Answered step by step

Verified Expert Solution

Question

1 Approved Answer

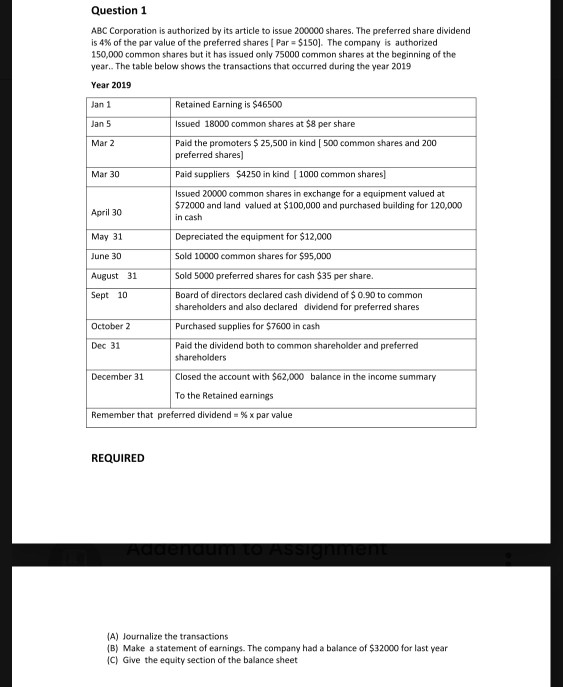

Question 1 ABC Corporation is authorized by its article to issue 200000 shares. The preferred share dividend is 4% of the par value of the

Question 1 ABC Corporation is authorized by its article to issue 200000 shares. The preferred share dividend is 4% of the par value of the preferred shares Par = $150). The company is authorized 150,000 common shares but it has issued only 75000 common shares at the beginning of the year. The table below shows the transactions that occurred during the year 2019 Year 2019 Jan 1 Retained Earning is $46500 Jan 5 Issued 18000 common shares at $8 per share Mar 2 Paid the promoters $ 25,500 in kind ( 500 common shares and 200 preferred shares) Mar 30 Paid suppliers $4250 in kind (1000 common shares] Issued 20000 common shares in exchange for a equipment valued at April 30 $72000 and land valued at $100,000 and purchased building for 120,000 in cash May 31 Depreciated the equipment for $12,000 June 30 Sold 10000 common shares for $95,000 August 31 Sold 5000 preferred shares for cash $35 per share. Sept 10 Board of directors declared cash dividend of $0.90 to common shareholders and also declared dividend for preferred shares October 2 Purchased supplies for $7600 in cash Dec 31 Paid the dividend both to common shareholder and preferred shareholders December 31 Closed the account with $62,000 balance in the income summary To the Retained earnings Remember that preferred dividend=% x par value REQUIRED Addendum to Assignment (A) Journalize the transactions (B) Make a statement of earnings. The company had a balance of $32000 for last year C) Give the equity section of the balance sheet Question 1 ABC Corporation is authorized by its article to issue 200000 shares. The preferred share dividend is 4% of the par value of the preferred shares Par = $150). The company is authorized 150,000 common shares but it has issued only 75000 common shares at the beginning of the year. The table below shows the transactions that occurred during the year 2019 Year 2019 Jan 1 Retained Earning is $46500 Jan 5 Issued 18000 common shares at $8 per share Mar 2 Paid the promoters $ 25,500 in kind ( 500 common shares and 200 preferred shares) Mar 30 Paid suppliers $4250 in kind (1000 common shares] Issued 20000 common shares in exchange for a equipment valued at April 30 $72000 and land valued at $100,000 and purchased building for 120,000 in cash May 31 Depreciated the equipment for $12,000 June 30 Sold 10000 common shares for $95,000 August 31 Sold 5000 preferred shares for cash $35 per share. Sept 10 Board of directors declared cash dividend of $0.90 to common shareholders and also declared dividend for preferred shares October 2 Purchased supplies for $7600 in cash Dec 31 Paid the dividend both to common shareholder and preferred shareholders December 31 Closed the account with $62,000 balance in the income summary To the Retained earnings Remember that preferred dividend=% x par value REQUIRED Addendum to Assignment (A) Journalize the transactions (B) Make a statement of earnings. The company had a balance of $32000 for last year C) Give the equity section of the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started