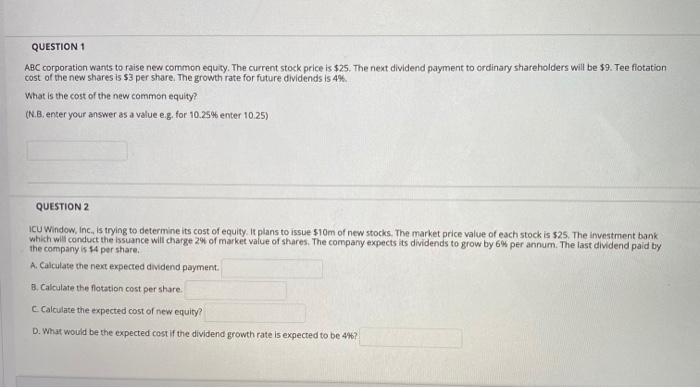

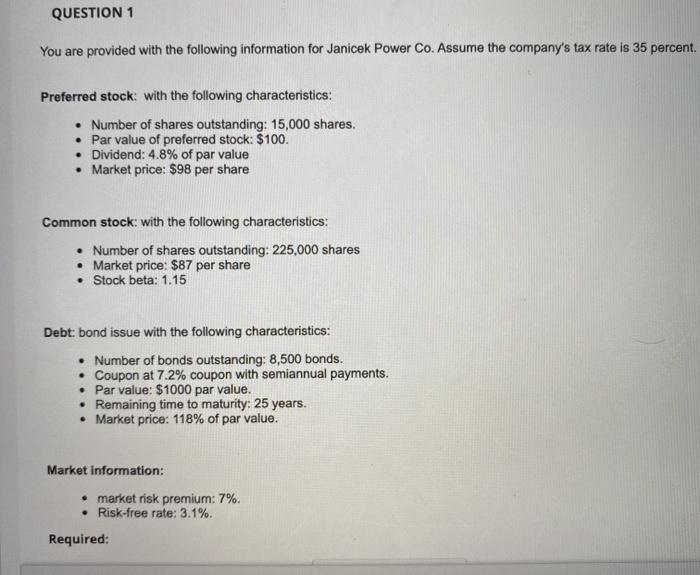

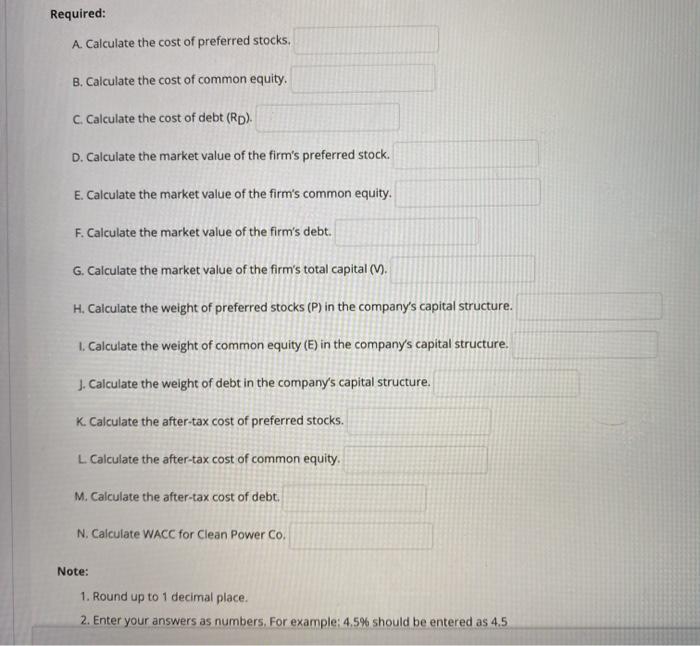

QUESTION 1 ABC corporation wants to raise new common equity. The current stock price is $25. The next dividend payment to ordinary shareholders will be $9. Tee flotation cost of the new shares is $3 per share. The growth rate for future dividends is 4% What is the cost of the new common equity? (N.B. enter your answer as a value eg, for 10.25% enter 10.25) QUESTION 2 ICU Window, Inc. is trying to determine its cost of equity. It plans to issue 510m of new stocks. The market price value of each stock is $25. The investment bank which will conduct the issuance will charge 2 of market value of shares. The company expects its dividends to grow by 6% per annum. The last dividend paid by the company is 14 per share. A. Calculate the next expected dividend payment. 8. Calculate the flotation cost per share Calculate the expected cost of new equity? D. What would be the expected cost if the dividend growth rate is expected to be 447 QUESTION 1 You are provided with the following information for Janicek Power Co. Assume the company's tax rate is 35 percent. Preferred stock: with the following characteristics: Number of shares outstanding: 15,000 shares. Par value of preferred stock: $100. Dividend: 4.8% of par value Market price: $98 per share Common stock: with the following characteristics: Number of shares outstanding: 225,000 shares Market price: $87 per share Stock beta: 1.15 Debt: bond issue with the following characteristics: Number of bonds outstanding: 8,500 bonds. Coupon at 7.2% coupon with semiannual payments. Par value: $1000 par value. Remaining time to maturity: 25 years. Market price: 118% of par value. Market Information: market risk premium: 7%. Risk-free rate: 3.1% Required: Required: A. Calculate the cost of preferred stocks, B. Calculate the cost of common equity. C. Calculate the cost of debt (Rp). D. Calculate the market value of the firm's preferred stock. E. Calculate the market value of the firm's common equity. F. Calculate the market value of the firm's debt. G. Calculate the market value of the firm's total capital (V). H. Calculate the weight of preferred stocks (P) in the company's capital structure. 1. Calculate the weight of common equity (E) in the company's capital structure. J. Calculate the weight of debt in the company's capital structure. K. Calculate the after-tax cost of preferred stocks. L Calculate the after-tax cost of common equity. M. Calculate the after-tax cost of debt. N. Calculate WACC for Clean Power Co. Note: 1. Round up to 1 decimal place. 2. Enter your answers as numbers. For example: 4.5% should be entered as 4,5