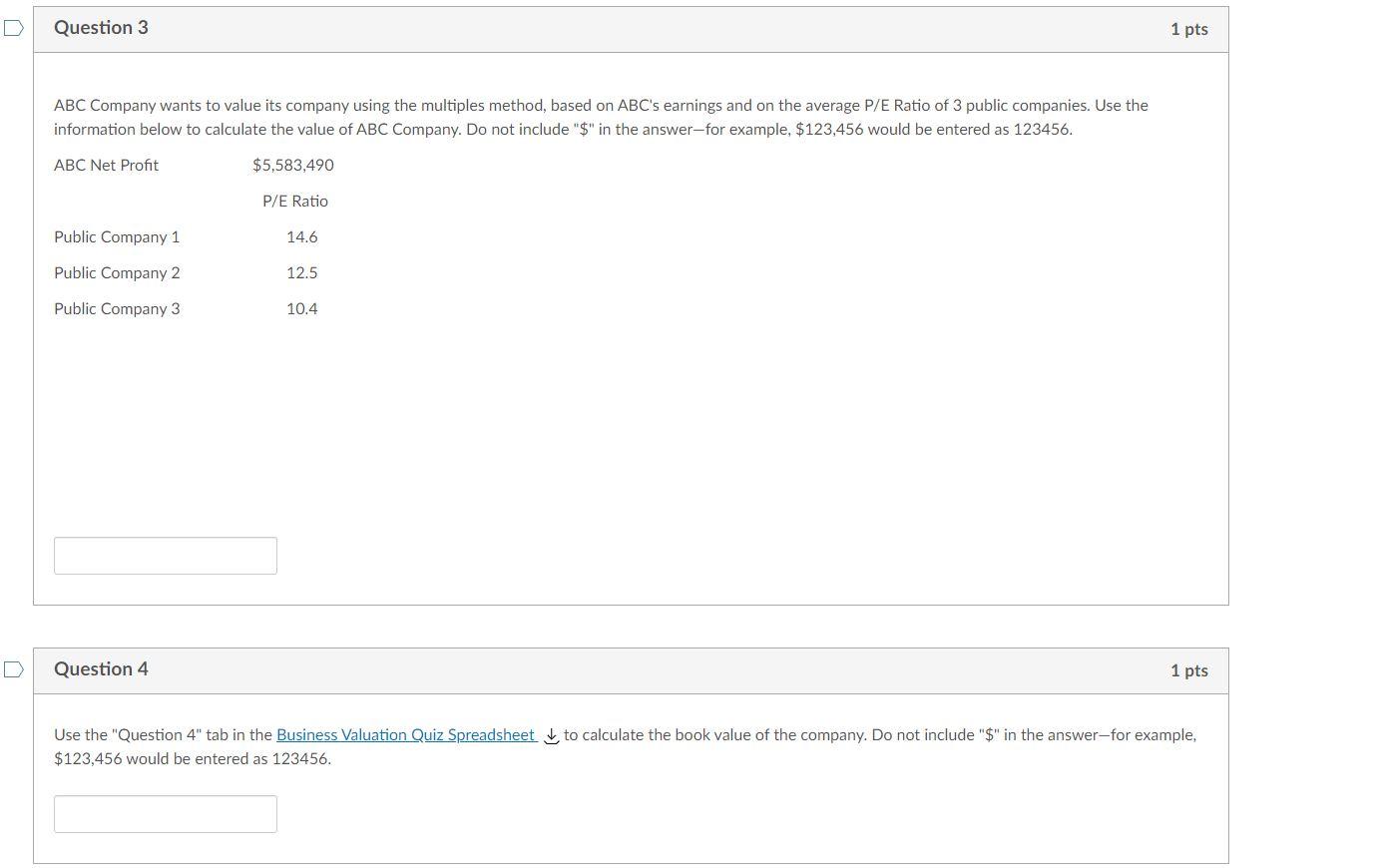

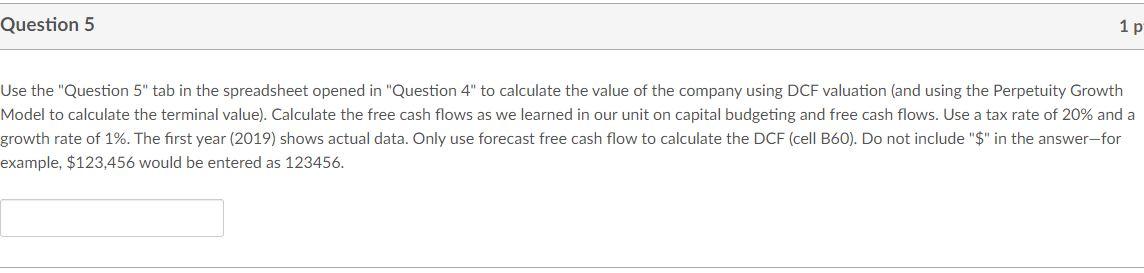

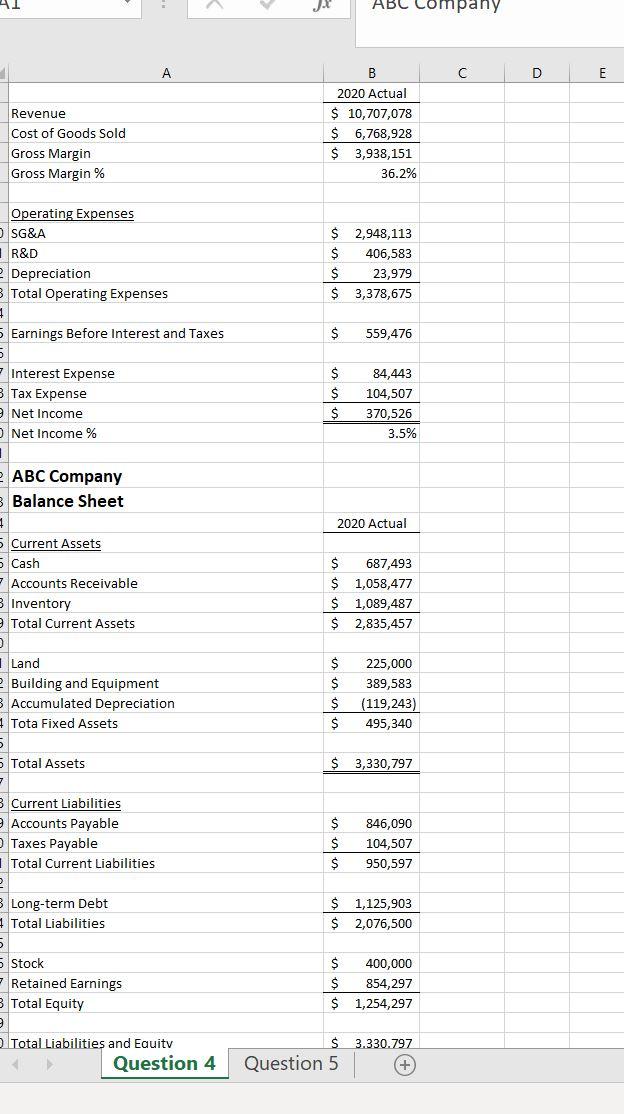

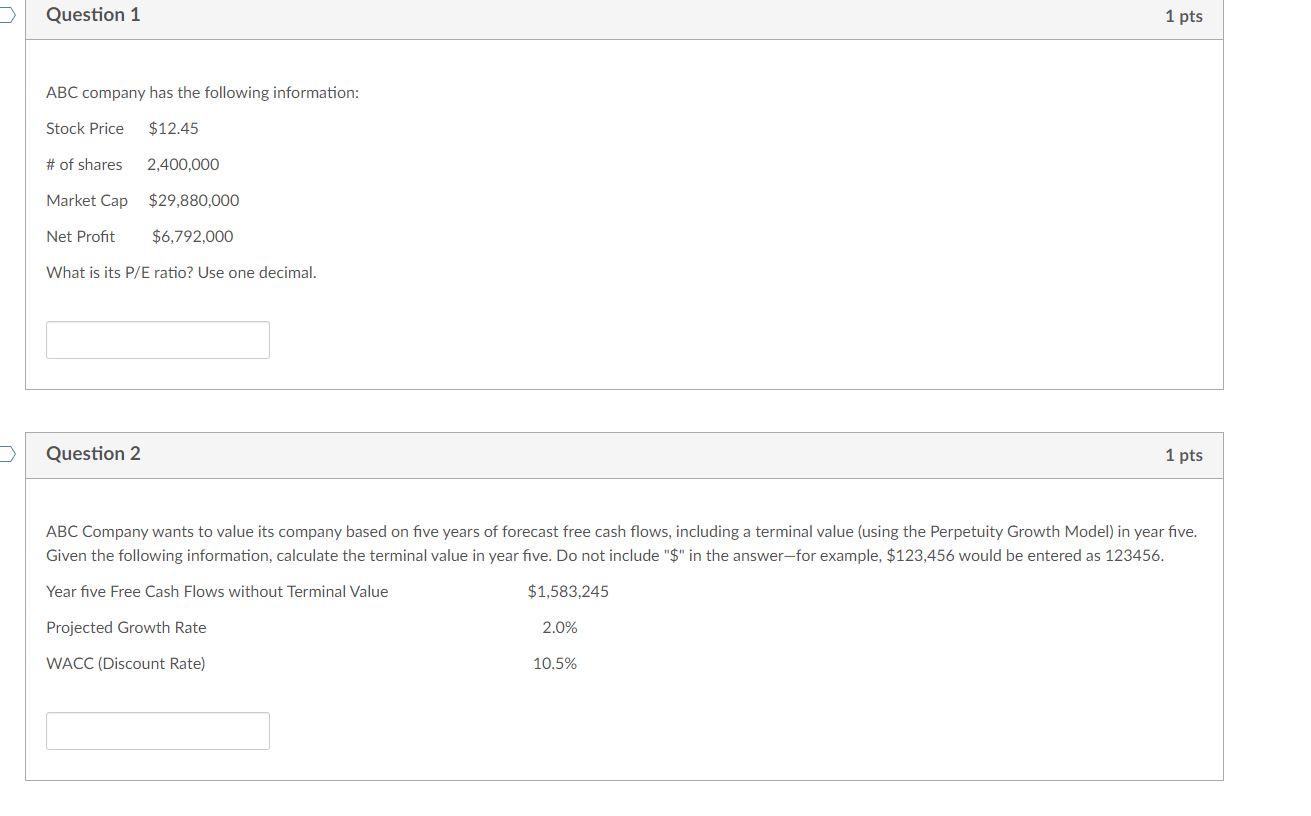

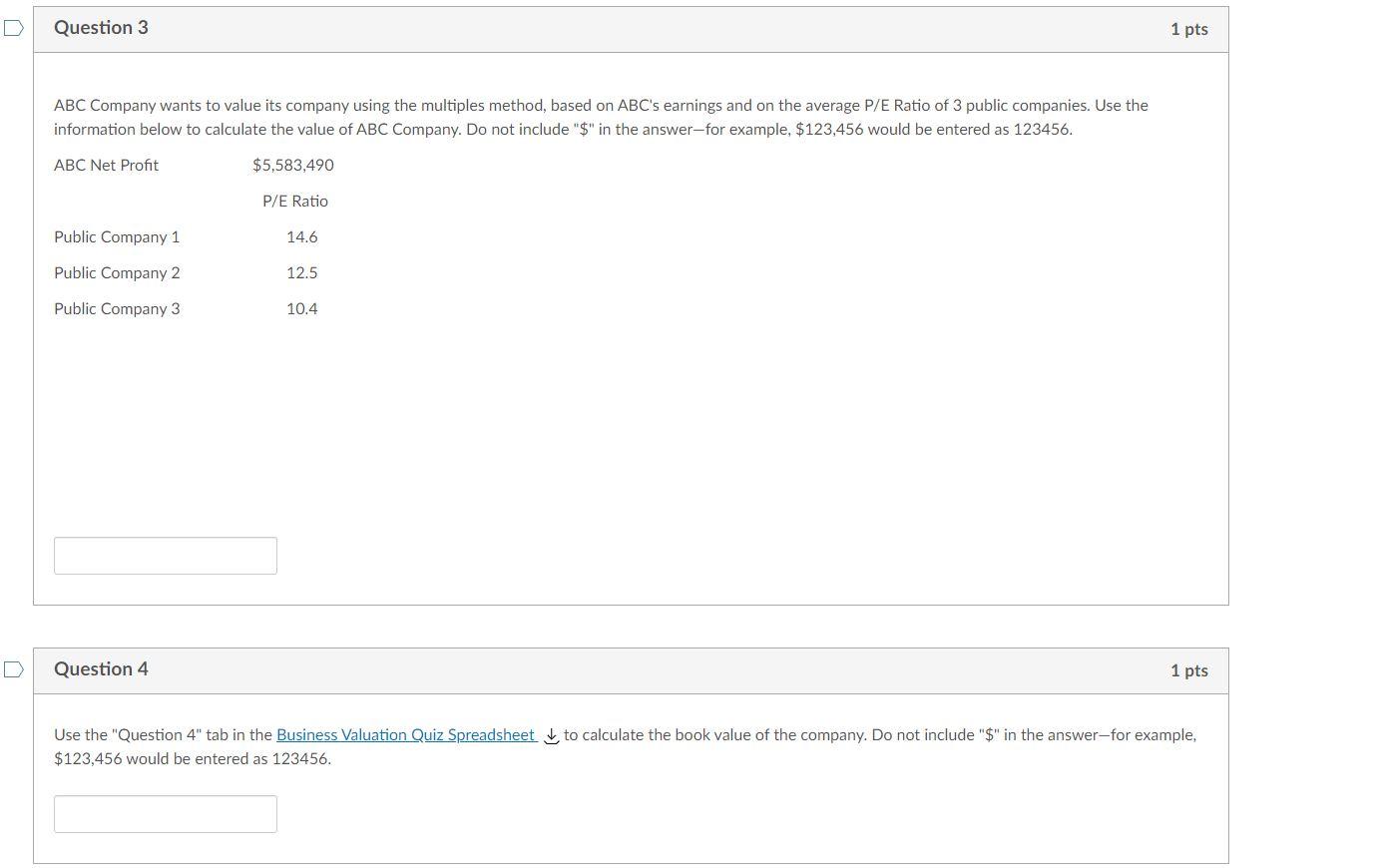

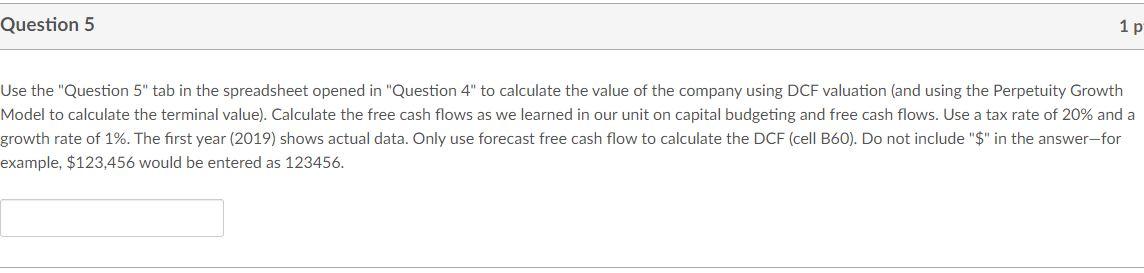

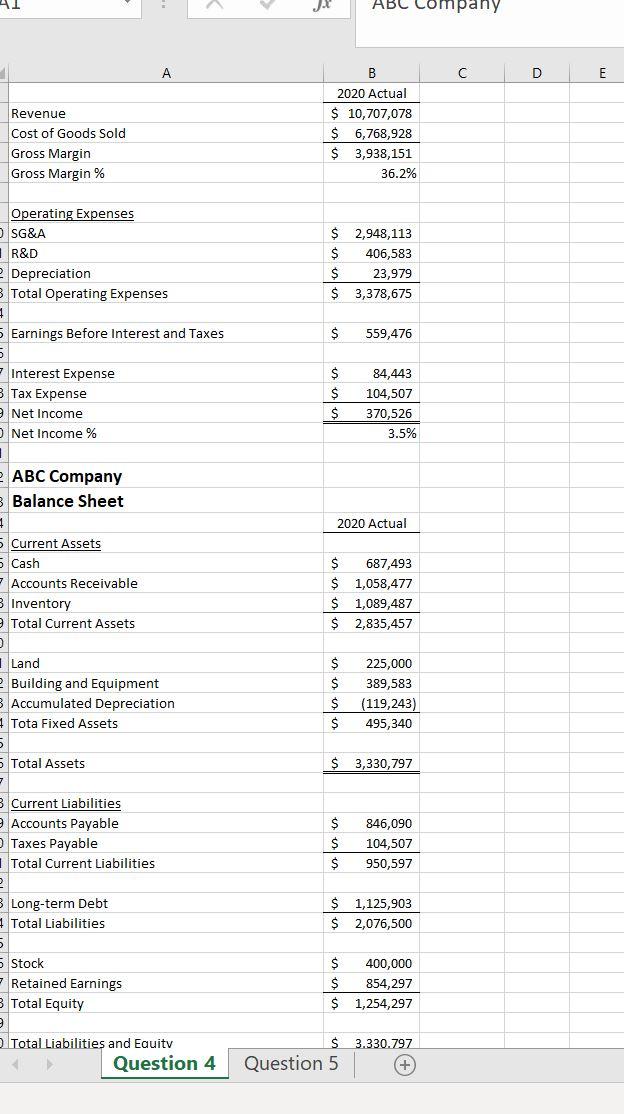

Question 1 ABC company has the following information: Stock Price $12.45 # of shares Market Cap 2,400,000 Question 2 $29,880,000 $6,792,000 Net Profit What is its P/E ratio? Use one decimal. Projected Growth Rate WACC (Discount Rate) ABC Company wants to value its company based on five years of forecast free cash flows, including