Answered step by step

Verified Expert Solution

Question

1 Approved Answer

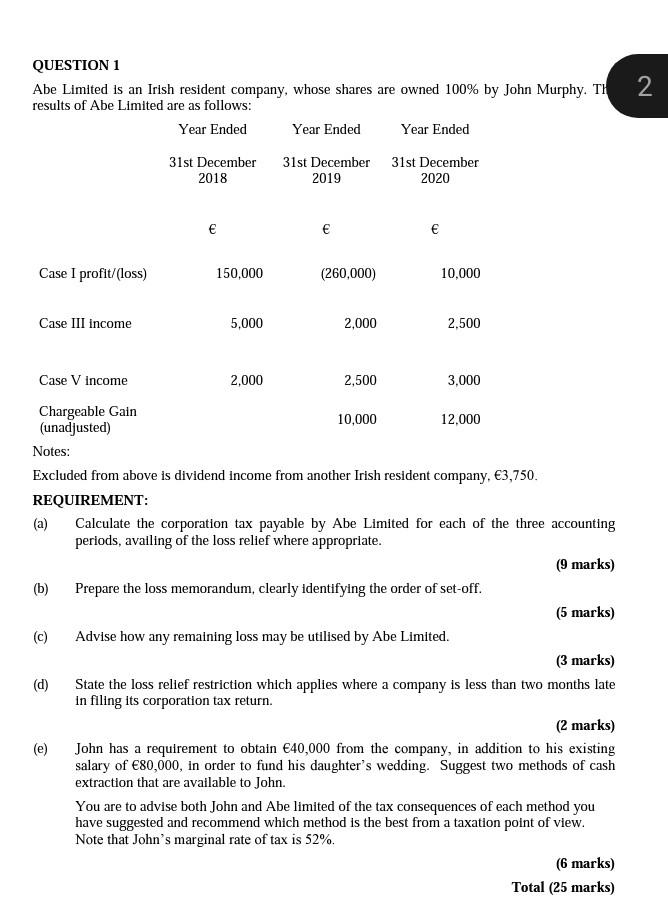

QUESTION 1 Abe Limited is an Irish resident company, whose shares are owned 100% by John Murphy. TH results of Abe Limited are as follows:

QUESTION 1 Abe Limited is an Irish resident company, whose shares are owned 100% by John Murphy. TH results of Abe Limited are as follows: Year Ended Year Ended Year Ended 2 31st December 2018 31st December 31st December 2019 2020 Case I profit/(loss) 150,000 (260,000) 10,000 Case III income 5,000 2,000 2,500 Case V income 2.000 2,500 3,000 Chargeable Gain 10,000 12.000 (unadjusted) Notes: Excluded from above is dividend income from another Irish resident company, 3,750. REQUIREMENT: (a) Calculate the corporation tax payable by Abe Limited for each of the three accounting periods, availing of the loss relief where appropriate. (9 marks) (b) Prepare the loss memorandum, clearly identifying the order of set-off. (5 marks) (c) Advise how any remaining loss may be utilised by Abe Limited. (3 marks) (d) State the loss relief restriction which applies where a company is less than two months late In filing its corporation tax return. (2 marks) (e) John has a requirement to obtain 40,000 from the company, in addition to his existing salary of 80,000, in order to fund his daughter's wedding. Suggest two methods of cash extraction that are available to John. You are to advise both John and Abe limited of the tax consequences of each method you have suggested and recommend which method is the best from a taxation point of view. Note that John's marginal rate of tax is 52%. (6 marks) Total (25 marks) QUESTION 1 Abe Limited is an Irish resident company, whose shares are owned 100% by John Murphy. TH results of Abe Limited are as follows: Year Ended Year Ended Year Ended 2 31st December 2018 31st December 31st December 2019 2020 Case I profit/(loss) 150,000 (260,000) 10,000 Case III income 5,000 2,000 2,500 Case V income 2.000 2,500 3,000 Chargeable Gain 10,000 12.000 (unadjusted) Notes: Excluded from above is dividend income from another Irish resident company, 3,750. REQUIREMENT: (a) Calculate the corporation tax payable by Abe Limited for each of the three accounting periods, availing of the loss relief where appropriate. (9 marks) (b) Prepare the loss memorandum, clearly identifying the order of set-off. (5 marks) (c) Advise how any remaining loss may be utilised by Abe Limited. (3 marks) (d) State the loss relief restriction which applies where a company is less than two months late In filing its corporation tax return. (2 marks) (e) John has a requirement to obtain 40,000 from the company, in addition to his existing salary of 80,000, in order to fund his daughter's wedding. Suggest two methods of cash extraction that are available to John. You are to advise both John and Abe limited of the tax consequences of each method you have suggested and recommend which method is the best from a taxation point of view. Note that John's marginal rate of tax is 52%. (6 marks) Total (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started