a terminal value (using the Perpetuity Growth Model) in year five. Given the following information, calculate the terminal value in year five. Do not include "$" in the answer-for example, $123,456 would be entered as 123456. Year five Free Cash Flows without Terminal Value $1,583,245 2.0% 1 pts 10.5% 1 pts D Question 3 ABC Company wants to value its company using the multiples method, based on ABC's earnings and on the average P/E Ratio of 3 public companies. Use the information below to calculate the value of ABC Company. Do not include "$" in the answer-for example, $123,456 would be entered as 123456. ABC Net Profit $5,583,490 Public Company 1 Public Company 2 Public Company 3 Question 4 P/E Ratio 14.6 12.5 10.4 1 pts 1 pts Use the "Question 4" tab in the Business Valuation Quiz Spreadsheet to calculate the book value of the company. Do not include "$" in the answer-for example, $123,456 would be entered as 123456. Question 5 1 p Use the "Question 5" tab in the spreadsheet opened in "Question 4" to calculate the value of the company using DCF valuation (and using the Perpetuity Growth Model to calculate the terminal value). Calculate the free cash flows as we learned in our unit on capital budgeting and free cash flows. Use a tax rate of 20% and a growth rate of 1%. The first year (2019) shows actual data. Only use forecast free cash flow to calculate the DCF (cell B60). Do not include "$" in the answer-for example, $123,456 would be entered as 123456. AL Revenue Cost of Goods Sold Gross Margin Gross Margin % Operating Expenses OSG&A R&D 2 Depreciation 3 Total Operating Expenses 1 5 Earnings Before Interest and Taxes 5 Interest Expense B Tax Expense 9 Net Income O Net Income % 1 ABC Company Balance Sheet 4 5 Current Assets 5 Cash Accounts Receivable B Inventory 9 Total Current Assets 0 Land 2 Building and Equipment 3 Accumulated Depreciation Tota Fixed Assets 5 5 Total Assets 7 A 3 Current Liabilities 9 Accounts Payable O Taxes Payable Total Current Liabilities 2 3 Long-term Debt Total Liabilities 5 5 Stock Retained Earnings B Total Equity 9 O Total Liabilities and Equitv 4 Question 4 Jx B 2020 Actual $ 10,707,078 $ 6,768,928 $ 3,938,151 36.2% $ $ $ $ $ $ $ $ $ ABC Company $ $ 2020 Actual 2,948,113 406,583 23,979 3,378,675 $ 687,493 $ 1,058,477 $ 1,089,487 $ 2,835,457 $ $ $ 559,476 84,443 104,507 370,526 3.5% Question 5 225,000 389,583 $ 3,330,797 (119,243) 495,340 846,090 104,507 950,597 $ 1,125,903 $ 2,076,500 $ 400,000 $ 854,297 $ 1,254,297 3.330.797 D E